Loss harvesting enables investors to offset capital gains by selling securities at a loss, effectively reducing their tax liability. The wash sale rule prohibits claiming a tax deduction on a security sold at a loss if the same or substantially identical security is purchased within 30 days before or after the sale. Explore our detailed guide to master strategic tax planning through loss harvesting while navigating the wash sale rule.

Why it is important

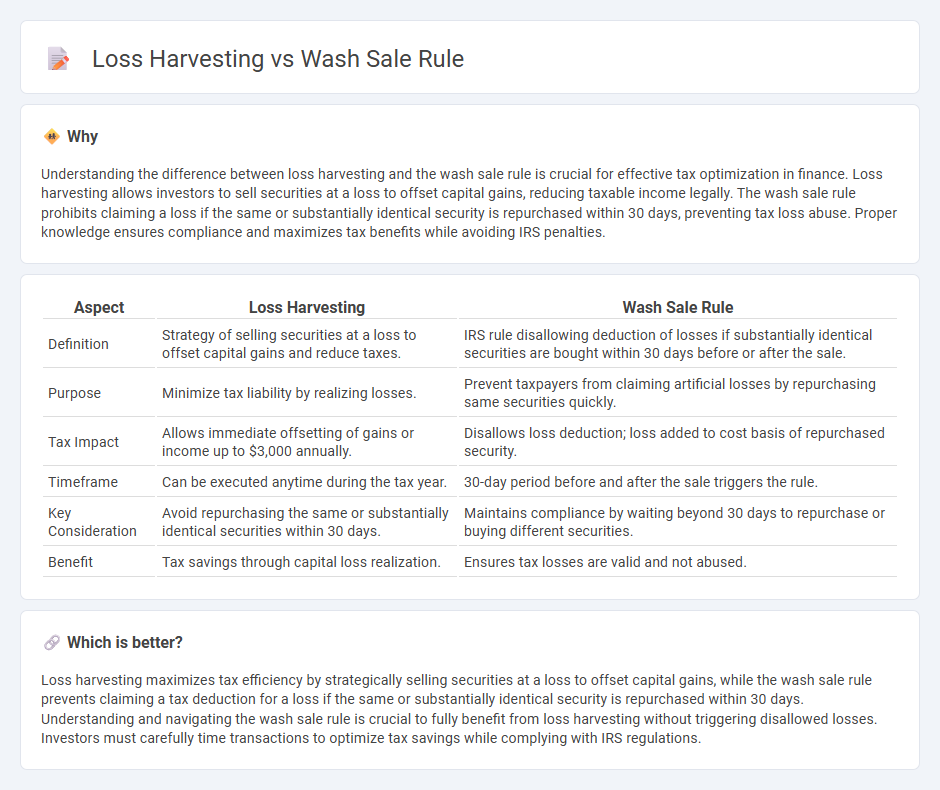

Understanding the difference between loss harvesting and the wash sale rule is crucial for effective tax optimization in finance. Loss harvesting allows investors to sell securities at a loss to offset capital gains, reducing taxable income legally. The wash sale rule prohibits claiming a loss if the same or substantially identical security is repurchased within 30 days, preventing tax loss abuse. Proper knowledge ensures compliance and maximizes tax benefits while avoiding IRS penalties.

Comparison Table

| Aspect | Loss Harvesting | Wash Sale Rule |

|---|---|---|

| Definition | Strategy of selling securities at a loss to offset capital gains and reduce taxes. | IRS rule disallowing deduction of losses if substantially identical securities are bought within 30 days before or after the sale. |

| Purpose | Minimize tax liability by realizing losses. | Prevent taxpayers from claiming artificial losses by repurchasing same securities quickly. |

| Tax Impact | Allows immediate offsetting of gains or income up to $3,000 annually. | Disallows loss deduction; loss added to cost basis of repurchased security. |

| Timeframe | Can be executed anytime during the tax year. | 30-day period before and after the sale triggers the rule. |

| Key Consideration | Avoid repurchasing the same or substantially identical securities within 30 days. | Maintains compliance by waiting beyond 30 days to repurchase or buying different securities. |

| Benefit | Tax savings through capital loss realization. | Ensures tax losses are valid and not abused. |

Which is better?

Loss harvesting maximizes tax efficiency by strategically selling securities at a loss to offset capital gains, while the wash sale rule prevents claiming a tax deduction for a loss if the same or substantially identical security is repurchased within 30 days. Understanding and navigating the wash sale rule is crucial to fully benefit from loss harvesting without triggering disallowed losses. Investors must carefully time transactions to optimize tax savings while complying with IRS regulations.

Connection

Loss harvesting involves selling securities at a loss to offset taxable gains, thereby reducing overall tax liability. The wash sale rule prohibits repurchasing the same or substantially identical security within 30 days before or after the sale to prevent taxpayers from claiming artificial losses. Understanding this connection is crucial for investors to optimize tax strategies without violating IRS regulations.

Key Terms

Tax Loss Harvesting

The wash sale rule prevents investors from claiming a tax deduction on a security sold at a loss if the same or substantially identical security is repurchased within 30 days before or after the sale, directly impacting tax loss harvesting strategies. Tax loss harvesting involves selling securities at a loss to offset capital gains and reduce taxable income, but investors must navigate the wash sale rule carefully to ensure losses are valid for tax benefits. Explore effective tax loss harvesting techniques while avoiding wash sale pitfalls to maximize your investment tax efficiency.

Substantially Identical Securities

The wash sale rule disallows claiming a tax loss on the sale of a security if a substantially identical security is purchased within 30 days before or after the sale, preventing investors from realizing tax benefits through quick repurchases. Loss harvesting strategies involve selling assets at a loss to offset gains but must navigate the wash sale rule to avoid disallowed losses, especially when dealing with substantially identical securities like shares of the same company or mutual funds with similar holdings. Explore detailed guidelines and examples to optimize tax advantages while complying with IRS regulations on substantially identical securities.

Holding Period

The wash sale rule prevents investors from claiming a tax loss if they repurchase the same or substantially identical security within 30 days before or after the sale, affecting their holding period by resetting it. Loss harvesting strategically sells securities at a loss to offset gains, but must navigate the wash sale rule to maintain the original holding period and avoid disallowed losses. Explore deeper strategies to optimize tax benefits while managing your investment holding periods effectively.

Source and External Links

Understanding the Wash Sale Rule for Investors - SD Mayer - The wash sale rule, regulated by the IRS, prohibits claiming a loss on the sale of a stock or security if the same or substantially identical one is repurchased within 30 days before or after the sale, disallowing the immediate tax benefit but adding the loss to the new purchase's cost basis.

Wash Sale Rule: What Is It, How Does It Work, and More - TurboTax - The wash sale rule prevents investors from "manufacturing" tax losses by selling a security at a loss and buying a substantially identical one within a 61-day period (30 days before and after sale), disallowing the loss for tax purposes.

Case Study 1: Wash Sales - IRS - The IRS defines a wash sale as selling securities at a loss and buying substantially identical securities within 30 days, disallowing the loss deduction but requiring addition of the loss to the cost basis of the new stock for future tax calculations.

dowidth.com

dowidth.com