Decentralized finance (DeFi) leverages blockchain technology to offer peer-to-peer financial services without intermediaries, enhancing transparency and accessibility. Crowdfunding pools capital from a large number of individuals through online platforms to fund projects or ventures, relying on collective participation. Explore the distinct advantages and risks of DeFi and crowdfunding to understand which model suits your financial goals.

Why it is important

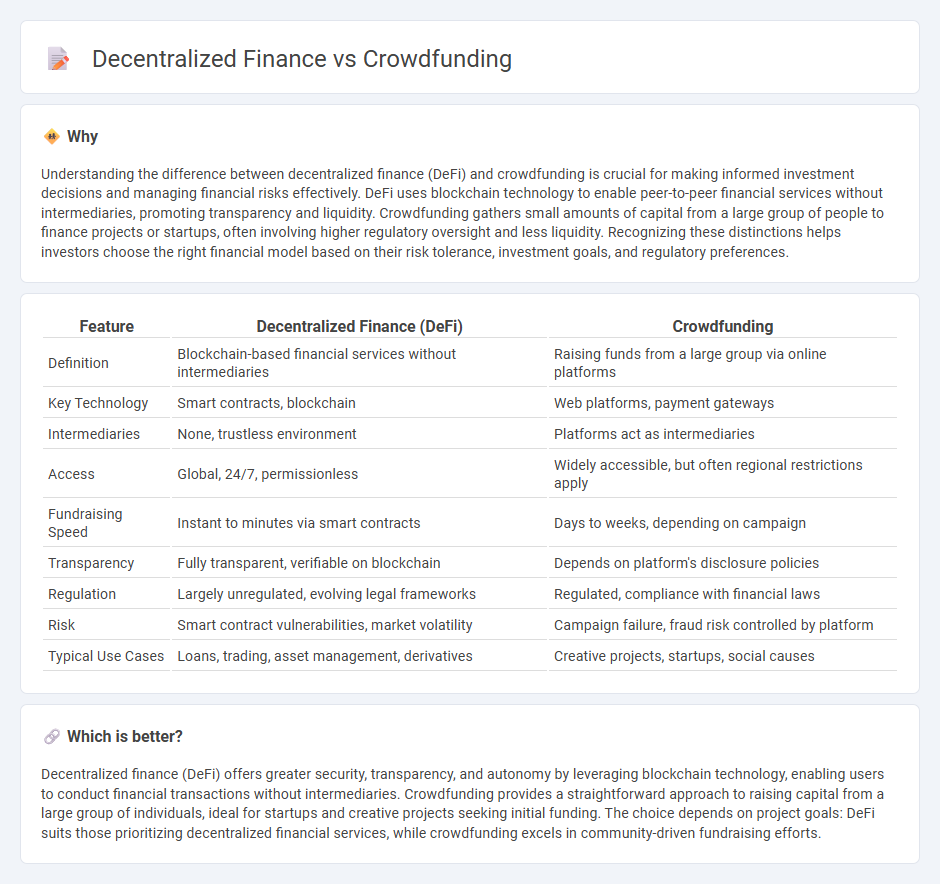

Understanding the difference between decentralized finance (DeFi) and crowdfunding is crucial for making informed investment decisions and managing financial risks effectively. DeFi uses blockchain technology to enable peer-to-peer financial services without intermediaries, promoting transparency and liquidity. Crowdfunding gathers small amounts of capital from a large group of people to finance projects or startups, often involving higher regulatory oversight and less liquidity. Recognizing these distinctions helps investors choose the right financial model based on their risk tolerance, investment goals, and regulatory preferences.

Comparison Table

| Feature | Decentralized Finance (DeFi) | Crowdfunding |

|---|---|---|

| Definition | Blockchain-based financial services without intermediaries | Raising funds from a large group via online platforms |

| Key Technology | Smart contracts, blockchain | Web platforms, payment gateways |

| Intermediaries | None, trustless environment | Platforms act as intermediaries |

| Access | Global, 24/7, permissionless | Widely accessible, but often regional restrictions apply |

| Fundraising Speed | Instant to minutes via smart contracts | Days to weeks, depending on campaign |

| Transparency | Fully transparent, verifiable on blockchain | Depends on platform's disclosure policies |

| Regulation | Largely unregulated, evolving legal frameworks | Regulated, compliance with financial laws |

| Risk | Smart contract vulnerabilities, market volatility | Campaign failure, fraud risk controlled by platform |

| Typical Use Cases | Loans, trading, asset management, derivatives | Creative projects, startups, social causes |

Which is better?

Decentralized finance (DeFi) offers greater security, transparency, and autonomy by leveraging blockchain technology, enabling users to conduct financial transactions without intermediaries. Crowdfunding provides a straightforward approach to raising capital from a large group of individuals, ideal for startups and creative projects seeking initial funding. The choice depends on project goals: DeFi suits those prioritizing decentralized financial services, while crowdfunding excels in community-driven fundraising efforts.

Connection

Decentralized finance (DeFi) and crowdfunding intersect by leveraging blockchain technology to democratize access to capital, enabling direct peer-to-peer investments without intermediaries. DeFi platforms use smart contracts to facilitate transparent, automated fundraising campaigns, increasing trust and reducing costs compared to traditional crowdfunding methods. This integration empowers startups and projects worldwide to secure funding efficiently while offering investors fractional ownership and liquidity options through tokenization.

Key Terms

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, allowing project initiators to bypass traditional financial intermediaries and raising billions annually worldwide.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding is a method for startups to raise money through collective effort from a large pool of individuals mostly online, offering an alternative to traditional funding methods by accessing diverse investors interested in supporting projects or businesses.

Crowdfunding explained - European Commission - Crowdfunding enables fundraisers, especially startups and SMEs, to collect money from many people via online platforms, fostering community engagement and providing market insight, often through an all-or-nothing funding model to minimize risk.

dowidth.com

dowidth.com