Loss harvesting involves strategically selling investments at a loss to offset capital gains taxes, optimizing portfolio tax efficiency. Capital gains realization focuses on selling assets that have appreciated, triggering taxable events but potentially rebalancing the portfolio for better returns. Discover how these strategies can impact your investment goals and tax liabilities.

Why it is important

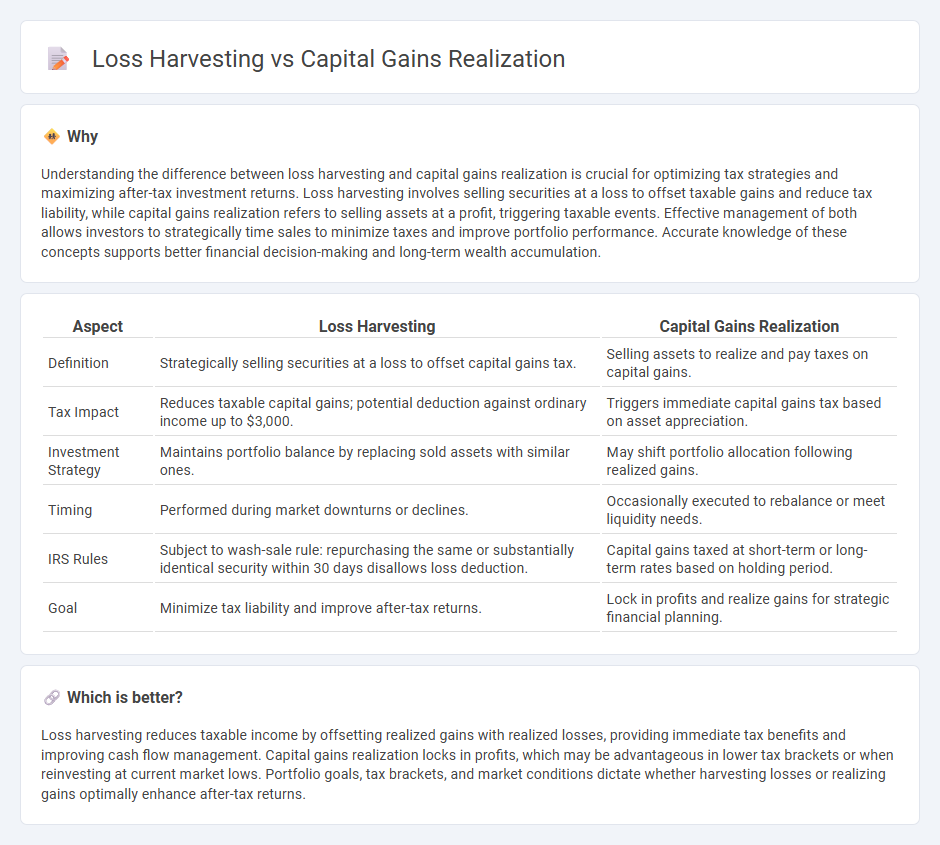

Understanding the difference between loss harvesting and capital gains realization is crucial for optimizing tax strategies and maximizing after-tax investment returns. Loss harvesting involves selling securities at a loss to offset taxable gains and reduce tax liability, while capital gains realization refers to selling assets at a profit, triggering taxable events. Effective management of both allows investors to strategically time sales to minimize taxes and improve portfolio performance. Accurate knowledge of these concepts supports better financial decision-making and long-term wealth accumulation.

Comparison Table

| Aspect | Loss Harvesting | Capital Gains Realization |

|---|---|---|

| Definition | Strategically selling securities at a loss to offset capital gains tax. | Selling assets to realize and pay taxes on capital gains. |

| Tax Impact | Reduces taxable capital gains; potential deduction against ordinary income up to $3,000. | Triggers immediate capital gains tax based on asset appreciation. |

| Investment Strategy | Maintains portfolio balance by replacing sold assets with similar ones. | May shift portfolio allocation following realized gains. |

| Timing | Performed during market downturns or declines. | Occasionally executed to rebalance or meet liquidity needs. |

| IRS Rules | Subject to wash-sale rule: repurchasing the same or substantially identical security within 30 days disallows loss deduction. | Capital gains taxed at short-term or long-term rates based on holding period. |

| Goal | Minimize tax liability and improve after-tax returns. | Lock in profits and realize gains for strategic financial planning. |

Which is better?

Loss harvesting reduces taxable income by offsetting realized gains with realized losses, providing immediate tax benefits and improving cash flow management. Capital gains realization locks in profits, which may be advantageous in lower tax brackets or when reinvesting at current market lows. Portfolio goals, tax brackets, and market conditions dictate whether harvesting losses or realizing gains optimally enhance after-tax returns.

Connection

Loss harvesting strategically offsets realized capital gains by selling investments at a loss to reduce taxable income. This tax management technique maximizes after-tax returns by balancing gains with losses within a portfolio. Effective synchronization of loss harvesting and capital gains realization enhances portfolio tax efficiency and supports long-term wealth accumulation.

Key Terms

Taxable Event

Capital gains realization triggers a taxable event, requiring investors to pay taxes on the profits from the sale of assets, while loss harvesting involves selling assets at a loss to offset those gains and reduce tax liability. Taxable events from realized gains increase taxable income, necessitating strategic planning to minimize tax impact throughout the fiscal year. Explore effective strategies to balance capital gains realization and loss harvesting for optimized tax outcomes.

Cost Basis

Capital gains realization occurs when an asset is sold for more than its cost basis, generating taxable income, whereas loss harvesting involves selling assets below their cost basis to offset gains and reduce tax liability. Understanding the cost basis is crucial for accurately calculating net capital gains or losses, as it represents the original purchase price adjusted for splits, dividends, or improvements. Explore more strategies to optimize your investment tax outcomes by mastering cost basis adjustments.

Offset

Capital gains realization involves selling assets that have appreciated in value to lock in profits, while loss harvesting focuses on selling assets at a loss to offset those gains and reduce taxable income. Offset strategies allow investors to balance gains with realized losses, effectively minimizing capital gains tax liability within a given tax year. Explore more on how offsetting gains with losses can optimize your investment tax strategy.

Source and External Links

What are capital gains taxes and how could they be reformed? - Capital gains realization occurs when an asset is sold, triggering a taxable event based on the difference between the sale price and the original purchase price, with a tax rate on realized gains (23.8% top rate for long-term holdings) generally lower than ordinary income tax rates.

Tax Managed Investing: Deciding When to Realize Capital Gains - Capital gains realization is the process of selling an asset to lock in a profit, and the timing of these sales often responds to changes in tax laws or market cycles, which can lead to significant fluctuations in IRS tax revenue from year to year.

What is capital gains tax? - Realized capital gains are profits from the sale of investments at a price higher than their purchase price, and these gains become subject to taxation only when the asset is actually sold, not while the gain remains "on paper."

dowidth.com

dowidth.com