Liquidity staking involves locking cryptocurrencies in a network to support blockchain security while earning staking rewards, offering a lower-risk option compared to yield farming. Yield farming requires providing assets to decentralized finance (DeFi) protocols for interest or token incentives, often exposing investors to higher volatility and smart contract risks. Explore more to understand which strategy aligns best with your financial goals.

Why it is important

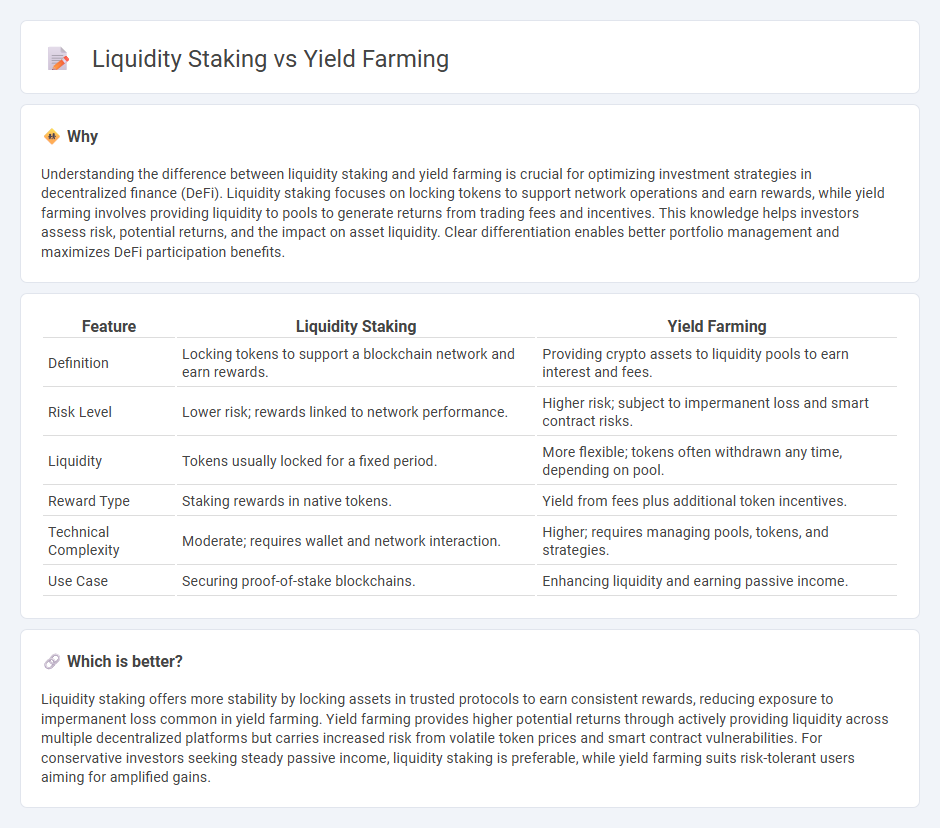

Understanding the difference between liquidity staking and yield farming is crucial for optimizing investment strategies in decentralized finance (DeFi). Liquidity staking focuses on locking tokens to support network operations and earn rewards, while yield farming involves providing liquidity to pools to generate returns from trading fees and incentives. This knowledge helps investors assess risk, potential returns, and the impact on asset liquidity. Clear differentiation enables better portfolio management and maximizes DeFi participation benefits.

Comparison Table

| Feature | Liquidity Staking | Yield Farming |

|---|---|---|

| Definition | Locking tokens to support a blockchain network and earn rewards. | Providing crypto assets to liquidity pools to earn interest and fees. |

| Risk Level | Lower risk; rewards linked to network performance. | Higher risk; subject to impermanent loss and smart contract risks. |

| Liquidity | Tokens usually locked for a fixed period. | More flexible; tokens often withdrawn any time, depending on pool. |

| Reward Type | Staking rewards in native tokens. | Yield from fees plus additional token incentives. |

| Technical Complexity | Moderate; requires wallet and network interaction. | Higher; requires managing pools, tokens, and strategies. |

| Use Case | Securing proof-of-stake blockchains. | Enhancing liquidity and earning passive income. |

Which is better?

Liquidity staking offers more stability by locking assets in trusted protocols to earn consistent rewards, reducing exposure to impermanent loss common in yield farming. Yield farming provides higher potential returns through actively providing liquidity across multiple decentralized platforms but carries increased risk from volatile token prices and smart contract vulnerabilities. For conservative investors seeking steady passive income, liquidity staking is preferable, while yield farming suits risk-tolerant users aiming for amplified gains.

Connection

Liquidity staking enhances decentralized finance (DeFi) by allowing users to earn rewards on staked tokens while providing liquidity to protocols, which supports yield farming strategies. Yield farming leverages liquidity pools funded by staked assets to generate high returns through interest, fees, or token incentives. This interconnected mechanism optimizes capital efficiency and maximizes passive income opportunities within the blockchain ecosystem.

Key Terms

Annual Percentage Yield (APY)

Yield farming typically offers higher Annual Percentage Yield (APY) by allowing users to earn rewards through providing liquidity and staking multiple tokens in decentralized finance (DeFi) protocols. Liquidity staking generally provides more stable but lower APYs by locking tokens in staking pools to support network security while earning staking rewards. Explore detailed comparisons and strategies to maximize your returns in yield farming and liquidity staking.

Liquidity Pool

Liquidity pools are core components in both yield farming and liquidity staking, offering token holders a platform to contribute assets and earn rewards by facilitating decentralized trading. Yield farming often involves moving assets across multiple pools to maximize returns through reward tokens, while liquidity staking typically emphasizes long-term asset commitment within a single pool to support network security and governance. Explore the detailed dynamics of liquidity pools to better understand their impact on decentralized finance strategies.

Staking Rewards

Yield farming offers variable staking rewards through multiple DeFi protocols by providing liquidity to diverse token pools, often maximizing returns with higher risk. Liquidity staking delivers consistent staking rewards by locking assets in a single blockchain protocol, aiming for stable income with reduced exposure. Explore the detailed comparison to understand which strategy aligns best with your investment goals and risk tolerance.

Source and External Links

What is yield farming and how does it work? - Yield farming is a DeFi practice where users allocate digital assets into protocols to earn rewards, typically in governance tokens, by providing liquidity through smart contracts in exchange for yields expressed as APY, but it involves risks like impermanent loss and smart contract flaws.

What Is Yield Farming? Meaning and Definition - Yield farming (or liquidity mining) rewards users for providing liquidity or other value to decentralized applications, mainly to bootstrap liquidity and distribute governance tokens fairly, generating returns proportional to deposits and helping grow DeFi ecosystems.

Yield Farming Explained: Your Complete Beginner's Guide - Yield farming is a DeFi strategy to earn rewards by supplying liquidity to decentralized exchanges or lending platforms, with rewards including transaction fees and governance tokens, while requiring attention to risks like impermanent loss, smart contract vulnerabilities, and rug pulls.

dowidth.com

dowidth.com