Quantitative tightening involves the central bank reducing its balance sheet by selling assets or letting them mature, leading to decreased money supply and higher interest rates. Helicopter money refers to directly distributing cash to the public to stimulate spending and boost inflation. Explore the impact of these contrasting monetary policies on economic growth and inflation.

Why it is important

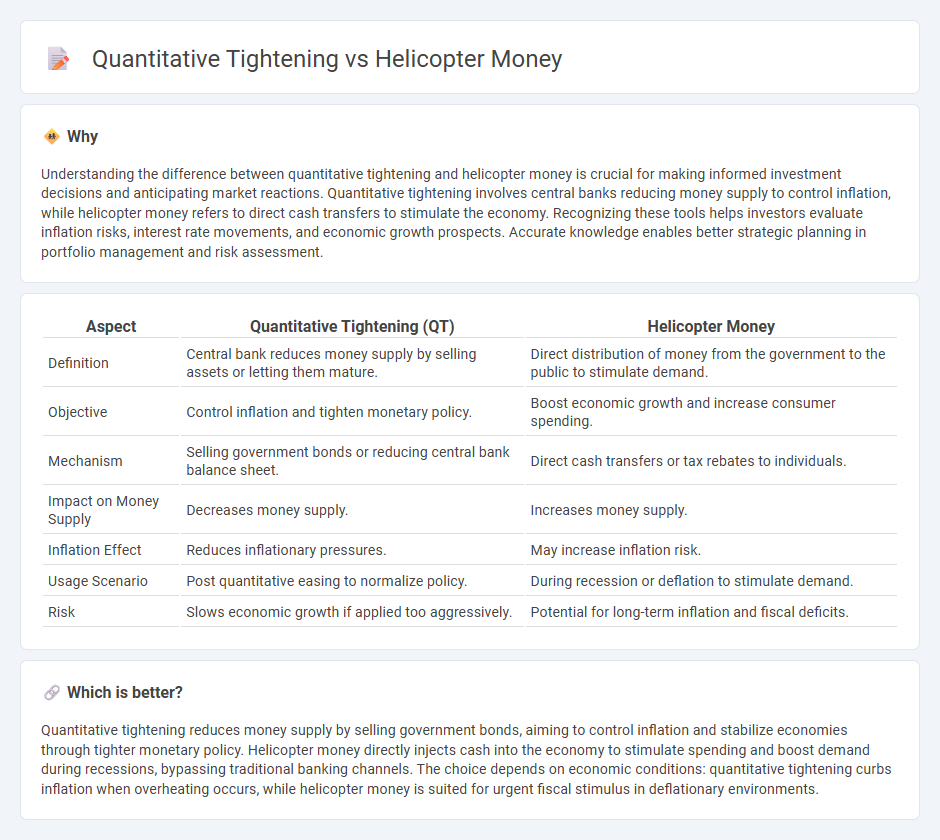

Understanding the difference between quantitative tightening and helicopter money is crucial for making informed investment decisions and anticipating market reactions. Quantitative tightening involves central banks reducing money supply to control inflation, while helicopter money refers to direct cash transfers to stimulate the economy. Recognizing these tools helps investors evaluate inflation risks, interest rate movements, and economic growth prospects. Accurate knowledge enables better strategic planning in portfolio management and risk assessment.

Comparison Table

| Aspect | Quantitative Tightening (QT) | Helicopter Money |

|---|---|---|

| Definition | Central bank reduces money supply by selling assets or letting them mature. | Direct distribution of money from the government to the public to stimulate demand. |

| Objective | Control inflation and tighten monetary policy. | Boost economic growth and increase consumer spending. |

| Mechanism | Selling government bonds or reducing central bank balance sheet. | Direct cash transfers or tax rebates to individuals. |

| Impact on Money Supply | Decreases money supply. | Increases money supply. |

| Inflation Effect | Reduces inflationary pressures. | May increase inflation risk. |

| Usage Scenario | Post quantitative easing to normalize policy. | During recession or deflation to stimulate demand. |

| Risk | Slows economic growth if applied too aggressively. | Potential for long-term inflation and fiscal deficits. |

Which is better?

Quantitative tightening reduces money supply by selling government bonds, aiming to control inflation and stabilize economies through tighter monetary policy. Helicopter money directly injects cash into the economy to stimulate spending and boost demand during recessions, bypassing traditional banking channels. The choice depends on economic conditions: quantitative tightening curbs inflation when overheating occurs, while helicopter money is suited for urgent fiscal stimulus in deflationary environments.

Connection

Quantitative tightening reduces the money supply by selling government bonds or letting them mature, which contracts liquidity in the financial system. Helicopter money involves direct distribution of cash to the public, increasing money supply to stimulate demand. Both represent opposing monetary policies influencing inflation, with quantitative tightening aiming to curb excess liquidity and helicopter money aiming to boost economic activity.

Key Terms

Money Supply

Helicopter money increases money supply directly by distributing cash to the public, stimulating demand and inflation without raising debt levels. Quantitative tightening reduces money supply by selling government bonds or letting them mature, leading to higher interest rates and cooling economic activity. Explore how these contrasting monetary policies impact financial markets and economic growth.

Central Bank

Central banks use helicopter money to directly stimulate the economy by distributing cash to citizens, increasing spending, and boosting inflation expectations, whereas quantitative tightening involves reducing the central bank's balance sheet by selling assets to absorb excess liquidity, thereby tightening monetary conditions. Helicopter money bypasses traditional monetary policy channels, providing immediate fiscal stimulus, while quantitative tightening aims to control inflation and stabilize financial markets by draining liquidity. Explore how these contrasting monetary tools impact economic stability and central bank policy effectiveness.

Interest Rates

Helicopter money involves direct fiscal stimulus by distributing money to the public, which typically increases demand and puts upward pressure on interest rates due to inflation expectations. Quantitative tightening reduces central bank balance sheets by selling government bonds, leading to higher interest rates as liquidity decreases and borrowing costs rise. Explore more to understand how these monetary policies distinctly influence interest rate dynamics.

Source and External Links

Helicopter money - Wikipedia - Helicopter money is a proposed monetary policy where central banks make direct payments to individuals or finance government deficits by creating base money, aimed at stimulating the economy during recessions when interest rates are near zero and traditional policies are ineffective.

What is helicopter money? - The World Economic Forum - The concept, popularized by economist Milton Friedman in 1969, involves direct money transfers from the central bank to the public to boost spending and inflation, especially in economies operating below potential, with further developments including monetary-financed tax cuts.

Helicopter Money - Definition, How It Works, Example - Helicopter money is an unconventional tool of printing large sums of money to distribute to the public via the government, boosting consumer spending and economic output during recessions.

dowidth.com

dowidth.com