Degen Box and Collateralized Debt Position (CDP) are crucial tools in decentralized finance for managing digital assets and debt exposure. Degen Box enables flexible asset management with automated strategies optimizing yield, while CDPs allow users to lock collateral and generate a stablecoin loan against their holdings, ensuring liquidity without selling assets. Explore deeper insights into how these mechanisms impact risk management and capital efficiency in crypto lending.

Why it is important

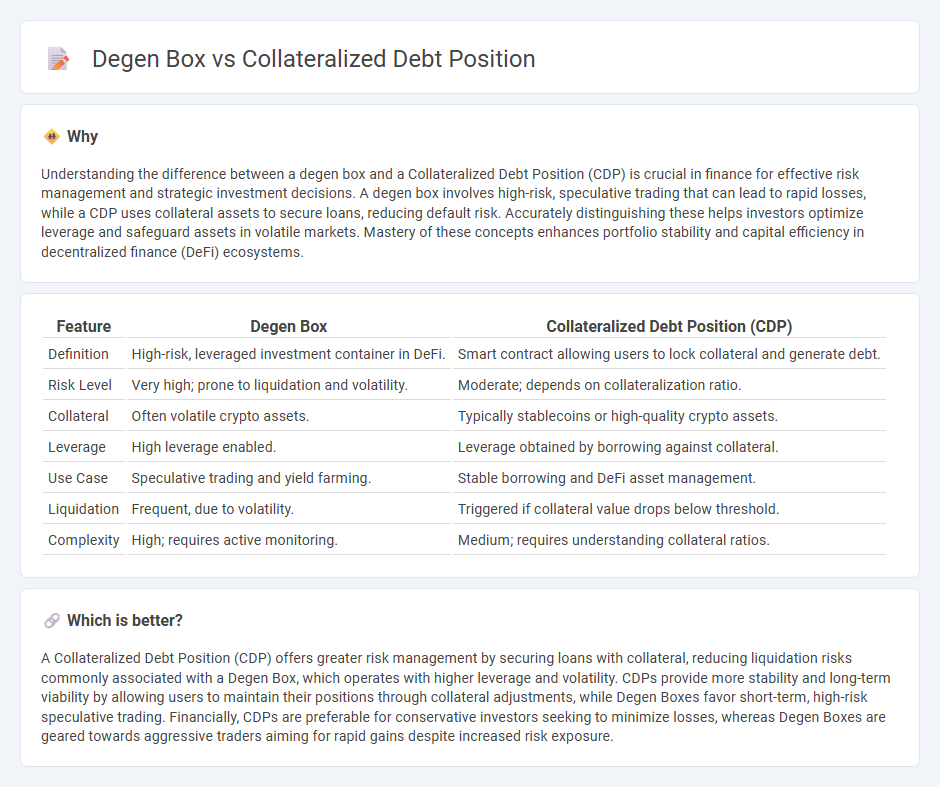

Understanding the difference between a degen box and a Collateralized Debt Position (CDP) is crucial in finance for effective risk management and strategic investment decisions. A degen box involves high-risk, speculative trading that can lead to rapid losses, while a CDP uses collateral assets to secure loans, reducing default risk. Accurately distinguishing these helps investors optimize leverage and safeguard assets in volatile markets. Mastery of these concepts enhances portfolio stability and capital efficiency in decentralized finance (DeFi) ecosystems.

Comparison Table

| Feature | Degen Box | Collateralized Debt Position (CDP) |

|---|---|---|

| Definition | High-risk, leveraged investment container in DeFi. | Smart contract allowing users to lock collateral and generate debt. |

| Risk Level | Very high; prone to liquidation and volatility. | Moderate; depends on collateralization ratio. |

| Collateral | Often volatile crypto assets. | Typically stablecoins or high-quality crypto assets. |

| Leverage | High leverage enabled. | Leverage obtained by borrowing against collateral. |

| Use Case | Speculative trading and yield farming. | Stable borrowing and DeFi asset management. |

| Liquidation | Frequent, due to volatility. | Triggered if collateral value drops below threshold. |

| Complexity | High; requires active monitoring. | Medium; requires understanding collateral ratios. |

Which is better?

A Collateralized Debt Position (CDP) offers greater risk management by securing loans with collateral, reducing liquidation risks commonly associated with a Degen Box, which operates with higher leverage and volatility. CDPs provide more stability and long-term viability by allowing users to maintain their positions through collateral adjustments, while Degen Boxes favor short-term, high-risk speculative trading. Financially, CDPs are preferable for conservative investors seeking to minimize losses, whereas Degen Boxes are geared towards aggressive traders aiming for rapid gains despite increased risk exposure.

Connection

A Degen Box is a specialized smart contract framework used in decentralized finance (DeFi) platforms to manage Collateralized Debt Positions (CDPs) efficiently. It streamlines interactions with CDPs by bundling collateral management, borrowing, and liquidation processes into a single contract, enhancing user experience and reducing gas fees. This integration improves risk management and liquidity by ensuring automatic and transparent collateral adjustments aligned with debt levels.

Key Terms

Leverage

A Collateralized Debt Position (CDP) allows users to lock collateral to generate a stablecoin, enabling controlled leverage based on the value of deposited assets, while a Degen Box employs extreme leverage through tokenized collateral and borrowing, amplifying risks and rewards significantly. CDPs maintain a safer leverage ratio with liquidation thresholds to protect the system, whereas Degen Box strategies often involve rapid, high-risk leveraging for experienced users seeking amplified returns. Explore detailed comparisons to understand leverage mechanisms and risk profiles in decentralized finance.

Liquidation

Collateralized Debt Positions (CDPs) manage collateral to maintain loan health and avoid liquidation through strict collateralization ratios, triggering liquidation when asset values drastically fall. Degen Boxes, utilized in decentralized finance, automate liquidation processes by leveraging smart contracts for quicker and more efficient collateral seizure. Explore detailed mechanisms and risk implications of liquidation in both systems to enhance your strategic decisions.

Yield

Collateralized debt positions (CDPs) offer yield through stablecoin loans backed by crypto assets, ensuring lower risk and predictable returns. Degen boxes, by contrast, amplify yield opportunities through high-leverage strategies and complex risk exposure, attracting aggressive yield seekers. Explore detailed comparisons to optimize your yield-focused DeFi strategy.

Source and External Links

What is Collateralized Debt Position (CDP)? Definition & ... - A CDP is created by locking collateral into MakerDAO's smart contract, generating decentralized stablecoin DAI, requiring collateral value to exceed 150% of DAI, with liquidation triggered if undercollateralized.

What is Collateralized Debt Position (CDP) in DeFi? - CDPs allow users to lock collateral to borrow stablecoins like DAI, maintaining a 150% collateralization ratio to prevent liquidation while providing liquidity in decentralized finance.

Collateral Debt Positions - Community Development - MakerDAO's CDPs are smart contract loans on Ethereum, enabling users to generate DAI against escrowed collateral that remains locked until the debt is repaid, ensuring overcollateralization for system stability.

dowidth.com

dowidth.com