Tokenization of real-world assets transforms physical assets like real estate and commodities into digital tokens on a blockchain, enabling fractional ownership, increased liquidity, and transparent trading. Derivatives are financial contracts whose value depends on underlying assets but do not represent actual ownership, often used for hedging or speculation. Explore how these innovative financial instruments are reshaping investment strategies and market accessibility.

Why it is important

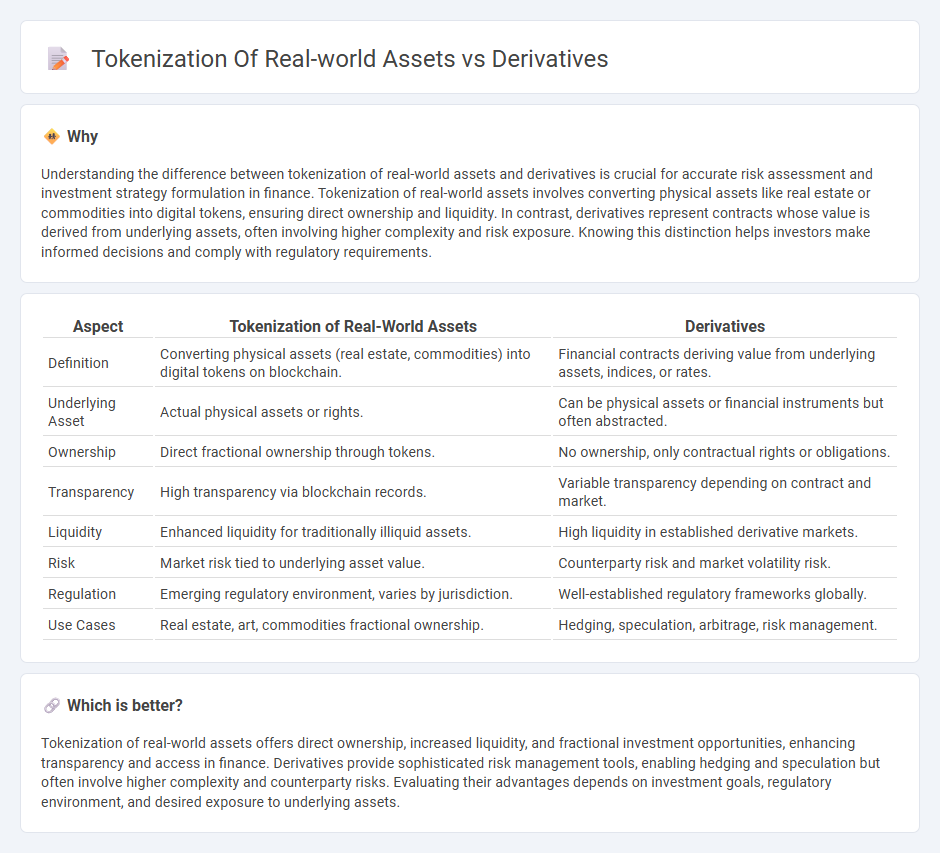

Understanding the difference between tokenization of real-world assets and derivatives is crucial for accurate risk assessment and investment strategy formulation in finance. Tokenization of real-world assets involves converting physical assets like real estate or commodities into digital tokens, ensuring direct ownership and liquidity. In contrast, derivatives represent contracts whose value is derived from underlying assets, often involving higher complexity and risk exposure. Knowing this distinction helps investors make informed decisions and comply with regulatory requirements.

Comparison Table

| Aspect | Tokenization of Real-World Assets | Derivatives |

|---|---|---|

| Definition | Converting physical assets (real estate, commodities) into digital tokens on blockchain. | Financial contracts deriving value from underlying assets, indices, or rates. |

| Underlying Asset | Actual physical assets or rights. | Can be physical assets or financial instruments but often abstracted. |

| Ownership | Direct fractional ownership through tokens. | No ownership, only contractual rights or obligations. |

| Transparency | High transparency via blockchain records. | Variable transparency depending on contract and market. |

| Liquidity | Enhanced liquidity for traditionally illiquid assets. | High liquidity in established derivative markets. |

| Risk | Market risk tied to underlying asset value. | Counterparty risk and market volatility risk. |

| Regulation | Emerging regulatory environment, varies by jurisdiction. | Well-established regulatory frameworks globally. |

| Use Cases | Real estate, art, commodities fractional ownership. | Hedging, speculation, arbitrage, risk management. |

Which is better?

Tokenization of real-world assets offers direct ownership, increased liquidity, and fractional investment opportunities, enhancing transparency and access in finance. Derivatives provide sophisticated risk management tools, enabling hedging and speculation but often involve higher complexity and counterparty risks. Evaluating their advantages depends on investment goals, regulatory environment, and desired exposure to underlying assets.

Connection

Tokenization of real-world assets transforms physical assets into digital tokens on blockchain platforms, enabling fractional ownership and increased liquidity. Derivatives contracts can be created based on these tokenized assets, allowing investors to hedge risks or speculate on asset price movements more efficiently. This integration enhances transparency, reduces counterparty risk, and streamlines settlement processes within financial markets.

Key Terms

Underlying Asset

Derivatives represent financial contracts whose value is derived from an underlying asset such as stocks, commodities, or indexes, enabling investors to speculate or hedge without owning the asset directly. Tokenization of real-world assets converts tangible assets like real estate or art into digital tokens on a blockchain, granting fractional ownership and increased liquidity. Discover how understanding the nuances of underlying assets in both frameworks can enhance your investment strategy.

Smart Contracts

Derivatives represent contracts whose value is derived from underlying assets, while tokenization converts real-world assets into digital tokens on a blockchain, enabling fractional ownership and improved liquidity. Smart contracts automate these processes by executing predefined rules without intermediaries, enhancing transparency, security, and efficiency in asset management. Explore how smart contracts revolutionize derivatives and tokenization for deeper insight.

Securitization

Derivatives based on real-world assets involve contracts whose value is derived from underlying securities, while tokenization converts physical assets into digital tokens on a blockchain, enhancing liquidity and transparency. Securitization, a traditional financial process, pools various asset-backed securities to create tradable instruments, whereas tokenization simplifies accessibility and fractional ownership through digital means. Explore further to understand how these innovations are revolutionizing asset management and investment strategies.

Source and External Links

Derivative - Wikipedia - The derivative in mathematics measures how a function's output changes in response to changes in its input, with higher-order derivatives representing repeated differentiation such as velocity, acceleration, and jerk in physics.

Introduction to Derivatives - Math is Fun - Derivatives are found using the limit process on the slope formula, showing the instantaneous rate of change of a function, for example, the derivative of \(x^2\) is \(2x\).

Derivative (finance) - Wikipedia - In finance, derivatives are contracts between parties whose value is based on underlying assets like commodities or stocks, allowing risk management and market participation without owning the assets.

dowidth.com

dowidth.com