Convexity hedging mitigates interest rate risk by adjusting a portfolio's sensitivity to changes in yield curve curvature, enhancing protection against large, non-linear price movements in bonds or fixed-income derivatives. Factor hedging targets specific underlying risk factors, such as duration, credit spread, or volatility, to systematically neutralize undesired exposures across a diversified portfolio. Discover how these distinct hedging strategies optimize risk management and improve portfolio resilience in dynamic financial markets.

Why it is important

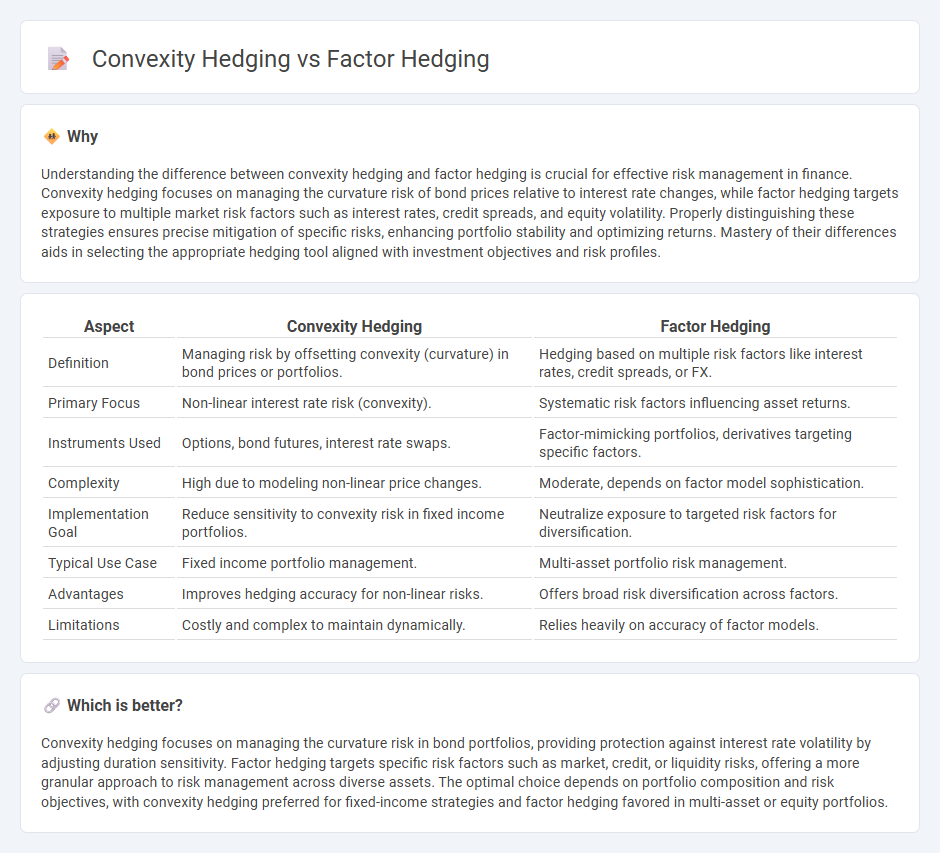

Understanding the difference between convexity hedging and factor hedging is crucial for effective risk management in finance. Convexity hedging focuses on managing the curvature risk of bond prices relative to interest rate changes, while factor hedging targets exposure to multiple market risk factors such as interest rates, credit spreads, and equity volatility. Properly distinguishing these strategies ensures precise mitigation of specific risks, enhancing portfolio stability and optimizing returns. Mastery of their differences aids in selecting the appropriate hedging tool aligned with investment objectives and risk profiles.

Comparison Table

| Aspect | Convexity Hedging | Factor Hedging |

|---|---|---|

| Definition | Managing risk by offsetting convexity (curvature) in bond prices or portfolios. | Hedging based on multiple risk factors like interest rates, credit spreads, or FX. |

| Primary Focus | Non-linear interest rate risk (convexity). | Systematic risk factors influencing asset returns. |

| Instruments Used | Options, bond futures, interest rate swaps. | Factor-mimicking portfolios, derivatives targeting specific factors. |

| Complexity | High due to modeling non-linear price changes. | Moderate, depends on factor model sophistication. |

| Implementation Goal | Reduce sensitivity to convexity risk in fixed income portfolios. | Neutralize exposure to targeted risk factors for diversification. |

| Typical Use Case | Fixed income portfolio management. | Multi-asset portfolio risk management. |

| Advantages | Improves hedging accuracy for non-linear risks. | Offers broad risk diversification across factors. |

| Limitations | Costly and complex to maintain dynamically. | Relies heavily on accuracy of factor models. |

Which is better?

Convexity hedging focuses on managing the curvature risk in bond portfolios, providing protection against interest rate volatility by adjusting duration sensitivity. Factor hedging targets specific risk factors such as market, credit, or liquidity risks, offering a more granular approach to risk management across diverse assets. The optimal choice depends on portfolio composition and risk objectives, with convexity hedging preferred for fixed-income strategies and factor hedging favored in multi-asset or equity portfolios.

Connection

Convexity hedging and factor hedging are connected through their roles in managing interest rate risk and portfolio sensitivity to market movements. Convexity hedging adjusts a portfolio's exposure to changes in bond prices and yields, while factor hedging targets underlying risk factors such as interest rates, credit spreads, or inflation to stabilize returns. Both strategies complement each other by reducing nonlinear risks and controlling systematic risk drivers in fixed income and multi-asset portfolios.

Key Terms

Risk Factors

Factor hedging targets specific risk factors such as interest rate movements, credit spreads, or equity price changes to neutralize portfolio exposure to these underlying drivers. Convexity hedging addresses the nonlinear risks related to changes in bond prices and yields, particularly managing the curvature effects in fixed income instruments. Explore further to understand how each strategy optimizes risk management in complex financial portfolios.

Duration

Factor hedging primarily targets interest rate risk by adjusting portfolio exposure based on duration, aiming to offset losses from interest rate movements. Convexity hedging, on the other hand, manages the curvature effect of bond prices relative to interest rates, refining the hedge by accounting for changes in duration as rates fluctuate. Explore more to understand how integrating both strategies optimizes fixed income portfolio risk management.

Interest Rate Sensitivity

Factor hedging targets broader risk dimensions by adjusting exposures to multiple interest rate risk factors extracted from yield curve changes, effectively mitigating shifts in level, slope, and curvature. Convexity hedging specifically manages the second-order sensitivity of bond prices to interest rate changes, reducing portfolio value fluctuations from large rate movements by balancing duration and curvature effects. Explore deeper insights into optimizing interest rate risk management strategies through factor and convexity hedging.

Source and External Links

Hedging Risk Factors - Eller College of Management - Factor hedging involves constructing portfolios to offset exposure to common risk factors by creating long-short positions that result in negative factor betas, which can reduce risk without sacrificing expected return.

Factor Investing - The Hedge Fund Journal - Factor hedging is based on managing and neutralizing exposures to pricing factors, which explain variation in asset returns, by forming replicating portfolios that reduce unwanted factor risk and align portfolio returns with desired factor risks.

What is factor investing? - BlackRock - Factor hedging uses investment strategies that target and manage exposures to return-driving factors across asset classes, which can reduce specific risks and improve portfolio diversification without necessarily diminishing returns.

dowidth.com

dowidth.com