Tokenization of real-world assets leverages blockchain technology to convert physical assets into digital tokens, enhancing liquidity and transparency compared to traditional asset-backed securities, which rely on legal claims to pooled financial assets. This innovative approach reduces intermediaries, lowers transaction costs, and allows fractional ownership, democratizing access to various asset classes such as real estate, commodities, and art. Explore how tokenization is transforming asset management and investment strategies for modern finance.

Why it is important

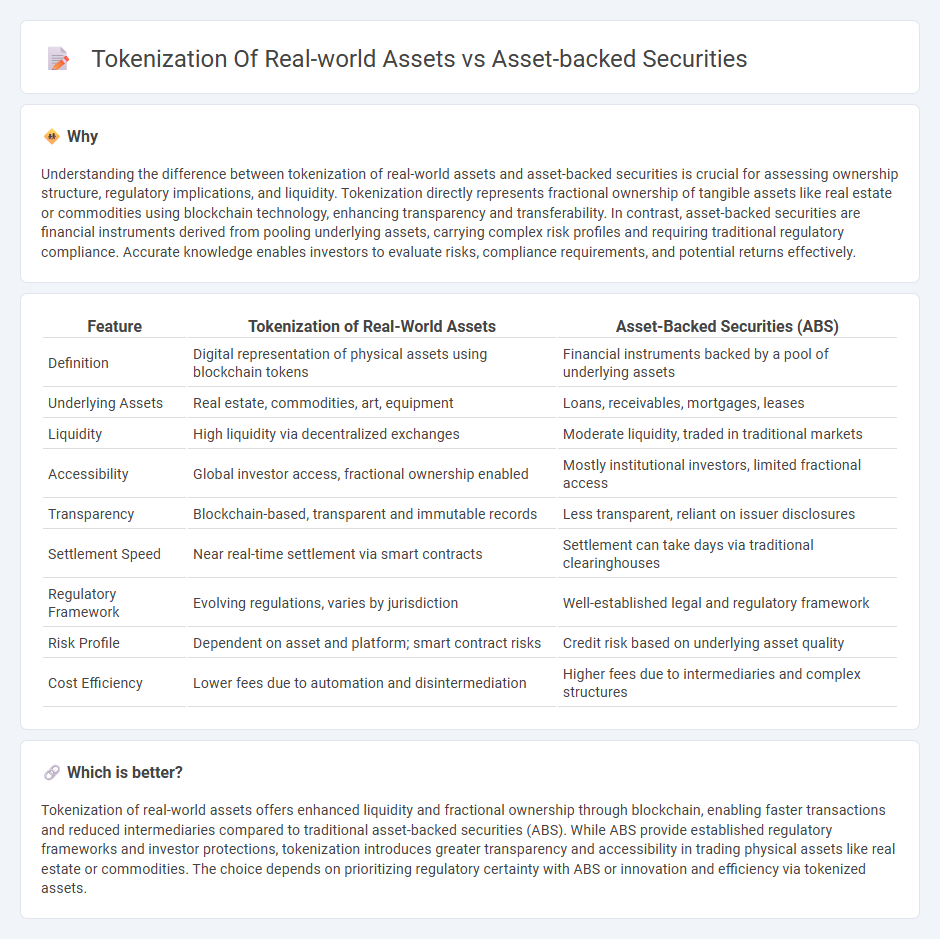

Understanding the difference between tokenization of real-world assets and asset-backed securities is crucial for assessing ownership structure, regulatory implications, and liquidity. Tokenization directly represents fractional ownership of tangible assets like real estate or commodities using blockchain technology, enhancing transparency and transferability. In contrast, asset-backed securities are financial instruments derived from pooling underlying assets, carrying complex risk profiles and requiring traditional regulatory compliance. Accurate knowledge enables investors to evaluate risks, compliance requirements, and potential returns effectively.

Comparison Table

| Feature | Tokenization of Real-World Assets | Asset-Backed Securities (ABS) |

|---|---|---|

| Definition | Digital representation of physical assets using blockchain tokens | Financial instruments backed by a pool of underlying assets |

| Underlying Assets | Real estate, commodities, art, equipment | Loans, receivables, mortgages, leases |

| Liquidity | High liquidity via decentralized exchanges | Moderate liquidity, traded in traditional markets |

| Accessibility | Global investor access, fractional ownership enabled | Mostly institutional investors, limited fractional access |

| Transparency | Blockchain-based, transparent and immutable records | Less transparent, reliant on issuer disclosures |

| Settlement Speed | Near real-time settlement via smart contracts | Settlement can take days via traditional clearinghouses |

| Regulatory Framework | Evolving regulations, varies by jurisdiction | Well-established legal and regulatory framework |

| Risk Profile | Dependent on asset and platform; smart contract risks | Credit risk based on underlying asset quality |

| Cost Efficiency | Lower fees due to automation and disintermediation | Higher fees due to intermediaries and complex structures |

Which is better?

Tokenization of real-world assets offers enhanced liquidity and fractional ownership through blockchain, enabling faster transactions and reduced intermediaries compared to traditional asset-backed securities (ABS). While ABS provide established regulatory frameworks and investor protections, tokenization introduces greater transparency and accessibility in trading physical assets like real estate or commodities. The choice depends on prioritizing regulatory certainty with ABS or innovation and efficiency via tokenized assets.

Connection

Tokenization of real-world assets transforms physical or financial properties into digital tokens on a blockchain, enhancing liquidity and accessibility. Asset-backed securities (ABS) are financial instruments backed by pools of tangible assets, and tokenization enables these securities to be fractionalized and traded more efficiently. This fusion allows investors to gain direct exposure to underlying assets while leveraging blockchain's transparency and security features.

Key Terms

Securitization

Asset-backed securities (ABS) are traditional financial instruments representing pooled assets like mortgages or loans, offering investors debt-like returns backed by underlying collateral. Tokenization of real-world assets digitizes ownership through blockchain, enhancing liquidity, transparency, and fractional ownership while reducing intermediaries. Explore the evolving landscape of securitization to understand the benefits and challenges of these mechanisms in modern finance.

Digital Tokens

Asset-backed securities (ABS) represent pooled financial assets like loans or receivables, offering investors structured payouts, while tokenization of real-world assets involves converting tangible assets such as real estate or commodities into digital tokens on a blockchain platform. Digital tokens enable increased liquidity, fractional ownership, and enhanced transparency compared to traditional ABS by leveraging decentralized ledger technology. Explore how digital tokens are transforming asset markets and investment strategies.

Underlying Assets

Asset-backed securities (ABS) are financial instruments backed by pools of underlying assets such as loans, leases, or receivables, providing investors with periodic cash flows derived from those assets. Tokenization of real-world assets involves converting ownership rights of tangible assets like real estate or commodities into digital tokens on a blockchain, enhancing liquidity and transparency. Explore the evolving landscape of asset-backed securities and tokenization to understand their impact on market accessibility and investment strategies.

Source and External Links

The ABCs of Asset-Backed Securities | Guggenheim Investments - Asset-backed securities (ABS) finance pools of assets like auto loans, aircraft leases, credit card receivables, mortgages, and business loans, providing investor protections such as tranching and overcollateralization, and offering higher yields than similarly rated corporate bonds.

Asset-backed security - Wikipedia - ABS are securities backed by pools of illiquid financial assets, converting these into tradable instruments with different risk/return profiles through tranching, benefiting loan originators by reducing risk and freeing capital but adding risk to investors.

Asset-Backed Securities - ABS - Janus Henderson Investors - ABS are securitized pools of cash-flowing assets such as auto loans and credit cards, offering investors an alternative fixed income with attractive yields, high credit quality, and low correlation to equities within an $880 billion U.S. market.

dowidth.com

dowidth.com