Synthetic assets replicate the value and cash flows of physical assets through complex financial instruments, enabling exposure without direct ownership. They offer greater liquidity, lower transaction costs, and easier portfolio diversification compared to physical assets like real estate or commodities. Explore the advantages and risks of synthetic versus physical assets to optimize your investment strategy.

Why it is important

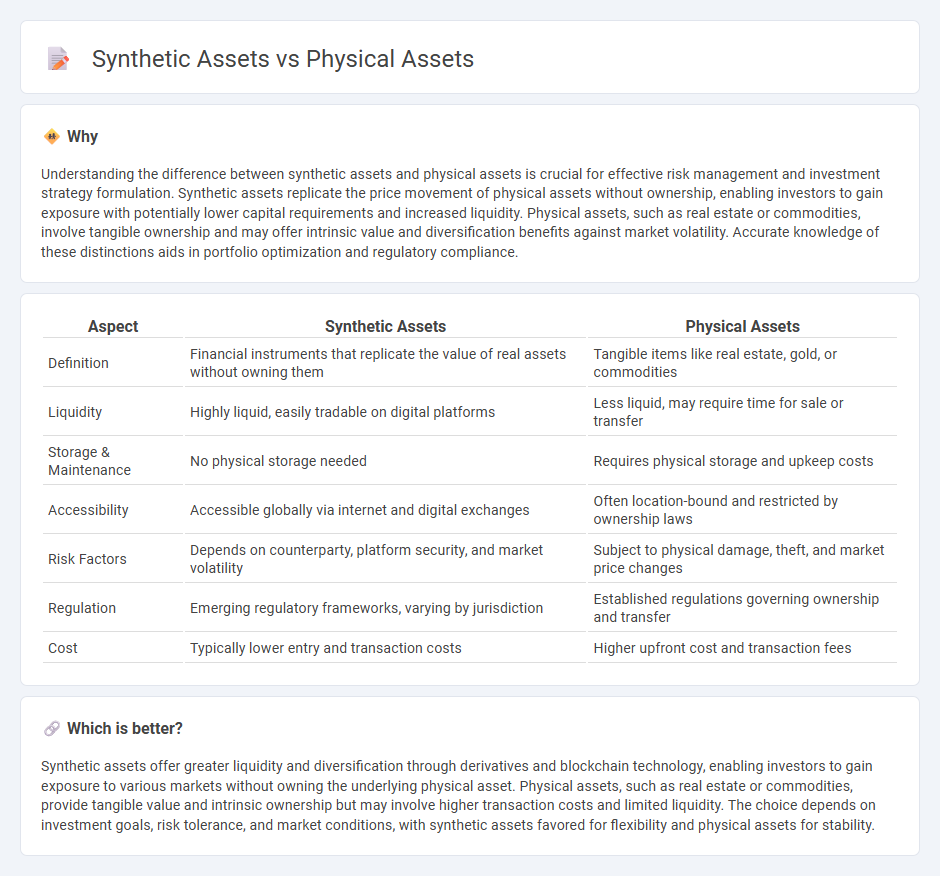

Understanding the difference between synthetic assets and physical assets is crucial for effective risk management and investment strategy formulation. Synthetic assets replicate the price movement of physical assets without ownership, enabling investors to gain exposure with potentially lower capital requirements and increased liquidity. Physical assets, such as real estate or commodities, involve tangible ownership and may offer intrinsic value and diversification benefits against market volatility. Accurate knowledge of these distinctions aids in portfolio optimization and regulatory compliance.

Comparison Table

| Aspect | Synthetic Assets | Physical Assets |

|---|---|---|

| Definition | Financial instruments that replicate the value of real assets without owning them | Tangible items like real estate, gold, or commodities |

| Liquidity | Highly liquid, easily tradable on digital platforms | Less liquid, may require time for sale or transfer |

| Storage & Maintenance | No physical storage needed | Requires physical storage and upkeep costs |

| Accessibility | Accessible globally via internet and digital exchanges | Often location-bound and restricted by ownership laws |

| Risk Factors | Depends on counterparty, platform security, and market volatility | Subject to physical damage, theft, and market price changes |

| Regulation | Emerging regulatory frameworks, varying by jurisdiction | Established regulations governing ownership and transfer |

| Cost | Typically lower entry and transaction costs | Higher upfront cost and transaction fees |

Which is better?

Synthetic assets offer greater liquidity and diversification through derivatives and blockchain technology, enabling investors to gain exposure to various markets without owning the underlying physical asset. Physical assets, such as real estate or commodities, provide tangible value and intrinsic ownership but may involve higher transaction costs and limited liquidity. The choice depends on investment goals, risk tolerance, and market conditions, with synthetic assets favored for flexibility and physical assets for stability.

Connection

Synthetic assets replicate the performance of physical assets through derivatives, enabling exposure without actual ownership. They provide liquidity and flexibility, bridging traditional markets with digital finance by tracking underlying asset values like stocks, commodities, or real estate. This connection allows investors to hedge risks, diversify portfolios, and access otherwise inaccessible asset classes efficiently.

Key Terms

Tangibility

Physical assets represent tangible properties such as real estate, machinery, or precious metals, offering inherent value through their physical existence. Synthetic assets, generated via financial derivatives or blockchain technology, lack physical form but replicate the economic exposure and benefits of real assets. Explore the nuances of tangibility in asset investment by learning more about their unique attributes and risk profiles.

Derivatives

Physical assets represent tangible commodities or financial instruments like stocks and bonds, while synthetic assets are derivative instruments designed to replicate the performance of these underlying assets without direct ownership. Derivatives such as options, futures, and swaps enable investors to gain exposure, hedge risks, or speculate on asset price movements with increased flexibility and leverage. Explore further to understand the complexities and strategic advantages of derivatives in financial markets.

Underlying asset

Physical assets represent tangible items like real estate, commodities, or precious metals, holding intrinsic value based on their physical properties and market demand. Synthetic assets, derived through financial derivatives or blockchain technology, replicate the value of underlying physical or financial assets without direct ownership of those assets. Explore the mechanisms and implications of these asset types to deepen your understanding of their roles in modern investment strategies.

Source and External Links

What is Physical Asset Management? Types & Key Strategies - Physical assets are tangible items like equipment, machinery, vehicles, buildings, and infrastructure that an organization owns to generate value, and managing these assets efficiently maximizes value while minimizing costs.

Financial Assets vs Physical Assets - Physical assets are tangible economic resources such as land, buildings, machinery, tools, and vehicles, which depreciate over time due to wear and tear and require maintenance.

Digital vs Physical Assets - Physical assets like real estate, gold, and physical currencies are tangible, widely accepted, and provide real utility but typically have lower liquidity compared to digital assets.

dowidth.com

dowidth.com