Crowdlending and invoice financing are innovative financing solutions empowering businesses with alternative funding sources beyond traditional banks. Crowdlending connects companies directly with individual or institutional investors through online platforms, facilitating peer-to-peer loans with flexible terms. Explore the advantages and nuances of crowdlending versus invoice financing to identify the best fit for your financial strategy.

Why it is important

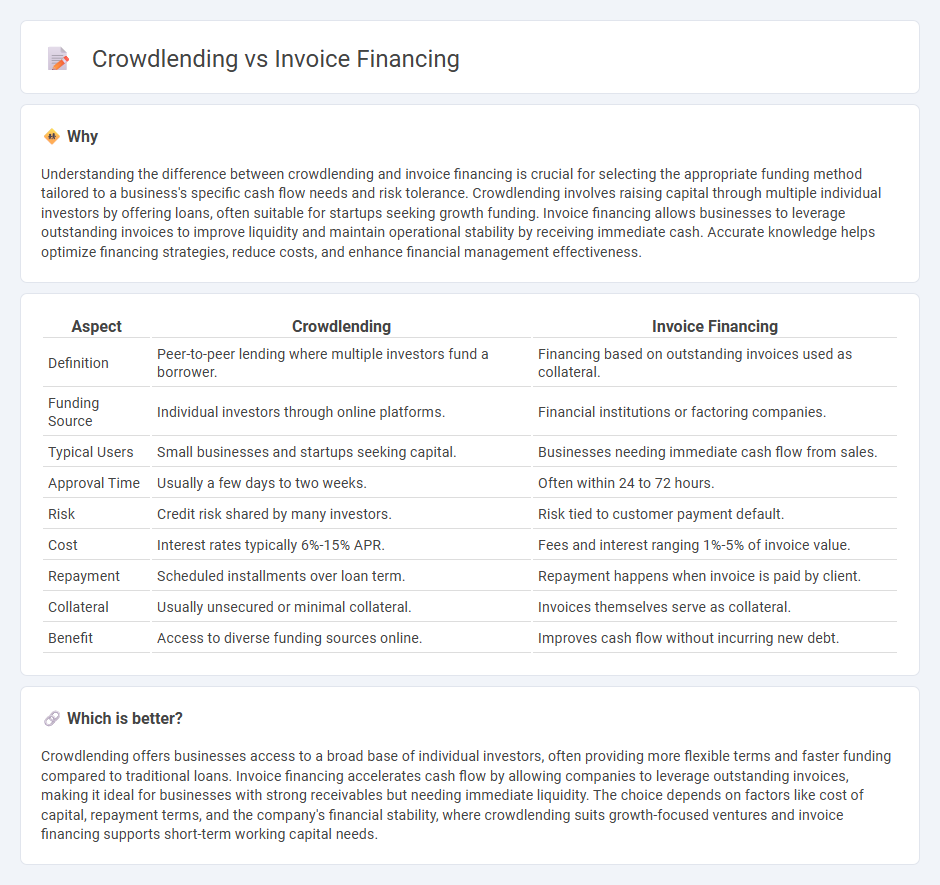

Understanding the difference between crowdlending and invoice financing is crucial for selecting the appropriate funding method tailored to a business's specific cash flow needs and risk tolerance. Crowdlending involves raising capital through multiple individual investors by offering loans, often suitable for startups seeking growth funding. Invoice financing allows businesses to leverage outstanding invoices to improve liquidity and maintain operational stability by receiving immediate cash. Accurate knowledge helps optimize financing strategies, reduce costs, and enhance financial management effectiveness.

Comparison Table

| Aspect | Crowdlending | Invoice Financing |

|---|---|---|

| Definition | Peer-to-peer lending where multiple investors fund a borrower. | Financing based on outstanding invoices used as collateral. |

| Funding Source | Individual investors through online platforms. | Financial institutions or factoring companies. |

| Typical Users | Small businesses and startups seeking capital. | Businesses needing immediate cash flow from sales. |

| Approval Time | Usually a few days to two weeks. | Often within 24 to 72 hours. |

| Risk | Credit risk shared by many investors. | Risk tied to customer payment default. |

| Cost | Interest rates typically 6%-15% APR. | Fees and interest ranging 1%-5% of invoice value. |

| Repayment | Scheduled installments over loan term. | Repayment happens when invoice is paid by client. |

| Collateral | Usually unsecured or minimal collateral. | Invoices themselves serve as collateral. |

| Benefit | Access to diverse funding sources online. | Improves cash flow without incurring new debt. |

Which is better?

Crowdlending offers businesses access to a broad base of individual investors, often providing more flexible terms and faster funding compared to traditional loans. Invoice financing accelerates cash flow by allowing companies to leverage outstanding invoices, making it ideal for businesses with strong receivables but needing immediate liquidity. The choice depends on factors like cost of capital, repayment terms, and the company's financial stability, where crowdlending suits growth-focused ventures and invoice financing supports short-term working capital needs.

Connection

Crowdlending and invoice financing both serve as alternative financing methods that leverage business cash flow to secure funding. Crowdlending enables multiple investors to provide capital directly to businesses, often based on creditworthiness or projected income, while invoice financing allows companies to unlock working capital by selling unpaid invoices to financiers. Both approaches facilitate improved liquidity and cash flow management for businesses by connecting funding sources to receivables or future earnings.

Key Terms

Accounts Receivable

Invoice financing leverages outstanding invoices as collateral to provide immediate cash flow, accelerating working capital without incurring traditional debt. Crowdlending pools funds from multiple investors, offering businesses access to loans while diversifying risk across lenders rather than relying solely on accounts receivable. Explore detailed comparisons on how each method optimizes accounts receivable management and impacts business liquidity.

Peer-to-Peer Lending

Invoice financing provides businesses with immediate cash flow by selling outstanding invoices to lenders, while crowdlending, particularly Peer-to-Peer (P2P) lending, connects borrowers directly with individual investors through an online platform. P2P lending platforms enhance accessibility and transparency, enabling small businesses to secure funds without traditional banking hurdles. Explore detailed comparisons on how P2P lending can optimize your financing strategy.

Interest Rate

Invoice financing typically offers interest rates ranging from 1% to 5% per month based on the invoice value and duration, providing quick access to cash by leveraging outstanding invoices. Crowdlending interest rates vary widely, commonly between 5% and 15% annually, influenced by borrower creditworthiness and campaign structure on platforms like Funding Circle or Mintos. Explore detailed comparisons and case studies to understand which financing option best suits your business needs.

Source and External Links

How to Use Invoice Financing (And When You Shouldn't) - Upflow - Invoice financing allows businesses to borrow against outstanding invoices to get immediate working capital, advancing 70-90% of the invoice amount while the business retains control of customer relationships and collections.

Invoice Financing: Definition and How It Works - NerdWallet - Invoice financing is a way for B2B businesses to use unpaid invoices as collateral to secure loans or credit, often advancing up to 90% of the invoice and requiring repayment with fees once customers pay.

Invoice Financing: A Small Business Guide - Fundera - Invoice financing provides advances up to about 85-90% of unpaid invoices, charging 1%-5% fees, helps businesses improve cash flow quickly, and differs from factoring as the business retains collection responsibilities.

dowidth.com

dowidth.com