Fractional shares allow investors to purchase a portion of a stock, enabling portfolio diversification with limited capital. Stock options grant the right, but not the obligation, to buy or sell shares at a predetermined price within a specific timeframe, often used for hedging or speculation. Explore the advantages and risks of fractional shares compared to stock options to optimize your investment strategy.

Why it is important

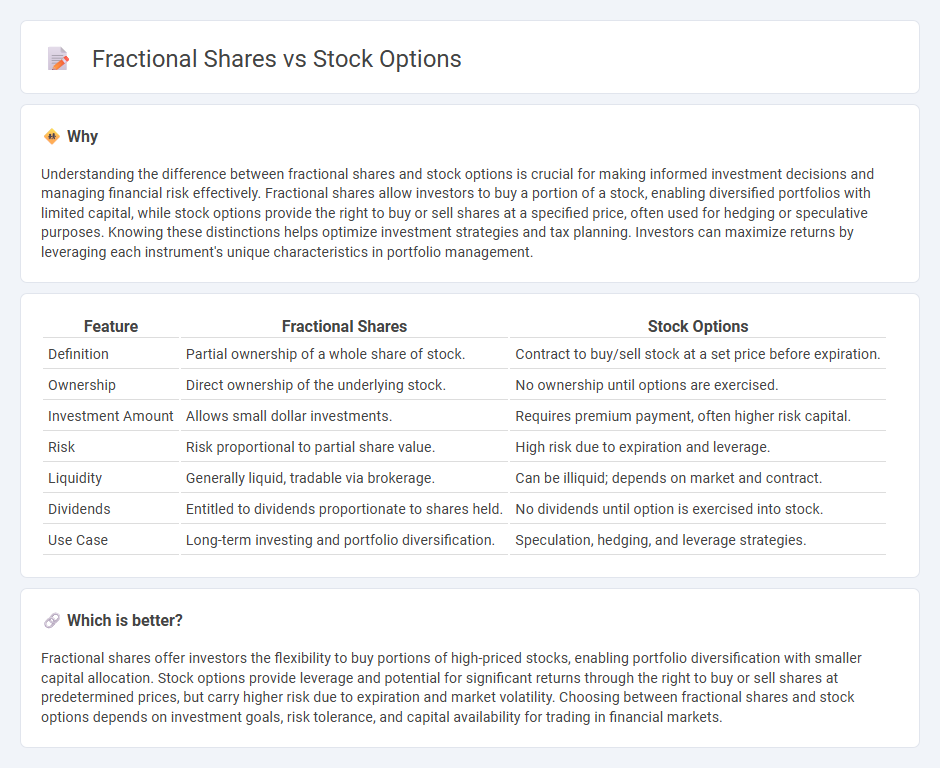

Understanding the difference between fractional shares and stock options is crucial for making informed investment decisions and managing financial risk effectively. Fractional shares allow investors to buy a portion of a stock, enabling diversified portfolios with limited capital, while stock options provide the right to buy or sell shares at a specified price, often used for hedging or speculative purposes. Knowing these distinctions helps optimize investment strategies and tax planning. Investors can maximize returns by leveraging each instrument's unique characteristics in portfolio management.

Comparison Table

| Feature | Fractional Shares | Stock Options |

|---|---|---|

| Definition | Partial ownership of a whole share of stock. | Contract to buy/sell stock at a set price before expiration. |

| Ownership | Direct ownership of the underlying stock. | No ownership until options are exercised. |

| Investment Amount | Allows small dollar investments. | Requires premium payment, often higher risk capital. |

| Risk | Risk proportional to partial share value. | High risk due to expiration and leverage. |

| Liquidity | Generally liquid, tradable via brokerage. | Can be illiquid; depends on market and contract. |

| Dividends | Entitled to dividends proportionate to shares held. | No dividends until option is exercised into stock. |

| Use Case | Long-term investing and portfolio diversification. | Speculation, hedging, and leverage strategies. |

Which is better?

Fractional shares offer investors the flexibility to buy portions of high-priced stocks, enabling portfolio diversification with smaller capital allocation. Stock options provide leverage and potential for significant returns through the right to buy or sell shares at predetermined prices, but carry higher risk due to expiration and market volatility. Choosing between fractional shares and stock options depends on investment goals, risk tolerance, and capital availability for trading in financial markets.

Connection

Fractional shares allow investors to purchase portions of a stock, enabling portfolio diversification with limited capital, while stock options provide the right to buy or sell stocks at predetermined prices, offering strategic leverage in trading. Both instruments enhance investment flexibility: fractional shares lower entry barriers to high-priced equities, and stock options enable hedging or speculative tactics within financial markets. Together, they expand access and strategic possibilities in equity investment, aligning risk management with personalized financial goals.

Key Terms

Strike Price

Stock options come with a strike price, which is the fixed price at which an employee can buy shares in the future, typically set below market value to offer potential profit. Fractional shares allow investors to purchase portions of stock without the complexities of strike prices or expiration dates. Explore the advantages of stock options and fractional shares to make informed investment decisions.

Exercising

Exercising stock options involves purchasing the underlying shares at a predetermined strike price, often requiring upfront capital and triggering tax implications based on the spread between the strike price and market value. Fractional shares, representing partial ownership of a stock, allow investors to buy smaller, more affordable portions without the complexities tied to option exercise or vesting schedules. Explore detailed strategies and tax considerations on exercising stock options versus investing in fractional shares for informed decision-making.

Partial Ownership

Stock options grant the right to buy company shares at a set price, offering potential profit if the stock price rises, while fractional shares allow investors to own a portion of a whole share, enabling partial ownership without purchasing a full stock. Stock options are often part of employee compensation packages with vesting schedules, whereas fractional shares are accessible through brokerage platforms, facilitating diversified investments with smaller capital. Explore these distinct partial ownership methods to understand their benefits and investment strategies.

Source and External Links

Stock option | EBSCO Research Starters - A stock option is a financial tool granting the holder the right, but not the obligation, to buy or sell shares at a predetermined price within a certain time frame, used by companies to attract and retain talent through compensation packages.

Stock Option - What is a Stock Option and How Does it Work? - Stock options are contracts giving the buyer rights to buy or sell stock at a strike price before expiration, with call options allowing buying and put options allowing selling, commonly used in trading and investment strategies.

Understanding Stock Options | Morgan Stanley at Work - Once vested, stock options give employees the right to purchase company shares at a set price, potentially allowing them to buy shares below market value, with vesting schedules often applying before exercise is permitted.

dowidth.com

dowidth.com