Tokenization leverages blockchain technology to create digital assets representing real estate ownership, enabling fractional investment, increased liquidity, and reduced transaction costs. Real Estate Investment Trusts (REITs) offer investors a way to pool funds to invest in diversified property portfolios, providing steady income through dividends and easier market access. Explore the benefits, risks, and future trends of tokenization versus traditional REIT investing to make informed financial decisions.

Why it is important

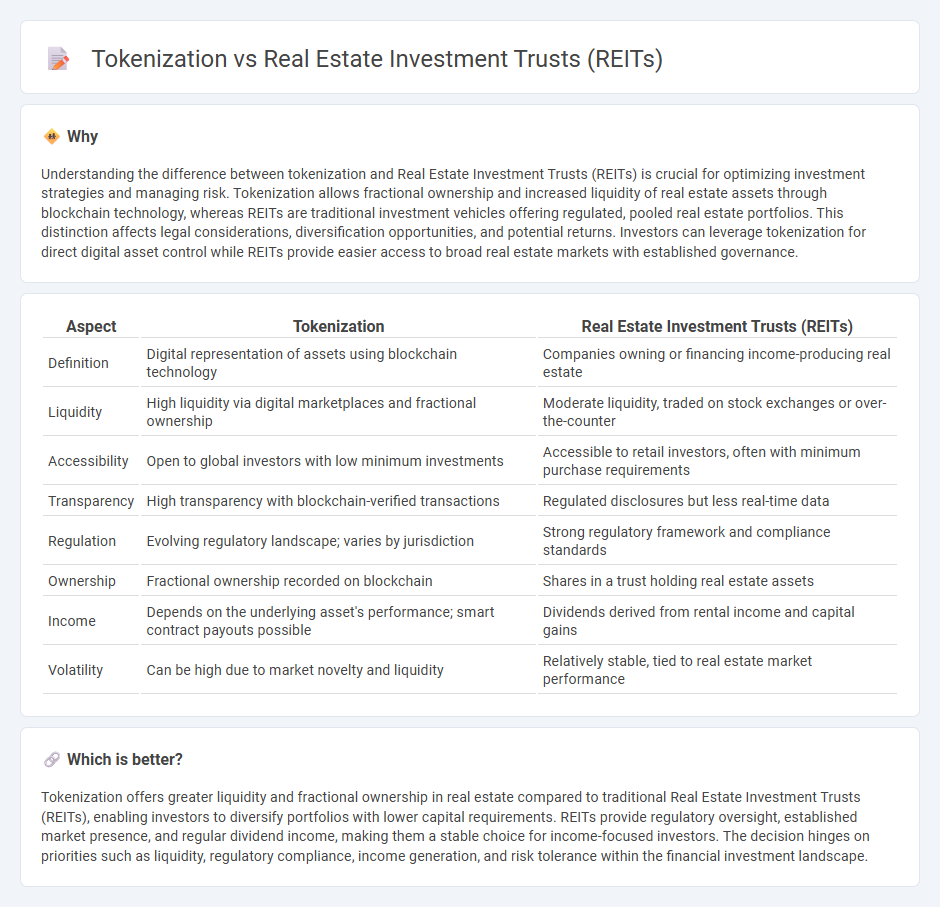

Understanding the difference between tokenization and Real Estate Investment Trusts (REITs) is crucial for optimizing investment strategies and managing risk. Tokenization allows fractional ownership and increased liquidity of real estate assets through blockchain technology, whereas REITs are traditional investment vehicles offering regulated, pooled real estate portfolios. This distinction affects legal considerations, diversification opportunities, and potential returns. Investors can leverage tokenization for direct digital asset control while REITs provide easier access to broad real estate markets with established governance.

Comparison Table

| Aspect | Tokenization | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Definition | Digital representation of assets using blockchain technology | Companies owning or financing income-producing real estate |

| Liquidity | High liquidity via digital marketplaces and fractional ownership | Moderate liquidity, traded on stock exchanges or over-the-counter |

| Accessibility | Open to global investors with low minimum investments | Accessible to retail investors, often with minimum purchase requirements |

| Transparency | High transparency with blockchain-verified transactions | Regulated disclosures but less real-time data |

| Regulation | Evolving regulatory landscape; varies by jurisdiction | Strong regulatory framework and compliance standards |

| Ownership | Fractional ownership recorded on blockchain | Shares in a trust holding real estate assets |

| Income | Depends on the underlying asset's performance; smart contract payouts possible | Dividends derived from rental income and capital gains |

| Volatility | Can be high due to market novelty and liquidity | Relatively stable, tied to real estate market performance |

Which is better?

Tokenization offers greater liquidity and fractional ownership in real estate compared to traditional Real Estate Investment Trusts (REITs), enabling investors to diversify portfolios with lower capital requirements. REITs provide regulatory oversight, established market presence, and regular dividend income, making them a stable choice for income-focused investors. The decision hinges on priorities such as liquidity, regulatory compliance, income generation, and risk tolerance within the financial investment landscape.

Connection

Tokenization transforms real estate assets into digital tokens on blockchain platforms, enabling fractional ownership and increased liquidity for investors. Real Estate Investment Trusts (REITs) benefit from tokenization by simplifying the buying and selling process, broadening access to real estate markets, and enhancing transparency through immutable records. This integration promotes greater investor participation and efficient capital flows within the real estate finance ecosystem.

Key Terms

Liquidity

Real estate investment trusts (REITs) offer investors liquidity through publicly traded shares that can be bought and sold on stock exchanges, providing a relatively accessible entry into property markets. Tokenization uses blockchain technology to represent ownership of real estate assets as digital tokens, enabling fractional ownership and potentially increasing liquidity by facilitating peer-to-peer trading 24/7 on decentralized platforms. Explore more about how tokenization is transforming liquidity in real estate investments.

Fractional Ownership

Real Estate Investment Trusts (REITs) offer investors access to diversified property portfolios through shares, enabling fractional ownership without the complexities of direct property management. Tokenization leverages blockchain technology to create digital tokens representing fractional ownership of real estate assets, enhancing transparency, liquidity, and ease of transfer compared to traditional REITs. Explore further to understand how tokenization is revolutionizing fractional ownership in real estate.

Regulatory Compliance

Real Estate Investment Trusts (REITs) operate under stringent regulatory frameworks established by authorities like the SEC, ensuring investor protection through transparency and mandatory disclosures. Tokenization of real estate assets introduces blockchain technology, offering fractional ownership with enhanced liquidity but faces evolving and sometimes unclear regulatory compliance standards across jurisdictions. Explore deeper insights into how regulatory landscapes impact REITs and tokenized real estate investments.

Source and External Links

Real estate investment trust - Wikipedia - A REIT is a company that owns and often operates income-producing real estate such as offices, apartments, and shopping centers, and can be publicly traded or private with key types being equity REITs and mortgage REITs.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs own, operate, or finance income-producing real estate and provide investors with regular income, diversification, and capital appreciation, often trading on major stock exchanges.

Real Estate Investment Trusts (REITs) - Charles Schwab - REITs are companies owning income-producing real estate that distribute at least 90% of taxable income as dividends, offering a liquid way to invest in real estate with tax advantages but taxable dividend income.

dowidth.com

dowidth.com