Synthetic assets replicate the performance of traditional financial instruments through derivatives, enabling investors to gain exposure without owning the underlying asset. Direct investments involve purchasing actual assets such as stocks, bonds, or real estate, granting ownership and potential voting rights. Explore the benefits and risks of synthetic assets versus direct investments to optimize your financial strategy.

Why it is important

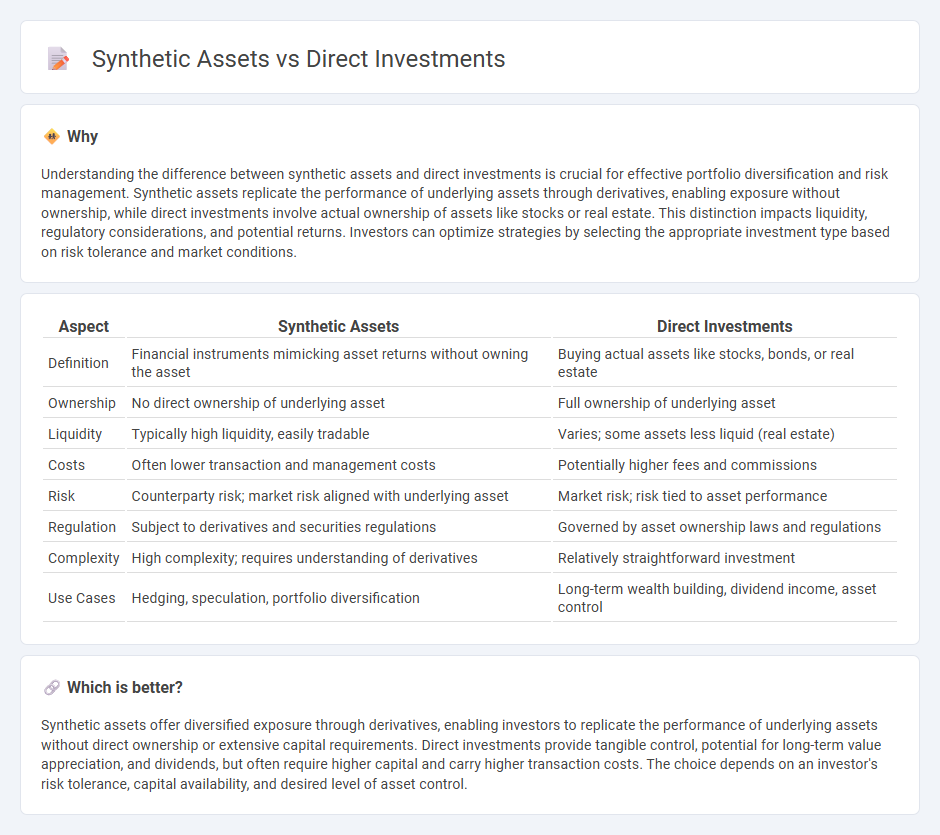

Understanding the difference between synthetic assets and direct investments is crucial for effective portfolio diversification and risk management. Synthetic assets replicate the performance of underlying assets through derivatives, enabling exposure without ownership, while direct investments involve actual ownership of assets like stocks or real estate. This distinction impacts liquidity, regulatory considerations, and potential returns. Investors can optimize strategies by selecting the appropriate investment type based on risk tolerance and market conditions.

Comparison Table

| Aspect | Synthetic Assets | Direct Investments |

|---|---|---|

| Definition | Financial instruments mimicking asset returns without owning the asset | Buying actual assets like stocks, bonds, or real estate |

| Ownership | No direct ownership of underlying asset | Full ownership of underlying asset |

| Liquidity | Typically high liquidity, easily tradable | Varies; some assets less liquid (real estate) |

| Costs | Often lower transaction and management costs | Potentially higher fees and commissions |

| Risk | Counterparty risk; market risk aligned with underlying asset | Market risk; risk tied to asset performance |

| Regulation | Subject to derivatives and securities regulations | Governed by asset ownership laws and regulations |

| Complexity | High complexity; requires understanding of derivatives | Relatively straightforward investment |

| Use Cases | Hedging, speculation, portfolio diversification | Long-term wealth building, dividend income, asset control |

Which is better?

Synthetic assets offer diversified exposure through derivatives, enabling investors to replicate the performance of underlying assets without direct ownership or extensive capital requirements. Direct investments provide tangible control, potential for long-term value appreciation, and dividends, but often require higher capital and carry higher transaction costs. The choice depends on an investor's risk tolerance, capital availability, and desired level of asset control.

Connection

Synthetic assets replicate the performance of real financial instruments through derivatives, enabling investors to gain exposure without owning the underlying asset. Direct investments involve purchasing actual assets or equity, providing ownership and potential dividends or capital appreciation. Both strategies allow portfolio diversification, with synthetic assets offering flexibility and leverage, while direct investments provide tangible asset control and voting rights.

Key Terms

Ownership

Direct investments provide actual ownership of the underlying asset, giving investors voting rights and entitlement to dividends or interest payments. Synthetic assets replicate the performance of real assets through derivatives, allowing exposure without transferring ownership or direct control. Explore the advantages and risks of each approach to optimize your investment strategy.

Derivatives

Direct investments involve purchasing underlying assets like stocks or bonds, offering actual ownership and exposure to market appreciation or dividends. Synthetic assets use derivatives such as options, futures, or swaps to replicate the price movements of these assets without ownership, providing flexibility and leverage in various market conditions. Explore how these instruments reshape portfolio strategies and risk management in modern finance.

Underlying Asset

Direct investments involve acquiring the actual underlying asset, such as stocks, bonds, or real estate, providing ownership rights and potential dividends or rent income. Synthetic assets replicate the performance of an underlying asset through derivatives like options, futures, or swaps, allowing exposure without direct ownership or physical possession. Explore more to understand how underlying asset dynamics influence investment choices and risk profiles.

Source and External Links

Direct Investments - Direct investments involve investing directly into companies or assets, appealing to wealthy individuals and family offices by eliminating fees charged by intermediaries and allowing alignment with personal values; about 67% of high-net-worth investors plan to increase allocations to direct investments over the next two years.

Direct Investing - Direct investing can be done via direct stock plans (DSP) or dividend reinvestment plans (DRIP), where investors buy shares directly from companies often without broker commissions but subject to specific plan rules and fees.

What Is Direct Investment? - Back to Basics Compilation Book - Direct investment generally refers to investing in a foreign enterprise to gain control or significant influence, often in forms like greenfield investment (building new facilities) or brownfield investment (acquiring existing operations), with governments actively encouraging such investments through incentives and economic zones.

dowidth.com

dowidth.com