Robo advisory services use advanced algorithms and artificial intelligence to provide automated, low-cost investment management tailored to individual risk profiles and financial goals. Self-directed investing empowers individuals to make their own investment decisions, offering complete control over asset selection but requiring significant knowledge and active management. Explore how choosing between robo advisors and self-directed investing can impact your financial strategy and long-term returns.

Why it is important

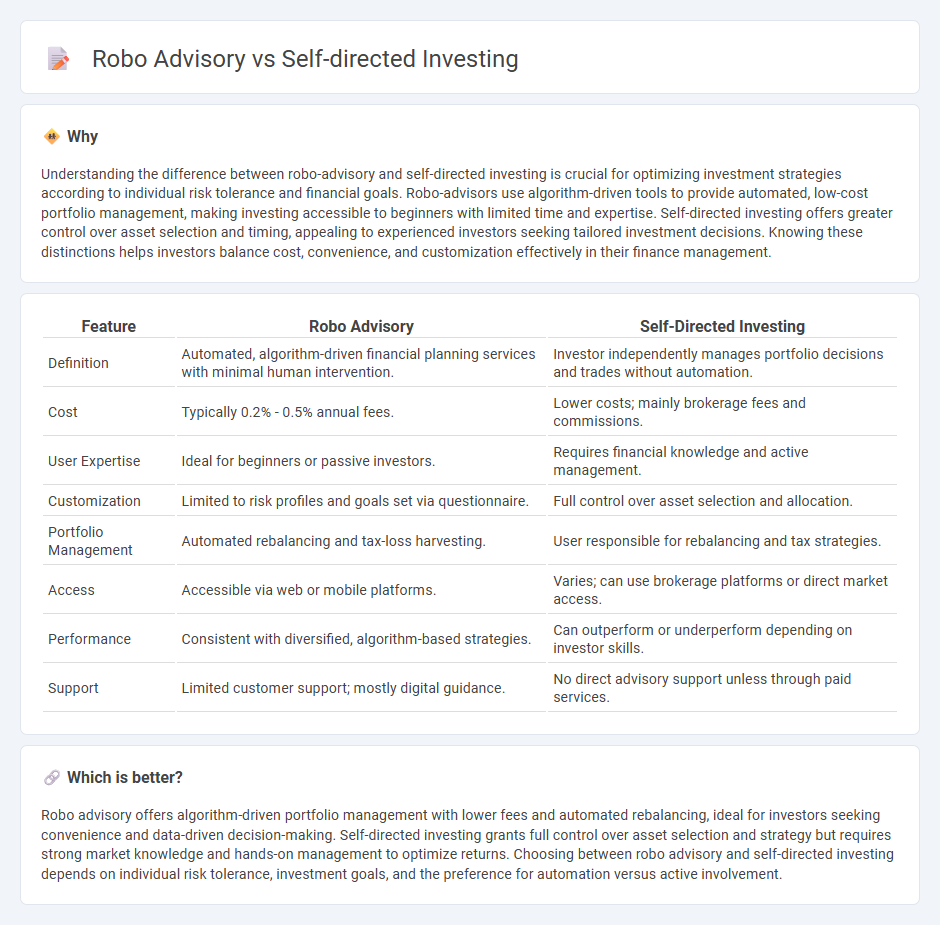

Understanding the difference between robo-advisory and self-directed investing is crucial for optimizing investment strategies according to individual risk tolerance and financial goals. Robo-advisors use algorithm-driven tools to provide automated, low-cost portfolio management, making investing accessible to beginners with limited time and expertise. Self-directed investing offers greater control over asset selection and timing, appealing to experienced investors seeking tailored investment decisions. Knowing these distinctions helps investors balance cost, convenience, and customization effectively in their finance management.

Comparison Table

| Feature | Robo Advisory | Self-Directed Investing |

|---|---|---|

| Definition | Automated, algorithm-driven financial planning services with minimal human intervention. | Investor independently manages portfolio decisions and trades without automation. |

| Cost | Typically 0.2% - 0.5% annual fees. | Lower costs; mainly brokerage fees and commissions. |

| User Expertise | Ideal for beginners or passive investors. | Requires financial knowledge and active management. |

| Customization | Limited to risk profiles and goals set via questionnaire. | Full control over asset selection and allocation. |

| Portfolio Management | Automated rebalancing and tax-loss harvesting. | User responsible for rebalancing and tax strategies. |

| Access | Accessible via web or mobile platforms. | Varies; can use brokerage platforms or direct market access. |

| Performance | Consistent with diversified, algorithm-based strategies. | Can outperform or underperform depending on investor skills. |

| Support | Limited customer support; mostly digital guidance. | No direct advisory support unless through paid services. |

Which is better?

Robo advisory offers algorithm-driven portfolio management with lower fees and automated rebalancing, ideal for investors seeking convenience and data-driven decision-making. Self-directed investing grants full control over asset selection and strategy but requires strong market knowledge and hands-on management to optimize returns. Choosing between robo advisory and self-directed investing depends on individual risk tolerance, investment goals, and the preference for automation versus active involvement.

Connection

Robo advisory and self-directed investing are connected through the use of automated technology that empowers investors to manage their portfolios with minimal human intervention. Robo advisors provide algorithm-driven financial planning services, while self-directed investing allows individuals to execute trades and make investment decisions independently using digital platforms. Both approaches emphasize low-cost, accessible investment management, leveraging data analytics to optimize portfolio performance and risk management.

Key Terms

Control

Self-directed investing offers complete control over asset selection, trading decisions, and portfolio management, appealing to investors who prefer hands-on engagement and personalized strategies. Robo advisory provides automated, algorithm-driven portfolio management with minimal human intervention, prioritizing convenience and efficiency over direct control. Explore the advantages and trade-offs between these approaches to determine the best fit for your investment style.

Automation

Self-directed investing empowers individuals to manage their own portfolios without external input, allowing complete control over asset selection and timing. Robo advisory leverages automated algorithms to streamline portfolio management, offering personalized investment strategies with minimal human intervention. Explore how automation transforms investment approaches and discover which method aligns best with your financial goals.

Fees

Self-directed investing typically offers lower fees as investors manage their own portfolios without paying management fees, though they incur transaction costs and require market knowledge. Robo advisory services charge annual management fees ranging from 0.25% to 0.50%, providing automated portfolio management and rebalancing with minimal human intervention. Explore our detailed comparison to find out which investment method aligns best with your financial goals and budget.

Source and External Links

Self-Directed Investing by First Citizens Investor Services - A commission-free, online platform offering the freedom to trade US stocks and ETFs at your own pace, with no minimum balance to start and integration within digital banking for easy account management.

What is Self-Directed Investing? | U.S. Bancorp Investments - Allows DIY investors to manage and trade stocks, mutual funds, ETFs, and options themselves online, choosing their investments and timing without a financial advisor.

What is self-directed investing - and is it right for you? - CIT Bank - Describes self-directed investing as managing your own portfolio without an advisor, emphasizing flexibility, cost-efficiency, and personal control over investment decisions.

dowidth.com

dowidth.com