Tokenization of real-world assets transforms ownership into digital tokens on a blockchain, enhancing liquidity, transparency, and fractional investment opportunities compared to traditional asset ownership methods. Traditional asset ownership often involves lengthy processes, high transaction costs, and limited accessibility for smaller investors. Explore how tokenization is revolutionizing finance and opening new avenues for inclusion and efficiency.

Why it is important

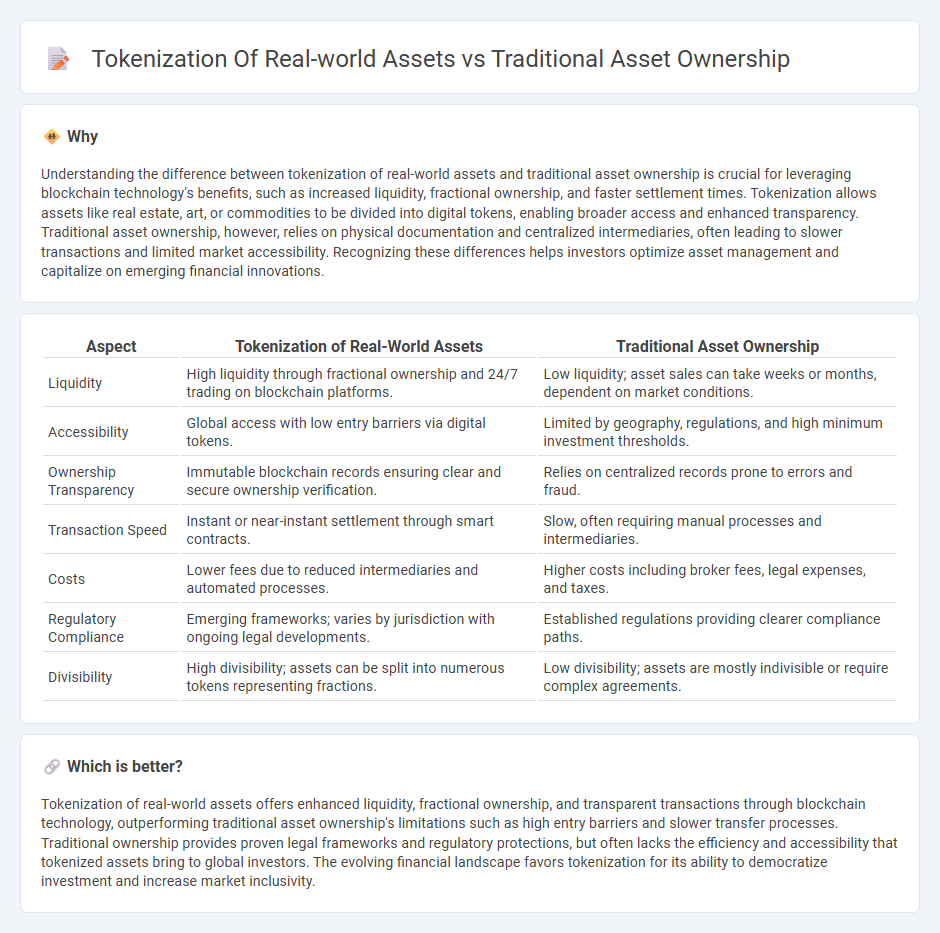

Understanding the difference between tokenization of real-world assets and traditional asset ownership is crucial for leveraging blockchain technology's benefits, such as increased liquidity, fractional ownership, and faster settlement times. Tokenization allows assets like real estate, art, or commodities to be divided into digital tokens, enabling broader access and enhanced transparency. Traditional asset ownership, however, relies on physical documentation and centralized intermediaries, often leading to slower transactions and limited market accessibility. Recognizing these differences helps investors optimize asset management and capitalize on emerging financial innovations.

Comparison Table

| Aspect | Tokenization of Real-World Assets | Traditional Asset Ownership |

|---|---|---|

| Liquidity | High liquidity through fractional ownership and 24/7 trading on blockchain platforms. | Low liquidity; asset sales can take weeks or months, dependent on market conditions. |

| Accessibility | Global access with low entry barriers via digital tokens. | Limited by geography, regulations, and high minimum investment thresholds. |

| Ownership Transparency | Immutable blockchain records ensuring clear and secure ownership verification. | Relies on centralized records prone to errors and fraud. |

| Transaction Speed | Instant or near-instant settlement through smart contracts. | Slow, often requiring manual processes and intermediaries. |

| Costs | Lower fees due to reduced intermediaries and automated processes. | Higher costs including broker fees, legal expenses, and taxes. |

| Regulatory Compliance | Emerging frameworks; varies by jurisdiction with ongoing legal developments. | Established regulations providing clearer compliance paths. |

| Divisibility | High divisibility; assets can be split into numerous tokens representing fractions. | Low divisibility; assets are mostly indivisible or require complex agreements. |

Which is better?

Tokenization of real-world assets offers enhanced liquidity, fractional ownership, and transparent transactions through blockchain technology, outperforming traditional asset ownership's limitations such as high entry barriers and slower transfer processes. Traditional ownership provides proven legal frameworks and regulatory protections, but often lacks the efficiency and accessibility that tokenized assets bring to global investors. The evolving financial landscape favors tokenization for its ability to democratize investment and increase market inclusivity.

Connection

Tokenization of real-world assets digitizes traditional asset ownership by representing physical assets like real estate, art, and commodities as blockchain-based tokens. This process enhances liquidity, simplifies transferability, and reduces intermediaries, bridging the gap between conventional financial systems and decentralized finance (DeFi). Traditional asset ownership gains increased transparency, fractional access, and global market reach through tokenization technologies.

Key Terms

Liquidity

Traditional asset ownership often lacks liquidity due to lengthy transfer processes and limited market access. Tokenization of real-world assets enhances liquidity by enabling fractional ownership and seamless trading on blockchain platforms. Explore how tokenization revolutionizes asset liquidity and market participation.

Fractional Ownership

Traditional asset ownership often requires singular control and significant capital investment, limiting accessibility for smaller investors. Tokenization of real-world assets enables fractional ownership by dividing assets into digital tokens, allowing multiple investors to hold proportional shares and enhancing liquidity. Explore how fractional ownership through tokenization is transforming investment opportunities and democratizing access to valuable assets.

Settlement Efficiency

Traditional asset ownership relies on physical certificates and manual processes, leading to longer settlement times and higher costs in transferring ownership. Tokenization of real-world assets leverages blockchain technology to enable near-instantaneous, transparent, and secure settlement, reducing counterparty risk and operational inefficiencies. Explore how asset tokenization transforms settlement efficiency by streamlining ownership transfers in modern financial markets.

Source and External Links

Tokenized Assets vs. Traditional Investments - Traditional asset ownership includes stocks, bonds, mutual funds, real estate, and commodities, typically traded through centralized platforms with legal registries that can make transactions time-consuming and restrictive.

Traditional vs Alternative Asset Classes - Traditional asset ownership mainly involves stocks (equity ownership in companies), bonds (debt instruments), and cash, considered the foundational investment categories for typical investors.

Tokenization vs Traditional Asset Management - Traditional asset management relies on centralized institutions with established compliance and regulatory structures that offer transparency and risk management, sustaining longer asset portfolios through tested frameworks.

dowidth.com

dowidth.com