Tax loss harvesting involves selling investments at a loss to offset gains and reduce taxable income, optimizing tax obligations. Tax-efficient funds focus on minimizing distributions and capital gains, offering a strategic approach to tax savings within investment portfolios. Explore these strategies further to enhance your investment tax planning and maximize after-tax returns.

Why it is important

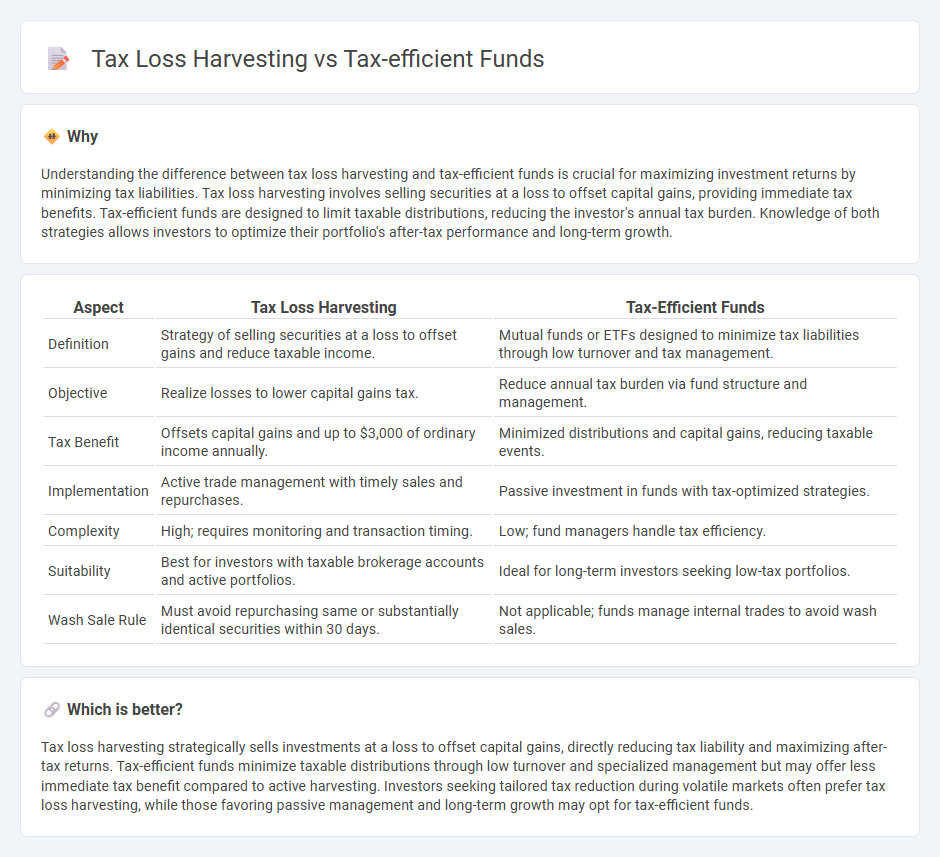

Understanding the difference between tax loss harvesting and tax-efficient funds is crucial for maximizing investment returns by minimizing tax liabilities. Tax loss harvesting involves selling securities at a loss to offset capital gains, providing immediate tax benefits. Tax-efficient funds are designed to limit taxable distributions, reducing the investor's annual tax burden. Knowledge of both strategies allows investors to optimize their portfolio's after-tax performance and long-term growth.

Comparison Table

| Aspect | Tax Loss Harvesting | Tax-Efficient Funds |

|---|---|---|

| Definition | Strategy of selling securities at a loss to offset gains and reduce taxable income. | Mutual funds or ETFs designed to minimize tax liabilities through low turnover and tax management. |

| Objective | Realize losses to lower capital gains tax. | Reduce annual tax burden via fund structure and management. |

| Tax Benefit | Offsets capital gains and up to $3,000 of ordinary income annually. | Minimized distributions and capital gains, reducing taxable events. |

| Implementation | Active trade management with timely sales and repurchases. | Passive investment in funds with tax-optimized strategies. |

| Complexity | High; requires monitoring and transaction timing. | Low; fund managers handle tax efficiency. |

| Suitability | Best for investors with taxable brokerage accounts and active portfolios. | Ideal for long-term investors seeking low-tax portfolios. |

| Wash Sale Rule | Must avoid repurchasing same or substantially identical securities within 30 days. | Not applicable; funds manage internal trades to avoid wash sales. |

Which is better?

Tax loss harvesting strategically sells investments at a loss to offset capital gains, directly reducing tax liability and maximizing after-tax returns. Tax-efficient funds minimize taxable distributions through low turnover and specialized management but may offer less immediate tax benefit compared to active harvesting. Investors seeking tailored tax reduction during volatile markets often prefer tax loss harvesting, while those favoring passive management and long-term growth may opt for tax-efficient funds.

Connection

Tax loss harvesting involves selling securities at a loss to offset capital gains, reducing taxable income, while tax-efficient funds are designed to minimize capital gains distributions and maximize after-tax returns. Investors often use tax loss harvesting in conjunction with tax-efficient funds to enhance tax savings and improve overall portfolio performance. Combining these strategies can lead to optimized tax management by lowering tax liabilities and preserving investment growth.

Key Terms

Capital Gains

Tax-efficient funds minimize capital gains distributions through strategic asset management, reducing tax liabilities for investors over time. Tax loss harvesting involves selling securities at a loss to offset realized capital gains, effectively lowering taxable income within a given tax year. Explore how both strategies optimize capital gains tax management to enhance investment returns and tax savings.

Tax Liability

Tax-efficient funds minimize tax liability by investing in assets that generate lower taxable income, such as municipal bonds or index funds with low turnover, thereby reducing capital gains distributions. Tax loss harvesting involves strategically selling securities at a loss to offset capital gains, lowering taxable income for the year and deferring taxes on gains. Explore how combining tax-efficient funds with tax loss harvesting strategies can optimize your overall tax liability.

Cost Basis

Tax-efficient funds minimize capital gains distributions by employing strategies like low turnover and tax-aware indexing, which helps preserve the original cost basis of investments. Tax loss harvesting involves selling securities at a loss to offset gains, thereby resetting the cost basis to a lower value and reducing taxable income. Explore how these strategies impact your investment portfolio's cost basis to optimize tax outcomes.

Source and External Links

Tax-Efficient Fund | T. Rowe Price - Tax-efficient funds aim for long-term capital appreciation while minimizing taxable distributions of capital gains and dividends to enhance after-tax returns for investors.

Tax-efficient investments | Vanguard - Index mutual funds and ETFs are inherently tax-efficient due to low trading activity, which reduces taxable events and allows for strategic lot selection to minimize capital gains.

25 Top Picks for Tax-Efficient ETFs and Mutual Funds - Morningstar - Leading tax-efficient options include broad market index funds like Vanguard Total Stock Market Index and Vanguard 500 Index, which benefit from low turnover and are strong long-term picks for taxable accounts.

dowidth.com

dowidth.com