Private credit involves non-bank lending where investors provide direct loans to companies, often targeting mid-sized businesses with tailored financing solutions. Trade finance facilitates international and domestic commerce by providing funding instruments like letters of credit and invoice factoring to manage cash flow and mitigate risk. Explore the key differences between private credit and trade finance to optimize your financing strategy.

Why it is important

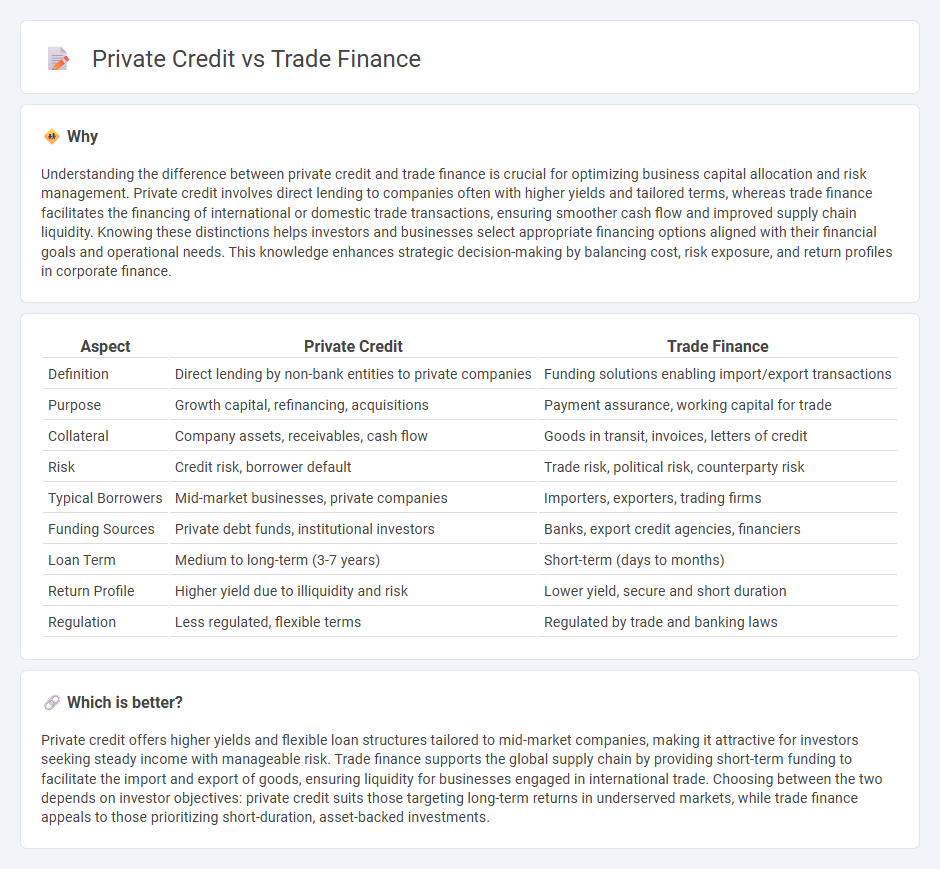

Understanding the difference between private credit and trade finance is crucial for optimizing business capital allocation and risk management. Private credit involves direct lending to companies often with higher yields and tailored terms, whereas trade finance facilitates the financing of international or domestic trade transactions, ensuring smoother cash flow and improved supply chain liquidity. Knowing these distinctions helps investors and businesses select appropriate financing options aligned with their financial goals and operational needs. This knowledge enhances strategic decision-making by balancing cost, risk exposure, and return profiles in corporate finance.

Comparison Table

| Aspect | Private Credit | Trade Finance |

|---|---|---|

| Definition | Direct lending by non-bank entities to private companies | Funding solutions enabling import/export transactions |

| Purpose | Growth capital, refinancing, acquisitions | Payment assurance, working capital for trade |

| Collateral | Company assets, receivables, cash flow | Goods in transit, invoices, letters of credit |

| Risk | Credit risk, borrower default | Trade risk, political risk, counterparty risk |

| Typical Borrowers | Mid-market businesses, private companies | Importers, exporters, trading firms |

| Funding Sources | Private debt funds, institutional investors | Banks, export credit agencies, financiers |

| Loan Term | Medium to long-term (3-7 years) | Short-term (days to months) |

| Return Profile | Higher yield due to illiquidity and risk | Lower yield, secure and short duration |

| Regulation | Less regulated, flexible terms | Regulated by trade and banking laws |

Which is better?

Private credit offers higher yields and flexible loan structures tailored to mid-market companies, making it attractive for investors seeking steady income with manageable risk. Trade finance supports the global supply chain by providing short-term funding to facilitate the import and export of goods, ensuring liquidity for businesses engaged in international trade. Choosing between the two depends on investor objectives: private credit suits those targeting long-term returns in underserved markets, while trade finance appeals to those prioritizing short-duration, asset-backed investments.

Connection

Private credit and trade finance are connected through their roles in providing flexible funding solutions to businesses, particularly in middle-market companies and international trade transactions. Private credit offers direct lending to companies that may not have access to traditional bank loans, while trade finance facilitates the smooth flow of goods and payments across borders by mitigating risks such as non-payment and currency fluctuations. Both financing methods enhance liquidity and operational efficiency, enabling businesses to manage cash flow and expand growth opportunities globally.

Key Terms

**Trade Finance:**

Trade finance facilitates international trade by providing short-term credit and liquidity solutions to exporters and importers, ensuring smooth transactions and risk mitigation. Key instruments include letters of credit, export factoring, and supply chain financing, which help businesses manage cash flow and reduce payment risks. Explore the nuances of trade finance to optimize global trade operations and improve financial stability.

Letter of Credit

Letters of Credit (LC) are pivotal in trade finance, providing exporters with payment assurance and mitigating risks associated with international transactions, unlike private credit which centers on direct lending without trade-specific guarantees. In trade finance, LCs facilitate smooth cross-border trade by ensuring sellers receive payments once shipment conditions are met, whereas private credit offers flexible funding for businesses without the formalized payment security an LC affords. Explore how Letters of Credit enhance secure global trade and compare these financial instruments in depth.

Bill of Lading

Trade finance revolves around securing transactions through documents like the Bill of Lading, which acts as proof of shipment and title to goods, crucial for mitigating risks in international trade. Private credit, meanwhile, typically involves direct lending arrangements where a Bill of Lading may serve as collateral but plays a secondary role compared to trade finance. Explore how the Bill of Lading distinctly influences financing strategies in both domains for a deeper understanding.

Source and External Links

Trade finance - Trade finance refers to the different strategies and financial instruments used to facilitate and finance international trade by helping manage payment risks and bridging the payment timing gap between exporters and importers.

Beginners guide to Trade Finance - Trade finance provides credit, payment guarantees, and insurance to ease international trade transactions by reducing payment gaps and supporting working capital needs, allowing companies, including small businesses, to trade larger volumes and strengthen buyer-seller relationships.

What Is Trade Finance? A Guide for Beginners - Trade finance includes financial tools that improve cash flow, reduce risk, and support business growth in international trade, but it involves costs, documentation complexity, and depends on creditworthiness.

dowidth.com

dowidth.com