Decentralized exchanges (DEXs) enable direct peer-to-peer cryptocurrency trading without intermediaries, enhancing security and control over assets. Swapping protocols facilitate automated token exchanges through liquidity pools, offering faster and more efficient trades with reduced slippage. Discover how these innovative finance tools are transforming digital asset management and trading.

Why it is important

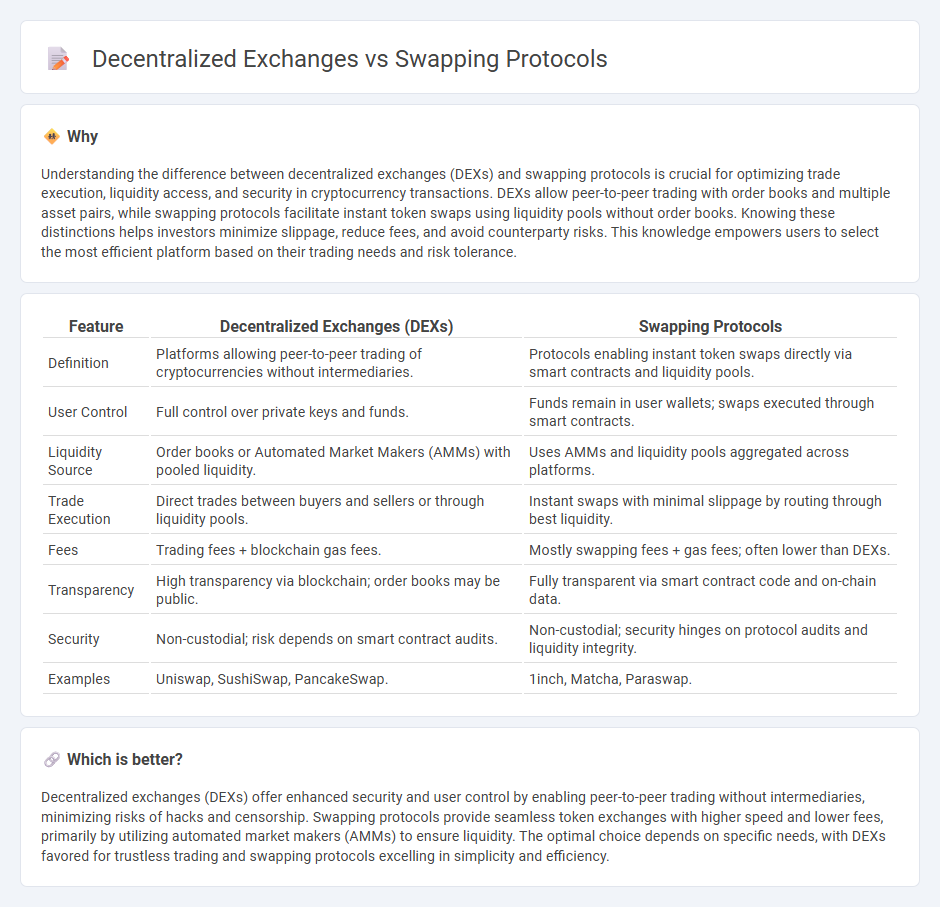

Understanding the difference between decentralized exchanges (DEXs) and swapping protocols is crucial for optimizing trade execution, liquidity access, and security in cryptocurrency transactions. DEXs allow peer-to-peer trading with order books and multiple asset pairs, while swapping protocols facilitate instant token swaps using liquidity pools without order books. Knowing these distinctions helps investors minimize slippage, reduce fees, and avoid counterparty risks. This knowledge empowers users to select the most efficient platform based on their trading needs and risk tolerance.

Comparison Table

| Feature | Decentralized Exchanges (DEXs) | Swapping Protocols |

|---|---|---|

| Definition | Platforms allowing peer-to-peer trading of cryptocurrencies without intermediaries. | Protocols enabling instant token swaps directly via smart contracts and liquidity pools. |

| User Control | Full control over private keys and funds. | Funds remain in user wallets; swaps executed through smart contracts. |

| Liquidity Source | Order books or Automated Market Makers (AMMs) with pooled liquidity. | Uses AMMs and liquidity pools aggregated across platforms. |

| Trade Execution | Direct trades between buyers and sellers or through liquidity pools. | Instant swaps with minimal slippage by routing through best liquidity. |

| Fees | Trading fees + blockchain gas fees. | Mostly swapping fees + gas fees; often lower than DEXs. |

| Transparency | High transparency via blockchain; order books may be public. | Fully transparent via smart contract code and on-chain data. |

| Security | Non-custodial; risk depends on smart contract audits. | Non-custodial; security hinges on protocol audits and liquidity integrity. |

| Examples | Uniswap, SushiSwap, PancakeSwap. | 1inch, Matcha, Paraswap. |

Which is better?

Decentralized exchanges (DEXs) offer enhanced security and user control by enabling peer-to-peer trading without intermediaries, minimizing risks of hacks and censorship. Swapping protocols provide seamless token exchanges with higher speed and lower fees, primarily by utilizing automated market makers (AMMs) to ensure liquidity. The optimal choice depends on specific needs, with DEXs favored for trustless trading and swapping protocols excelling in simplicity and efficiency.

Connection

Decentralized exchanges (DEXs) operate on blockchain networks, enabling peer-to-peer trading of cryptocurrencies without intermediaries, utilizing smart contracts to facilitate trustless transactions. Swapping protocols are integral components within DEXs, allowing users to instantly exchange one cryptocurrency for another via automated market maker (AMM) algorithms. This symbiotic relationship enhances liquidity and user autonomy while reducing reliance on centralized order books and custodial services.

Key Terms

Liquidity Pools

Liquidity pools form the backbone of swapping protocols, enabling users to trade tokens directly from pooled reserves without relying on traditional order books found in decentralized exchanges (DEXs). These pools aggregate assets from multiple users, facilitating continuous liquidity and reducing slippage during trades, which contrasts with the often fragmented liquidity in order book-based DEXs. Explore the mechanics and advantages of liquidity pools in swapping protocols to understand their impact on decentralized trading efficiency.

Automated Market Maker (AMM)

Automated Market Makers (AMMs) are core components of decentralized exchanges (DEXs), enabling trustless token swaps through liquidity pools rather than traditional order books. Swapping protocols leverage AMM algorithms like Constant Product Market Maker to facilitate instant asset trades, ensuring continuous liquidity and minimizing slippage. Explore how AMMs revolutionize decentralized finance by enhancing trading efficiency and accessibility.

Token Swapping

Token swapping protocols enable seamless peer-to-peer exchange of cryptocurrencies without intermediaries, enhancing transaction speed and cost efficiency compared to traditional centralized platforms. Decentralized exchanges (DEXs) integrate token swapping directly into their protocols, offering higher liquidity and reduced counterparty risk through smart contract automation. Explore the differences and benefits of token swapping in decentralized exchanges to optimize your crypto trading strategy.

Source and External Links

Swaps - Uniswap Docs - Swapping in the Uniswap protocol involves exchanging one ERC-20 token for another directly against liquidity pools in a permissionless manner, with fees rewarded to liquidity providers and slippage being an important consideration during transaction execution.

Swap Features | Aave Protocol Documentation - Aave enables token swaps through integration with ParaSwap or CoW Swap, allowing users to swap assets and automatically deposit the swapped tokens without using flash loans, via smart contract functions with detailed parameters for secure and efficient asset exchange.

Best 7 Cross-Chain Swap Protocols in DEX for 2024 - Nadcab Labs - Cross-chain swap protocols like Thorchain and Polkadot facilitate decentralized swapping of assets across different blockchain networks, enhancing liquidity and enabling seamless, trustless trading beyond single-chain ecosystems.

dowidth.com

dowidth.com