Shadow banking encompasses non-bank financial intermediaries that provide lending and credit services outside traditional banking regulations, often operating with higher risk and less transparency. Hedge funds are private investment funds that actively manage portfolios using diverse strategies, including leveraging and derivatives, aiming for high returns but with varying risk profiles. Explore the key differences and regulatory challenges between shadow banking and hedge funds to better understand their impact on the financial system.

Why it is important

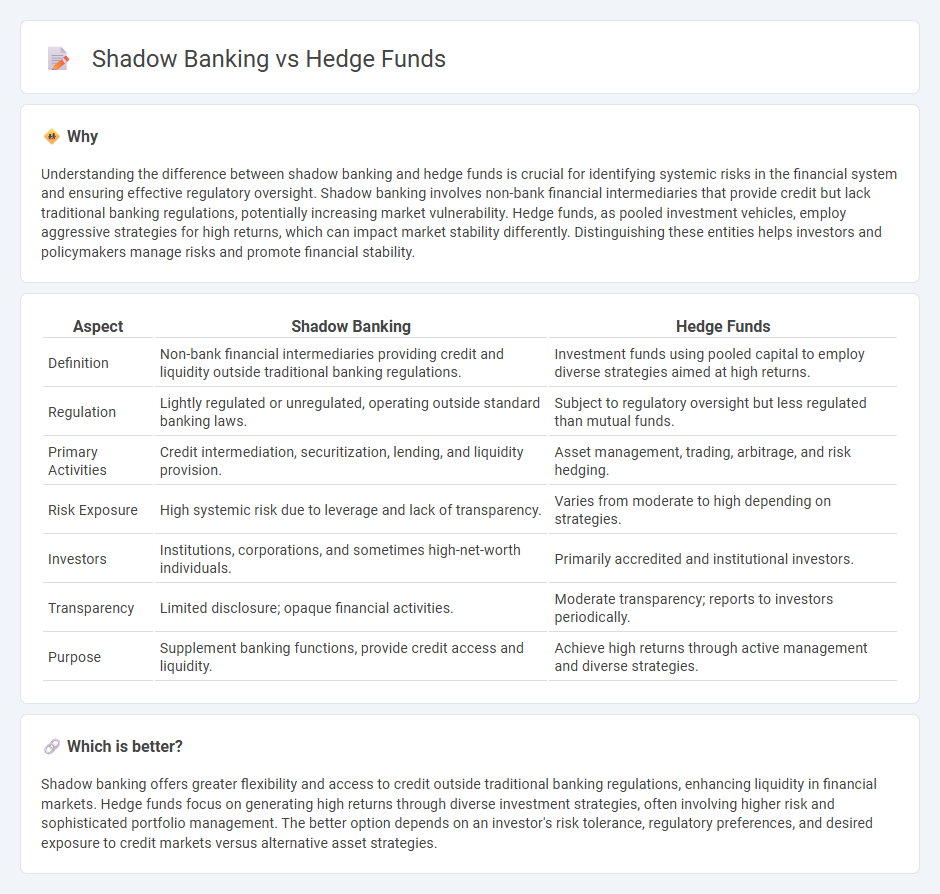

Understanding the difference between shadow banking and hedge funds is crucial for identifying systemic risks in the financial system and ensuring effective regulatory oversight. Shadow banking involves non-bank financial intermediaries that provide credit but lack traditional banking regulations, potentially increasing market vulnerability. Hedge funds, as pooled investment vehicles, employ aggressive strategies for high returns, which can impact market stability differently. Distinguishing these entities helps investors and policymakers manage risks and promote financial stability.

Comparison Table

| Aspect | Shadow Banking | Hedge Funds |

|---|---|---|

| Definition | Non-bank financial intermediaries providing credit and liquidity outside traditional banking regulations. | Investment funds using pooled capital to employ diverse strategies aimed at high returns. |

| Regulation | Lightly regulated or unregulated, operating outside standard banking laws. | Subject to regulatory oversight but less regulated than mutual funds. |

| Primary Activities | Credit intermediation, securitization, lending, and liquidity provision. | Asset management, trading, arbitrage, and risk hedging. |

| Risk Exposure | High systemic risk due to leverage and lack of transparency. | Varies from moderate to high depending on strategies. |

| Investors | Institutions, corporations, and sometimes high-net-worth individuals. | Primarily accredited and institutional investors. |

| Transparency | Limited disclosure; opaque financial activities. | Moderate transparency; reports to investors periodically. |

| Purpose | Supplement banking functions, provide credit access and liquidity. | Achieve high returns through active management and diverse strategies. |

Which is better?

Shadow banking offers greater flexibility and access to credit outside traditional banking regulations, enhancing liquidity in financial markets. Hedge funds focus on generating high returns through diverse investment strategies, often involving higher risk and sophisticated portfolio management. The better option depends on an investor's risk tolerance, regulatory preferences, and desired exposure to credit markets versus alternative asset strategies.

Connection

Shadow banking and hedge funds are interconnected through their roles in providing alternative credit and investment opportunities outside traditional banking regulations. Hedge funds often invest in or collaborate with shadow banking entities to access higher-yield, less regulated financial products, amplifying systemic risk in global finance. The overlap enhances liquidity flows but also increases vulnerability to market shocks due to the opaque nature of shadow banking activities.

Key Terms

Leverage

Hedge funds typically employ leverage to amplify returns through borrowing and derivatives, often maintaining regulatory oversight that imposes leverage limits, whereas shadow banking entities engage in higher leverage with less regulation, increasing systemic risk. The shadow banking system includes entities like money market funds and special purpose vehicles, which create credit and leverage off-balance-sheet, contributing to financial instability. Explore further to understand the nuanced risks and regulatory frameworks governing leverage in hedge funds versus shadow banking.

Regulation

Hedge funds operate under specific regulatory frameworks imposed by entities such as the SEC, focusing on transparency and investor protection. Shadow banking, encompassing unregulated or lightly regulated financial intermediaries like money market funds and off-balance-sheet vehicles, poses systemic risks due to a lack of stringent oversight. Explore the critical distinctions in regulation between hedge funds and shadow banking to understand their impact on financial stability.

Liquidity

Hedge funds offer high liquidity through frequent redemptions and flexible investment strategies, contrasting with shadow banking entities that often provide less transparent and less liquid credit instruments. Shadow banking platforms typically involve complex debt structures and leverage, which can lead to liquidity mismatches and heightened systemic risk during financial stress. Explore further insights into how liquidity dynamics influence risk management in hedge funds versus shadow banking.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - Hedge funds are private investment firms that seek to generate absolute returns through diverse strategies like short-selling, derivatives, and activism, differing from mutual funds which aim for relative returns.

Hedge Funds - Hedge funds are unregistered private investment vehicles pooling capital from sophisticated investors to pursue flexible, often higher-risk investment strategies that are not available to retail investors.

Hedge fund - Hedge funds use complex trading and risk management techniques, charge performance and management fees, and have grown to manage trillions, but they also carry risks such as leverage and liquidity issues that can contribute to market instability.

dowidth.com

dowidth.com