Hard rug pulls involve abrupt and intentional exit scams where developers drain liquidity from a decentralized finance (DeFi) platform, causing investors to lose their funds instantly. Wash trading manipulates market activity by repeatedly buying and selling the same asset to create misleading volume and falsely inflate prices. Explore these critical risks to safeguard your investments and deepen your understanding of DeFi security.

Why it is important

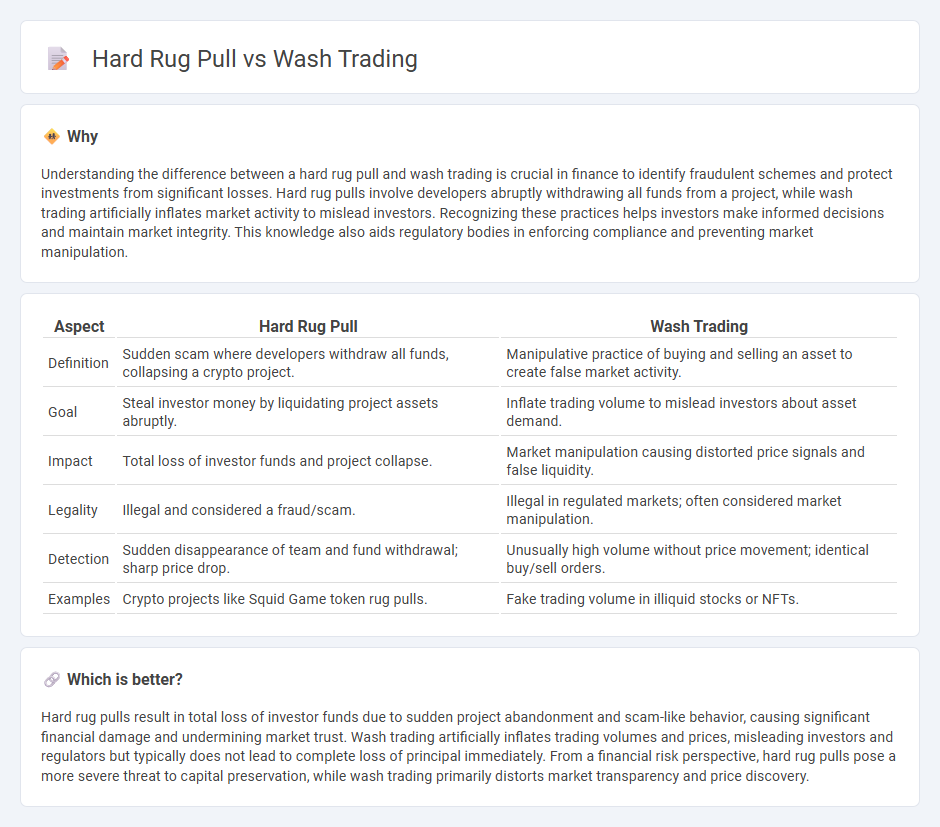

Understanding the difference between a hard rug pull and wash trading is crucial in finance to identify fraudulent schemes and protect investments from significant losses. Hard rug pulls involve developers abruptly withdrawing all funds from a project, while wash trading artificially inflates market activity to mislead investors. Recognizing these practices helps investors make informed decisions and maintain market integrity. This knowledge also aids regulatory bodies in enforcing compliance and preventing market manipulation.

Comparison Table

| Aspect | Hard Rug Pull | Wash Trading |

|---|---|---|

| Definition | Sudden scam where developers withdraw all funds, collapsing a crypto project. | Manipulative practice of buying and selling an asset to create false market activity. |

| Goal | Steal investor money by liquidating project assets abruptly. | Inflate trading volume to mislead investors about asset demand. |

| Impact | Total loss of investor funds and project collapse. | Market manipulation causing distorted price signals and false liquidity. |

| Legality | Illegal and considered a fraud/scam. | Illegal in regulated markets; often considered market manipulation. |

| Detection | Sudden disappearance of team and fund withdrawal; sharp price drop. | Unusually high volume without price movement; identical buy/sell orders. |

| Examples | Crypto projects like Squid Game token rug pulls. | Fake trading volume in illiquid stocks or NFTs. |

Which is better?

Hard rug pulls result in total loss of investor funds due to sudden project abandonment and scam-like behavior, causing significant financial damage and undermining market trust. Wash trading artificially inflates trading volumes and prices, misleading investors and regulators but typically does not lead to complete loss of principal immediately. From a financial risk perspective, hard rug pulls pose a more severe threat to capital preservation, while wash trading primarily distorts market transparency and price discovery.

Connection

Rug pulls and wash trading are interconnected fraudulent activities undermining trust in decentralized finance (DeFi) markets. Rug pulls involve developers abruptly withdrawing liquidity to defraud investors, while wash trading artificially inflates trading volumes to deceive market participants about an asset's demand. Both practices manipulate market perception, exacerbating risks and distorting price discovery in cryptocurrency trading environments.

Key Terms

Market Manipulation

Wash trading involves artificially inflating market activity by repeatedly buying and selling the same asset to create misleading signals of demand or liquidity, a common form of market manipulation. Hard rug pull refers to a sudden and deliberate withdrawal of all liquidity from a market or project, causing a sharp collapse in asset value and devastating investors. Explore the key differences and implications of these manipulative practices for a deeper understanding of market risks.

Liquidity Removal

Wash trading manipulates market perception by creating artificial trading volume, while hard rug pulls involve the sudden removal of liquidity, causing severe price collapses and investor losses. Liquidity removal in a hard rug pull leads to an inability to sell assets at fair market value, distinct from wash trading which primarily inflates trade activity without immediate liquidity impact. Explore in-depth contrasts between liquidity dynamics in wash trading and hard rug pulls for better investment protection.

False Volume

Wash trading manipulates market perception by creating false volume through repetitive buying and selling of the same asset, misleading investors about liquidity and demand. Hard rug pulls involve abrupt asset withdrawal by developers, causing significant investor losses and market collapse without pretense of volume or activity. Discover the key differences and warning signs between false volume and severe market exit strategies to protect your investments.

Source and External Links

What is Wash Trading? - NICE Actimize - Wash trading is a deceptive practice of simultaneously buying and selling the same security to create an illusion of market activity, misleading others by inflating volume or manipulating prices without real change in ownership.

Wash Trading - Overview, How It Works, and Example - Wash trading, also called round trip trading, is an illegal tactic where an investor buys and sells the same financial instrument at the same time to manipulate market appearance of demand and volume.

The Murky Waters of Wash Trading Digital Assets - DOJ Charges 18 ... - The US government recently charged multiple individuals and firms with illegal wash trading in cryptocurrency markets, highlighting its use as a tool for artificial market manipulation in digital assets.

dowidth.com

dowidth.com