Alternative data scraping harnesses unconventional sources such as social media, satellite imagery, and web traffic to uncover real-time market insights, enhancing predictive accuracy beyond standard datasets. Traditional data analysis relies on structured financial reports, historical pricing, and economic indicators, offering well-established but sometimes lagging perspectives. Explore the advantages and challenges of both approaches to optimize investment strategies.

Why it is important

Understanding the difference between Alternative Data Scraping and Traditional Data Analysis is crucial for finance professionals to leverage diverse, real-time data sources beyond conventional financial reports, enhancing predictive accuracy and investment decisions. Alternative data scraping captures unconventional data like social media sentiment, satellite imagery, and web traffic, providing unique insights not available through traditional methods focused on historical financial statements and market data. This knowledge allows for more comprehensive risk assessment, uncovering emerging market trends and identifying investment opportunities faster. Mastery of both techniques empowers finance experts to adopt innovative strategies and maintain a competitive edge in dynamic markets.

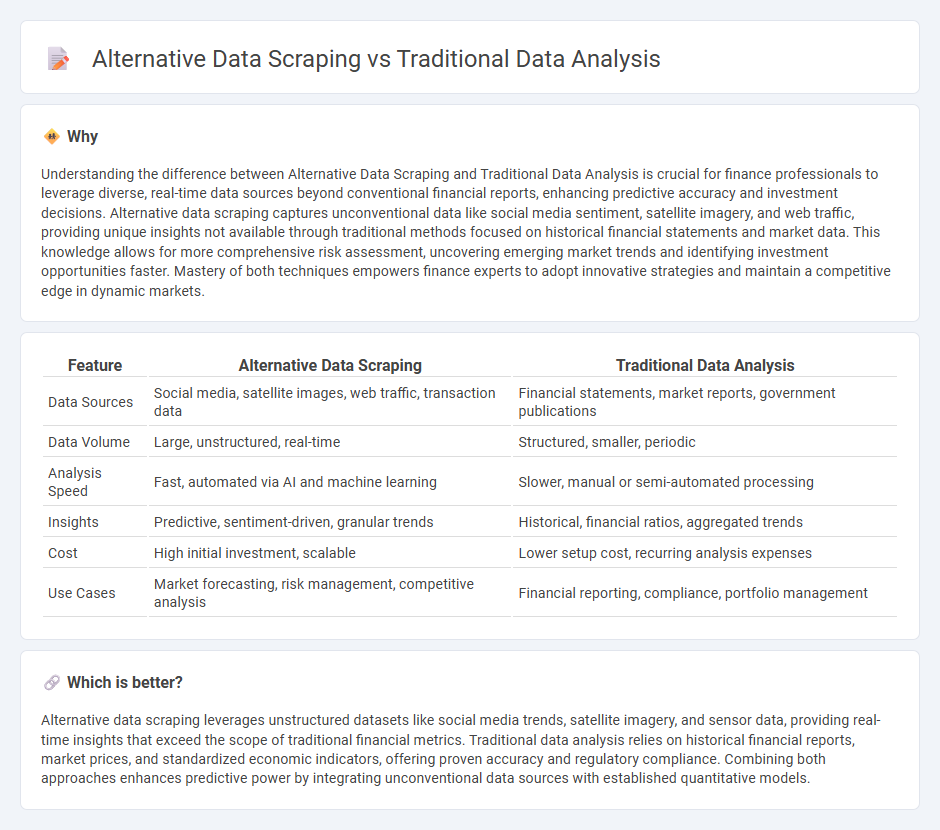

Comparison Table

| Feature | Alternative Data Scraping | Traditional Data Analysis |

|---|---|---|

| Data Sources | Social media, satellite images, web traffic, transaction data | Financial statements, market reports, government publications |

| Data Volume | Large, unstructured, real-time | Structured, smaller, periodic |

| Analysis Speed | Fast, automated via AI and machine learning | Slower, manual or semi-automated processing |

| Insights | Predictive, sentiment-driven, granular trends | Historical, financial ratios, aggregated trends |

| Cost | High initial investment, scalable | Lower setup cost, recurring analysis expenses |

| Use Cases | Market forecasting, risk management, competitive analysis | Financial reporting, compliance, portfolio management |

Which is better?

Alternative data scraping leverages unstructured datasets like social media trends, satellite imagery, and sensor data, providing real-time insights that exceed the scope of traditional financial metrics. Traditional data analysis relies on historical financial reports, market prices, and standardized economic indicators, offering proven accuracy and regulatory compliance. Combining both approaches enhances predictive power by integrating unconventional data sources with established quantitative models.

Connection

Alternative data scraping enhances traditional data analysis by providing unconventional datasets such as social media sentiment, satellite imagery, and web traffic patterns. Integrating these diverse sources allows financial analysts to uncover deeper insights, improve predictive models, and gain competitive advantages in market forecasting. This fusion of data methodologies drives more comprehensive risk assessments and investment decisions.

Key Terms

Fundamental Analysis

Traditional data analysis in fundamental analysis relies on financial statements, earnings reports, and market trends to evaluate a company's intrinsic value. Alternative data scraping enhances this approach by gathering real-time, unstructured data from social media, satellite images, or web traffic patterns, providing deeper insights into market sentiment and operational performance. Explore how integrating alternative data can revolutionize your fundamental analysis strategies.

Big Data

Traditional data analysis typically relies on structured datasets from established sources, enabling precise statistical modeling and trend identification within Big Data frameworks. Alternative data scraping collects unstructured or semi-structured data from unconventional sources such as social media, web logs, and sensor outputs, offering real-time insights and richer contextual information for enhanced predictive analytics. Explore the evolving methodologies and tools reshaping Big Data analytics for a deeper understanding.

Web Scraping

Traditional data analysis relies heavily on structured datasets from internal databases and established sources, while alternative data scraping, particularly web scraping, extracts unstructured data from diverse online platforms such as social media, e-commerce sites, and forums. Web scraping utilizes automated tools to collect real-time, high-volume data that can reveal consumer behavior patterns, market trends, and competitive intelligence not captured by conventional methods. Explore our comprehensive guide to understand how web scraping can transform your data strategy and business insights.

Source and External Links

AI-Powered Analytics vs. Traditional Data Analysis - Infomineo - Traditional data analysis uses statistical methods and human expertise to examine structured data, involving techniques like descriptive statistics, exploratory data analysis, hypothesis testing, regression analysis, and time series analysis to support decision-making without AI or machine learning.

Big Data Analytics Versus Traditional Data Analytics - Infomineo - Traditional data analytics mainly focuses on structured data stored in databases or spreadsheets and uses tools like SQL and statistical methods to enable informed decision-making across sectors like healthcare, finance, retail, and energy.

Generative analysis vs. traditional data analysis - Monterey AI - Traditional data analysis typically involves human analysts using quantitative datasets and tools such as Excel, Tableau, and Looker with pre-determined metrics to analyze data and make predictions, emphasizing structured data and statistical approaches.

dowidth.com

dowidth.com