Copy trading platforms allow investors to replicate the trades of experienced traders in real-time, offering a hands-off approach to market participation. Portfolio management services provide personalized investment strategies, asset allocation, and ongoing portfolio monitoring tailored to individual financial goals. Discover more about which financial solution suits your investment style and objectives.

Why it is important

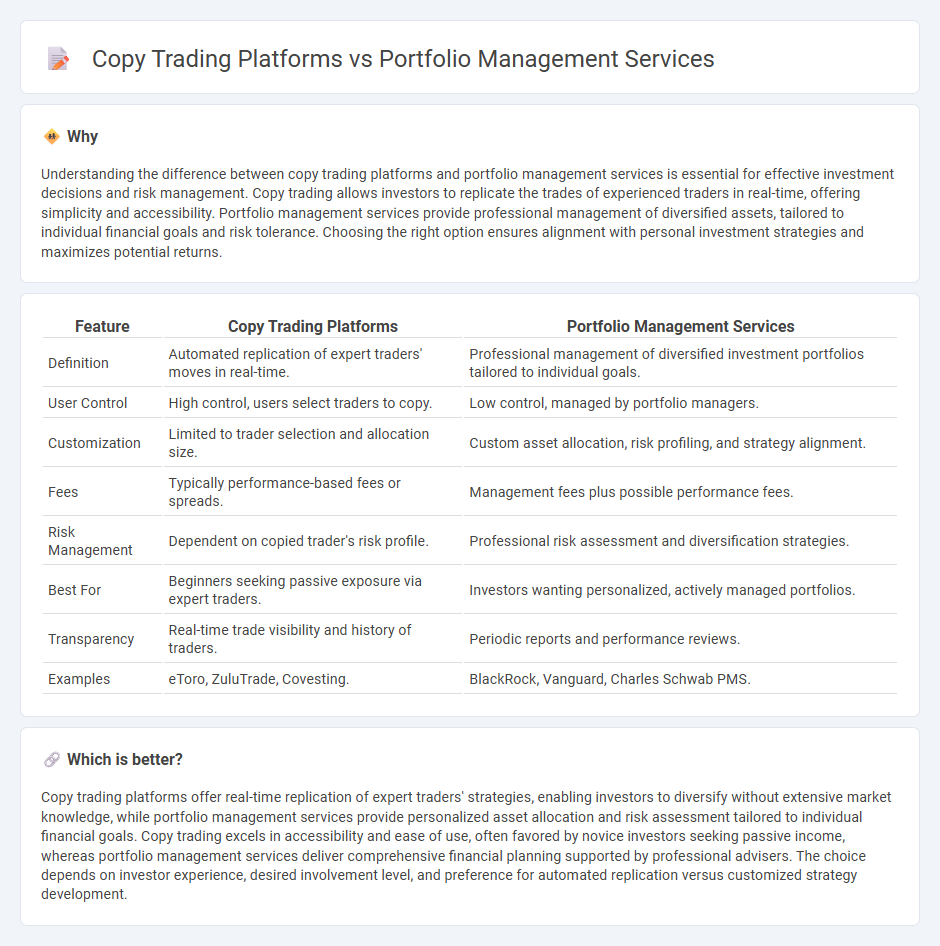

Understanding the difference between copy trading platforms and portfolio management services is essential for effective investment decisions and risk management. Copy trading allows investors to replicate the trades of experienced traders in real-time, offering simplicity and accessibility. Portfolio management services provide professional management of diversified assets, tailored to individual financial goals and risk tolerance. Choosing the right option ensures alignment with personal investment strategies and maximizes potential returns.

Comparison Table

| Feature | Copy Trading Platforms | Portfolio Management Services |

|---|---|---|

| Definition | Automated replication of expert traders' moves in real-time. | Professional management of diversified investment portfolios tailored to individual goals. |

| User Control | High control, users select traders to copy. | Low control, managed by portfolio managers. |

| Customization | Limited to trader selection and allocation size. | Custom asset allocation, risk profiling, and strategy alignment. |

| Fees | Typically performance-based fees or spreads. | Management fees plus possible performance fees. |

| Risk Management | Dependent on copied trader's risk profile. | Professional risk assessment and diversification strategies. |

| Best For | Beginners seeking passive exposure via expert traders. | Investors wanting personalized, actively managed portfolios. |

| Transparency | Real-time trade visibility and history of traders. | Periodic reports and performance reviews. |

| Examples | eToro, ZuluTrade, Covesting. | BlackRock, Vanguard, Charles Schwab PMS. |

Which is better?

Copy trading platforms offer real-time replication of expert traders' strategies, enabling investors to diversify without extensive market knowledge, while portfolio management services provide personalized asset allocation and risk assessment tailored to individual financial goals. Copy trading excels in accessibility and ease of use, often favored by novice investors seeking passive income, whereas portfolio management services deliver comprehensive financial planning supported by professional advisers. The choice depends on investor experience, desired involvement level, and preference for automated replication versus customized strategy development.

Connection

Copy trading platforms and portfolio management services are interconnected through their core function of enabling investors to replicate expert trading strategies while optimizing asset allocation. Both leverage advanced algorithms and real-time data analysis to enhance investment decisions, providing users with automated risk management and diversified portfolios. Integration of these tools allows seamless execution of trades and continuous monitoring, ensuring alignment with individual financial goals and market conditions.

Key Terms

Diversification

Portfolio management services offer professional asset allocation strategies designed to optimize diversification across various asset classes and sectors, reducing risk and enhancing returns. Copy trading platforms enable investors to replicate trades of experienced traders but often concentrate risk in a limited number of strategies or assets. Explore how each approach impacts portfolio diversification and risk management to make informed investment decisions.

Risk control

Portfolio management services employ advanced risk assessment models, diversified asset allocation, and continuous monitoring to minimize exposure and preserve capital. Copy trading platforms rely on replicating the trades of selected investors, often lacking personalized risk controls and leading to higher vulnerability during market volatility. Explore comprehensive strategies and tools that enhance risk management in both approaches to make informed investment decisions.

Discretionary management

Discretionary portfolio management services involve professional managers making investment decisions on behalf of clients, tailoring strategies based on individual risk tolerance and financial goals. Copy trading platforms allow investors to replicate the trades of experienced traders automatically, offering a more passive and accessible approach but with less personalized oversight. Explore the nuances and benefits of discretionary management to determine the best fit for your investment strategy.

Source and External Links

What Is Portfolio Management Services Know its Benefits | HDFC Bank - Portfolio Management Service (PMS) is a professional service where skilled portfolio managers manage your equity portfolio to maximize returns and minimize risk, offering types like active, passive, discretionary, and non-discretionary management suited to your investment goals.

Portfolio Management Services - Invest in PMS - Motilal Oswal - PMS provides customized, professional investment management tailored to your risk tolerance and goals, offering benefits including diversification, transparency, risk management, tax efficiency, and access to exclusive investment opportunities.

Portfolio Management Services(PMS) - ICICIdirect - ICICIdirect's PMS offers professional, customized portfolio management to deliver superior risk-adjusted returns while relieving investors from monitoring hassles through regular reviews and risk management.

dowidth.com

dowidth.com