Robo advisory leverages advanced algorithms and artificial intelligence to provide automated, cost-efficient financial planning and investment management tailored to individual risk profiles. Human financial advisory offers personalized guidance through expert analysis, emotional insight, and adaptive strategies that consider complex life circumstances. Explore more to understand how each approach can align with your unique financial goals and preferences.

Why it is important

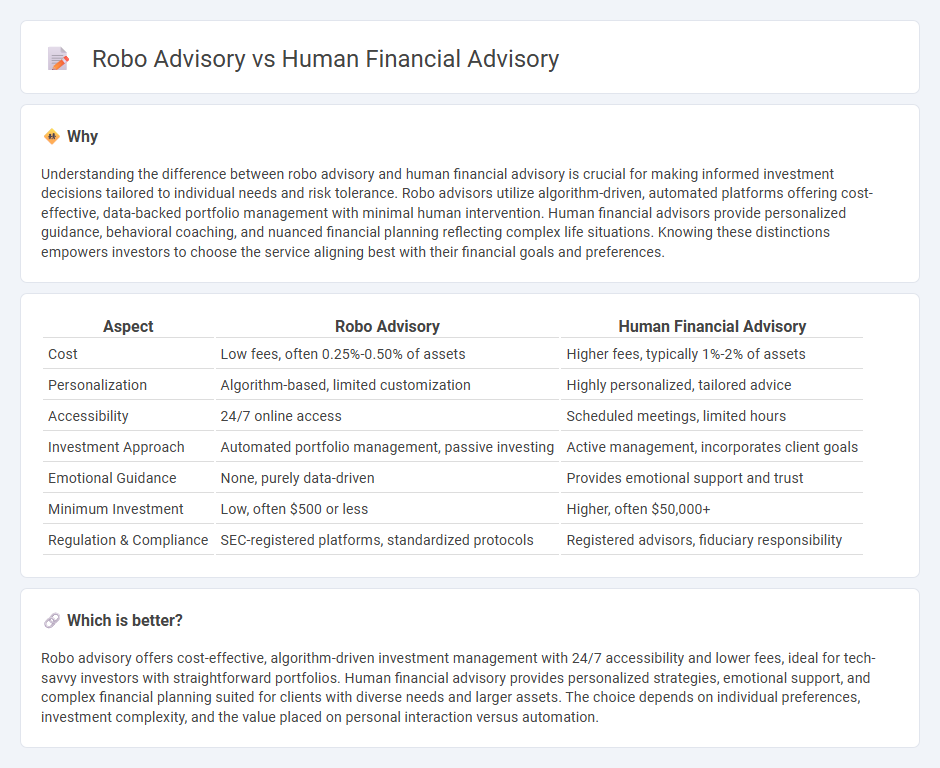

Understanding the difference between robo advisory and human financial advisory is crucial for making informed investment decisions tailored to individual needs and risk tolerance. Robo advisors utilize algorithm-driven, automated platforms offering cost-effective, data-backed portfolio management with minimal human intervention. Human financial advisors provide personalized guidance, behavioral coaching, and nuanced financial planning reflecting complex life situations. Knowing these distinctions empowers investors to choose the service aligning best with their financial goals and preferences.

Comparison Table

| Aspect | Robo Advisory | Human Financial Advisory |

|---|---|---|

| Cost | Low fees, often 0.25%-0.50% of assets | Higher fees, typically 1%-2% of assets |

| Personalization | Algorithm-based, limited customization | Highly personalized, tailored advice |

| Accessibility | 24/7 online access | Scheduled meetings, limited hours |

| Investment Approach | Automated portfolio management, passive investing | Active management, incorporates client goals |

| Emotional Guidance | None, purely data-driven | Provides emotional support and trust |

| Minimum Investment | Low, often $500 or less | Higher, often $50,000+ |

| Regulation & Compliance | SEC-registered platforms, standardized protocols | Registered advisors, fiduciary responsibility |

Which is better?

Robo advisory offers cost-effective, algorithm-driven investment management with 24/7 accessibility and lower fees, ideal for tech-savvy investors with straightforward portfolios. Human financial advisory provides personalized strategies, emotional support, and complex financial planning suited for clients with diverse needs and larger assets. The choice depends on individual preferences, investment complexity, and the value placed on personal interaction versus automation.

Connection

Robo advisory and human financial advisory intersect through the integration of algorithm-driven portfolio management with personalized, expert financial guidance. Robo advisors utilize artificial intelligence and data analytics to provide cost-effective, automated investment strategies, while human advisors offer nuanced insights and customized wealth management based on individual client goals and complex financial situations. This hybrid approach enhances investment efficiency, risk assessment, and client experience by combining technological precision with human judgment.

Key Terms

Personalization

Human financial advisory offers tailored strategies based on deep personal understanding and nuanced insight into clients' unique life circumstances and goals. Robo advisory provides algorithm-driven investment solutions with limited personalization, primarily based on questionnaire inputs and risk tolerance profiles. Explore the differences in personalization to determine which advisory approach best fits your financial needs.

Algorithm-based management

Algorithm-based management in robo advisory leverages complex algorithms and machine learning to analyze market data and personalize investment strategies efficiently. Human financial advisors offer tailored advice with nuanced understanding of client emotions and goals, but may lack the scalability and real-time data processing power of automated systems. Explore the evolving dynamics between algorithm-driven and human-centric financial advisory to optimize your investment approach.

Fiduciary duty

Human financial advisors are bound by a fiduciary duty to act in their clients' best interests, providing personalized and ethical financial advice tailored to individual needs and circumstances. Robo-advisors use algorithms and AI to offer automated investment management but may not always adhere to a fiduciary standard, potentially prioritizing efficiency over personalized care. Discover more about how fiduciary duty influences trust and decision-making in financial advisory services.

Source and External Links

Robo-Advisors vs. Financial Advisors: Which One Fits ... - Bankrate - Human financial advisors provide comprehensive, personalized financial strategies and responsive advice for complex tasks like estate planning and tax optimization that robo-advisors cannot fully replicate.

Despite robo hype, human financial advisors continue providing the ... - Human financial advisors offer empathetic, high-quality guidance that helps clients navigate life's uncertainties, especially when combined with technology for enhanced client relationships and better financial outcomes.

Robo-Advisors vs. Financial Advisors: Which One Fits ... - Bankrate - Human advisors excel in providing tailored, adaptable financial advice that can adjust to clients' changing life circumstances, such as market fluctuations or personal events like saving for college or retirement.

dowidth.com

dowidth.com