Special Purpose Acquisition Companies (SPACs) offer a faster route to public markets compared to traditional private equity, which involves longer investment periods and direct ownership stakes in private firms. SPACs provide liquidity and transparency through public trading, while private equity focuses on long-term value creation through active management and operational improvements. Explore the key differences and strategic considerations between SPACs and private equity to understand their impact on modern finance.

Why it is important

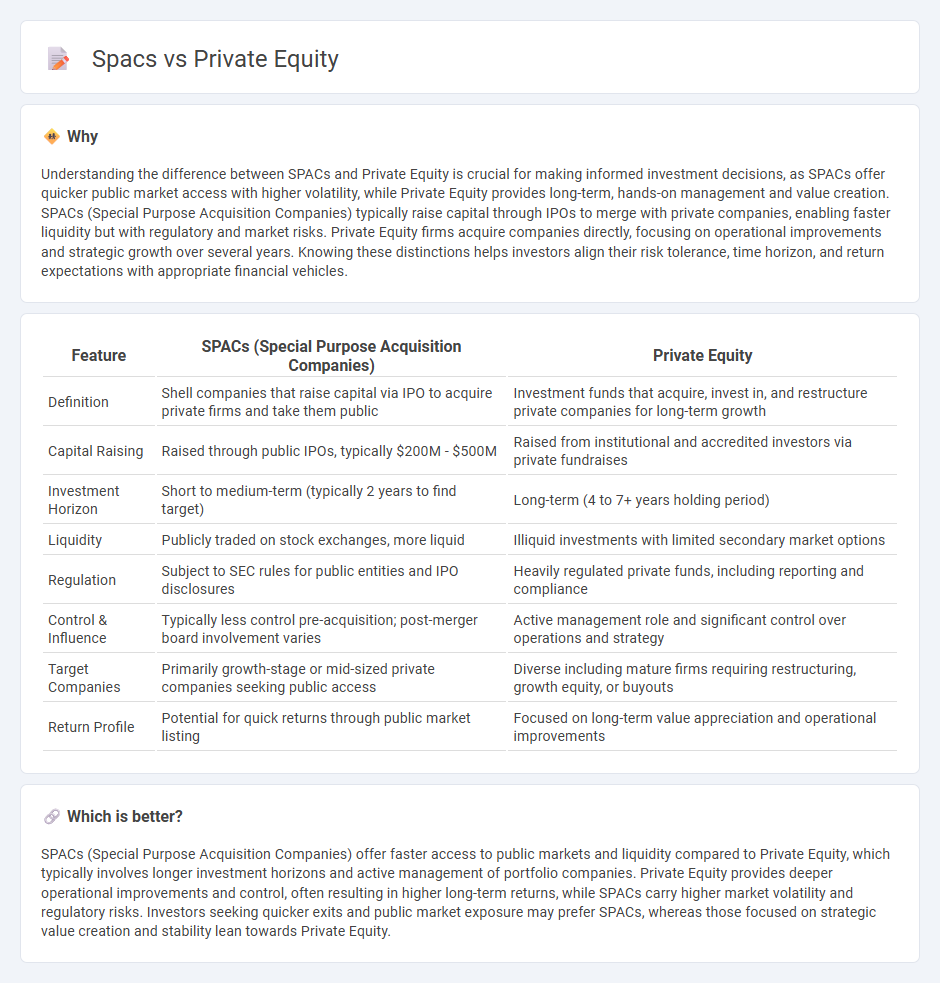

Understanding the difference between SPACs and Private Equity is crucial for making informed investment decisions, as SPACs offer quicker public market access with higher volatility, while Private Equity provides long-term, hands-on management and value creation. SPACs (Special Purpose Acquisition Companies) typically raise capital through IPOs to merge with private companies, enabling faster liquidity but with regulatory and market risks. Private Equity firms acquire companies directly, focusing on operational improvements and strategic growth over several years. Knowing these distinctions helps investors align their risk tolerance, time horizon, and return expectations with appropriate financial vehicles.

Comparison Table

| Feature | SPACs (Special Purpose Acquisition Companies) | Private Equity |

|---|---|---|

| Definition | Shell companies that raise capital via IPO to acquire private firms and take them public | Investment funds that acquire, invest in, and restructure private companies for long-term growth |

| Capital Raising | Raised through public IPOs, typically $200M - $500M | Raised from institutional and accredited investors via private fundraises |

| Investment Horizon | Short to medium-term (typically 2 years to find target) | Long-term (4 to 7+ years holding period) |

| Liquidity | Publicly traded on stock exchanges, more liquid | Illiquid investments with limited secondary market options |

| Regulation | Subject to SEC rules for public entities and IPO disclosures | Heavily regulated private funds, including reporting and compliance |

| Control & Influence | Typically less control pre-acquisition; post-merger board involvement varies | Active management role and significant control over operations and strategy |

| Target Companies | Primarily growth-stage or mid-sized private companies seeking public access | Diverse including mature firms requiring restructuring, growth equity, or buyouts |

| Return Profile | Potential for quick returns through public market listing | Focused on long-term value appreciation and operational improvements |

Which is better?

SPACs (Special Purpose Acquisition Companies) offer faster access to public markets and liquidity compared to Private Equity, which typically involves longer investment horizons and active management of portfolio companies. Private Equity provides deeper operational improvements and control, often resulting in higher long-term returns, while SPACs carry higher market volatility and regulatory risks. Investors seeking quicker exits and public market exposure may prefer SPACs, whereas those focused on strategic value creation and stability lean towards Private Equity.

Connection

Special Purpose Acquisition Companies (SPACs) and Private Equity (PE) share strategic investment goals by facilitating capital deployment into private companies seeking liquidity or growth funding. PE firms often sponsor or invest in SPACs to access alternative routes for taking portfolio companies public, bypassing traditional IPO challenges. This synergy accelerates capital flow between private markets and public investors, enhancing deal flexibility and valuation transparency.

Key Terms

Capital Structure

Private equity firms typically utilize a combination of equity and substantial debt to finance acquisitions, allowing for leveraged buyouts that can maximize returns through capital structure optimization. SPACs (Special Purpose Acquisition Companies) primarily rely on equity raised through initial public offerings and often secure additional capital through PIPE (Private Investment in Public Equity) funding to complete business combinations. Explore further to understand how these differing capital structures impact investment risk and return profiles.

Deal Sourcing

Private equity firms utilize extensive networks and industry expertise to source proprietary deals that often involve thorough due diligence and long-term value creation strategies. SPACs, or Special Purpose Acquisition Companies, primarily target faster acquisitions by raising capital through public markets and seeking attractive private companies for a merger, commonly driven by market trends and speed to liquidity. Explore how each approach influences deal sourcing dynamics and investment outcomes to deepen your understanding.

Exit Strategy

Private equity firms typically employ traditional exit strategies such as initial public offerings (IPOs), strategic sales, or secondary buyouts to maximize investor returns. Special Purpose Acquisition Companies (SPACs) offer a faster, more flexible exit route by merging with a private company, enabling quicker access to public markets without the lengthy IPO process. Explore how choosing between private equity and SPACs as exit strategies can impact valuation, timing, and control in your investment portfolio.

Source and External Links

Private equity - Wikipedia - Private equity involves investment managers raising capital from institutional investors to buy equity ownership stakes in companies, using equity and debt financing to drive revenue growth, margin expansion, and valuation multiple growth over a typical investment horizon of 4-7 years.

What is Private Equity? - BVCA - Private equity provides medium to long-term finance in exchange for equity in high-growth unquoted companies, with UK private equity supporting over 12,000 businesses and regulated by the FCA and industry guidelines.

What does a career in private equity look like? - CFA Institute - Private equity firms invest in companies through strategies such as venture capital, growth equity, and buyouts, where general partners manage operations to improve value while limited partners provide capital without operational involvement.

dowidth.com

dowidth.com