Convexity hedging focuses on managing interest rate risk by adjusting a portfolio to minimize the impact of changes in bond price curvature, enhancing stability during volatile market conditions. Yield curve hedging involves aligning portfolio duration and key rate exposures to protect against shifts in the yield curve, targeting interest rate risk across multiple maturities. Explore these strategies to optimize bond portfolio risk management and improve investment outcomes.

Why it is important

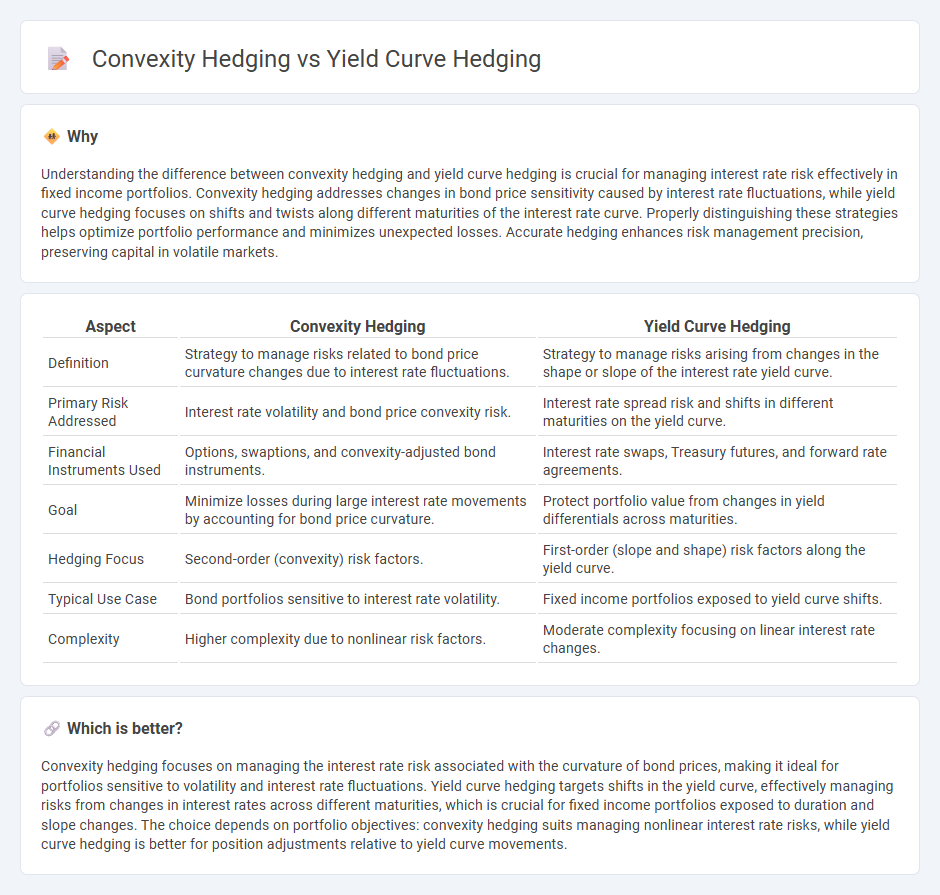

Understanding the difference between convexity hedging and yield curve hedging is crucial for managing interest rate risk effectively in fixed income portfolios. Convexity hedging addresses changes in bond price sensitivity caused by interest rate fluctuations, while yield curve hedging focuses on shifts and twists along different maturities of the interest rate curve. Properly distinguishing these strategies helps optimize portfolio performance and minimizes unexpected losses. Accurate hedging enhances risk management precision, preserving capital in volatile markets.

Comparison Table

| Aspect | Convexity Hedging | Yield Curve Hedging |

|---|---|---|

| Definition | Strategy to manage risks related to bond price curvature changes due to interest rate fluctuations. | Strategy to manage risks arising from changes in the shape or slope of the interest rate yield curve. |

| Primary Risk Addressed | Interest rate volatility and bond price convexity risk. | Interest rate spread risk and shifts in different maturities on the yield curve. |

| Financial Instruments Used | Options, swaptions, and convexity-adjusted bond instruments. | Interest rate swaps, Treasury futures, and forward rate agreements. |

| Goal | Minimize losses during large interest rate movements by accounting for bond price curvature. | Protect portfolio value from changes in yield differentials across maturities. |

| Hedging Focus | Second-order (convexity) risk factors. | First-order (slope and shape) risk factors along the yield curve. |

| Typical Use Case | Bond portfolios sensitive to interest rate volatility. | Fixed income portfolios exposed to yield curve shifts. |

| Complexity | Higher complexity due to nonlinear risk factors. | Moderate complexity focusing on linear interest rate changes. |

Which is better?

Convexity hedging focuses on managing the interest rate risk associated with the curvature of bond prices, making it ideal for portfolios sensitive to volatility and interest rate fluctuations. Yield curve hedging targets shifts in the yield curve, effectively managing risks from changes in interest rates across different maturities, which is crucial for fixed income portfolios exposed to duration and slope changes. The choice depends on portfolio objectives: convexity hedging suits managing nonlinear interest rate risks, while yield curve hedging is better for position adjustments relative to yield curve movements.

Connection

Convexity hedging and yield curve hedging are interconnected strategies used to manage interest rate risk in fixed income portfolios. Convexity hedging focuses on mitigating the non-linear price sensitivity to interest rate changes, while yield curve hedging targets exposures to shifts and twists in the yield curve across different maturities. By combining these approaches, investors can more effectively stabilize portfolio value and enhance risk-adjusted returns amid fluctuating interest rates.

Key Terms

Duration

Duration hedging primarily focuses on mitigating interest rate risk by offsetting the price sensitivity of bonds or portfolios to changes in interest rates using instruments aligned to the yield curve. Convexity hedging complements duration by addressing the nonlinear relationship between bond prices and interest rate changes, reducing risk from large rate movements or volatility. Explore detailed strategies and tools to optimize fixed-income risk management through duration and convexity hedging techniques.

Yield curve risk

Yield curve hedging targets the risk associated with shifts in the entire yield curve, aiming to stabilize portfolio value amid interest rate changes across different maturities. Convexity hedging addresses the sensitivity of bond prices to interest rate fluctuations, focusing on mitigating the non-linear relationship between bond prices and yields. Explore further to understand how these strategies optimize risk management in fixed income portfolios.

Convexity

Convexity hedging involves managing the risk associated with the curvature of bond prices relative to interest rate changes, ensuring that portfolio value remains stable amid fluctuating yields. Unlike yield curve hedging, which targets shifts along the interest rate term structure, convexity hedging specifically addresses the nonlinear relationship between bond prices and interest rates caused by duration changes. Explore the nuances of convexity hedging strategies to optimize fixed income portfolio performance in volatile markets.

Source and External Links

Staying Ahead of the Yield Curve - CME Group - Yield curve hedging can be effectively done using yield futures with uniform DV01, allowing traders to hedge any pair of points on the curve in a 1:1 ratio by taking opposite positions on futures contracts at different maturities, facilitating strategies like steepener or flattener trades.

Alternative Models For Hedging Yield Curve Risk - SSRN - Various models for hedging yield curve risk, including principal component analysis and key rate duration, have different effectiveness and costs, with error-adjusted principal component analysis offering superior hedging quality in empirical tests.

Bond Strategies for Rising Rates--Shorten, Float or Hedge? - Interest rate hedged bond strategies target Treasury rate risk specifically, enabling investors to manage bond risk from rising rates while maintaining credit spread exposure, using hedges tailored to the yield curve shape and credit risk dynamics.

dowidth.com

dowidth.com