Structured credit instruments, including asset-backed securities and collateralized debt obligations, are designed to redistribute credit risk by pooling various debt assets such as loans or bonds. Mortgage-backed securities (MBS) specifically focus on residential or commercial mortgage loans, offering investors returns based on the underlying mortgage payments. Explore deeper insights into how these financial products differ in risk, yield, and market impact.

Why it is important

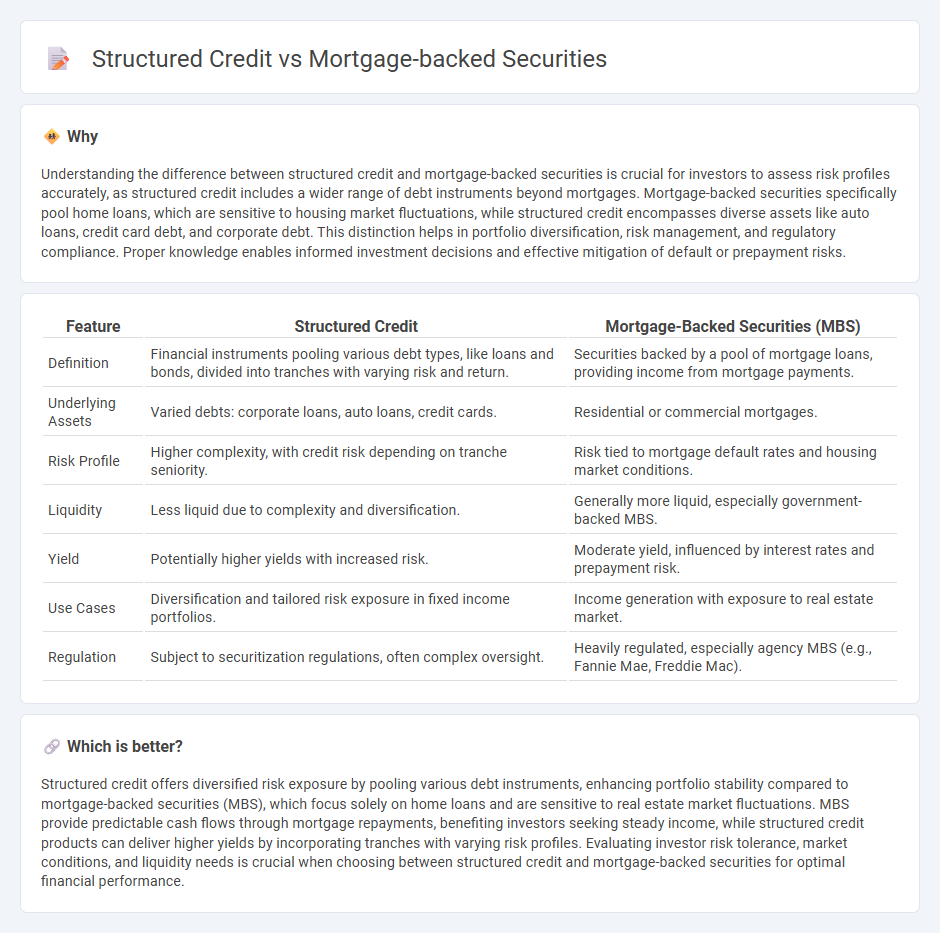

Understanding the difference between structured credit and mortgage-backed securities is crucial for investors to assess risk profiles accurately, as structured credit includes a wider range of debt instruments beyond mortgages. Mortgage-backed securities specifically pool home loans, which are sensitive to housing market fluctuations, while structured credit encompasses diverse assets like auto loans, credit card debt, and corporate debt. This distinction helps in portfolio diversification, risk management, and regulatory compliance. Proper knowledge enables informed investment decisions and effective mitigation of default or prepayment risks.

Comparison Table

| Feature | Structured Credit | Mortgage-Backed Securities (MBS) |

|---|---|---|

| Definition | Financial instruments pooling various debt types, like loans and bonds, divided into tranches with varying risk and return. | Securities backed by a pool of mortgage loans, providing income from mortgage payments. |

| Underlying Assets | Varied debts: corporate loans, auto loans, credit cards. | Residential or commercial mortgages. |

| Risk Profile | Higher complexity, with credit risk depending on tranche seniority. | Risk tied to mortgage default rates and housing market conditions. |

| Liquidity | Less liquid due to complexity and diversification. | Generally more liquid, especially government-backed MBS. |

| Yield | Potentially higher yields with increased risk. | Moderate yield, influenced by interest rates and prepayment risk. |

| Use Cases | Diversification and tailored risk exposure in fixed income portfolios. | Income generation with exposure to real estate market. |

| Regulation | Subject to securitization regulations, often complex oversight. | Heavily regulated, especially agency MBS (e.g., Fannie Mae, Freddie Mac). |

Which is better?

Structured credit offers diversified risk exposure by pooling various debt instruments, enhancing portfolio stability compared to mortgage-backed securities (MBS), which focus solely on home loans and are sensitive to real estate market fluctuations. MBS provide predictable cash flows through mortgage repayments, benefiting investors seeking steady income, while structured credit products can deliver higher yields by incorporating tranches with varying risk profiles. Evaluating investor risk tolerance, market conditions, and liquidity needs is crucial when choosing between structured credit and mortgage-backed securities for optimal financial performance.

Connection

Structured credit instruments pool various debt obligations, including mortgage loans, to create diversified investment products that spread risk among investors. Mortgage-backed securities (MBS) are a primary example of structured credit, where residential or commercial mortgage loans are bundled and sold as tradable assets. The performance of these securities relies on mortgage payment flows, linking structured credit to the housing finance market and influencing overall credit risk assessments.

Key Terms

Tranching

Mortgage-backed securities (MBS) and structured credit both utilize tranching to divide debt into segments with varying risk and return profiles, enabling tailored investment opportunities. In MBS, tranches are primarily categorized by payment priority and credit quality, directly linked to mortgage loan cash flows, whereas structured credit involves a broader range of underlying assets including loans, bonds, and receivables, with more complex risk layering. Discover how tranching techniques impact risk distribution and investor preferences in these asset classes by exploring the mechanisms in depth.

Collateral

Mortgage-backed securities (MBS) are structured credit instruments predominantly collateralized by residential or commercial mortgage loans, pooling individual mortgages into tradable assets that generate cash flows from mortgage payments. Structured credit encompasses a broader range of asset-backed securities, including collateralized loan obligations (CLOs) and asset-backed securities (ABS), with collateral comprising diverse debt instruments like corporate loans, credit card receivables, and auto loans. Explore more to understand the distinct risk profiles and investment implications driven by the collateral variations in mortgage-backed securities and structured credit.

Cash flow waterfall

Mortgage-backed securities (MBS) consist of pools of home loans that generate cash flows paid to investors through prioritized tranches, following a strict cash flow waterfall that allocates principal and interest payments based on seniority. Structured credit products, like collateralized debt obligations (CDOs), aggregate diverse debt assets, employing complex waterfall mechanisms to distribute cash flows and absorb losses across multiple tranches with varied risk profiles. Explore the nuances of cash flow waterfalls in structured finance to optimize investment strategies and risk assessment.

Source and External Links

Mortgage-Backed Securities and Collateralized Mortgage Obligations - Mortgage-backed securities (MBS) are debt obligations representing claims to cash flows from pools of residential mortgage loans that are securitized and issued by government agencies or private entities with different structures and payment priorities.

Mortgage-Backed Securities: A Guide | Quicken Loans - MBS are investments in collections of home mortgages sold by original lenders to other entities, spreading default risk and offering portfolio diversification, with three main types: pass-throughs, collateralized mortgage obligations, and stripped MBS.

Mortgage-backed security - Wikipedia - An MBS is a type of asset-backed security secured by a collection of mortgages, with repayments made monthly or quarterly from principal and interest on the underlying mortgage loans, often structured into tranches with varying risk and reward profiles.

dowidth.com

dowidth.com