Sovereign debt restructuring involves renegotiating the terms of a country's existing debt to achieve more sustainable repayment conditions, often including reduced interest rates, extended maturities, or partial debt forgiveness. Debt rollover refers to the process of refinancing maturing obligations by issuing new debt to pay off old debt, maintaining liquidity without altering original loan terms. Explore the nuances and strategic implications of both approaches to better understand sovereign debt management.

Why it is important

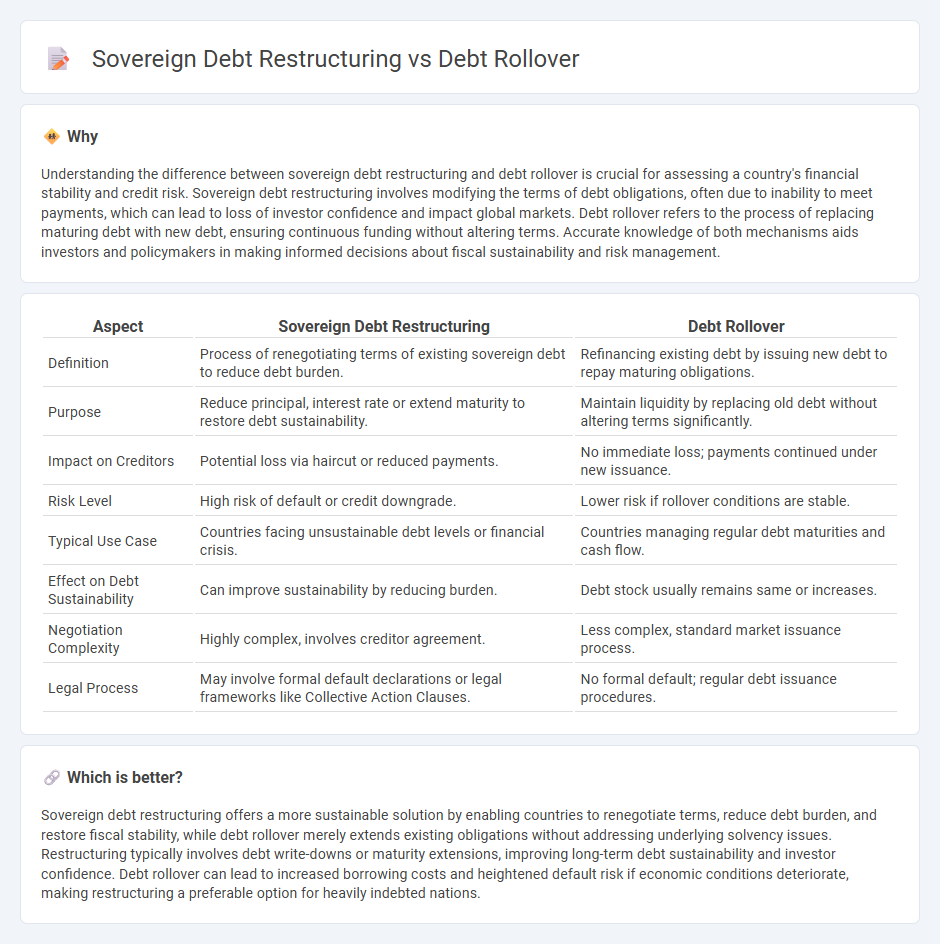

Understanding the difference between sovereign debt restructuring and debt rollover is crucial for assessing a country's financial stability and credit risk. Sovereign debt restructuring involves modifying the terms of debt obligations, often due to inability to meet payments, which can lead to loss of investor confidence and impact global markets. Debt rollover refers to the process of replacing maturing debt with new debt, ensuring continuous funding without altering terms. Accurate knowledge of both mechanisms aids investors and policymakers in making informed decisions about fiscal sustainability and risk management.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Debt Rollover |

|---|---|---|

| Definition | Process of renegotiating terms of existing sovereign debt to reduce debt burden. | Refinancing existing debt by issuing new debt to repay maturing obligations. |

| Purpose | Reduce principal, interest rate or extend maturity to restore debt sustainability. | Maintain liquidity by replacing old debt without altering terms significantly. |

| Impact on Creditors | Potential loss via haircut or reduced payments. | No immediate loss; payments continued under new issuance. |

| Risk Level | High risk of default or credit downgrade. | Lower risk if rollover conditions are stable. |

| Typical Use Case | Countries facing unsustainable debt levels or financial crisis. | Countries managing regular debt maturities and cash flow. |

| Effect on Debt Sustainability | Can improve sustainability by reducing burden. | Debt stock usually remains same or increases. |

| Negotiation Complexity | Highly complex, involves creditor agreement. | Less complex, standard market issuance process. |

| Legal Process | May involve formal default declarations or legal frameworks like Collective Action Clauses. | No formal default; regular debt issuance procedures. |

Which is better?

Sovereign debt restructuring offers a more sustainable solution by enabling countries to renegotiate terms, reduce debt burden, and restore fiscal stability, while debt rollover merely extends existing obligations without addressing underlying solvency issues. Restructuring typically involves debt write-downs or maturity extensions, improving long-term debt sustainability and investor confidence. Debt rollover can lead to increased borrowing costs and heightened default risk if economic conditions deteriorate, making restructuring a preferable option for heavily indebted nations.

Connection

Sovereign debt restructuring involves renegotiating the terms of a country's existing debt to achieve more manageable repayment conditions, which directly impacts debt rollover by altering the schedule and terms under which maturing debt is refinanced. Successful restructuring can lower borrowing costs and restore investor confidence, facilitating smoother debt rollover processes and reducing default risk. Consequently, the interplay between debt restructuring and rollover is critical for maintaining sovereign financial stability and ensuring sustainable public finance management.

Key Terms

Maturity Extension

Debt rollover involves extending the maturity of existing sovereign debt by replacing or renewing old obligations with new ones, enabling countries to manage liquidity without altering principal amounts. Sovereign debt restructuring, particularly maturity extension, renegotiates terms to lengthen repayment periods, often accompanied by changes in interest rates or principal reduction to restore debt sustainability. Explore more to understand the strategic differences and implications of these financial mechanisms.

Haircut

Debt rollover involves extending the maturity of existing sovereign debt without reducing the principal amount, whereas sovereign debt restructuring often includes a "haircut," which is a negotiated reduction in the debt's face value or interest payments to alleviate the borrower's financial burden. Haircuts directly impact the creditor's recovery rate and are commonly used during fiscal crises to restore debt sustainability and stabilize the economy. Explore the nuances and implications of haircuts in sovereign debt management to understand their role in global financial stability.

Credit Risk

Debt rollover involves issuing new debt to repay existing obligations, which maintains the sovereign's credit risk exposure by postponing default but can increase liabilities if market conditions worsen. Sovereign debt restructuring, on the other hand, typically reduces debt burdens through negotiated terms such as haircuts or extended maturities, directly affecting credit risk by improving long-term sustainability but potentially damaging investor confidence. Explore the strategies and impacts of managing sovereign credit risk through debt rollover versus restructuring for deeper insights.

Source and External Links

Rollover Risk: Definition, Overview & Examples - FreshBooks - Debt rollover refers to refinancing or renewing debt obligations such as loans or bonds at maturity, often involving the risk of higher interest rates on the new debt compared to the original loan, affecting liquidity and solvency of the borrower.

8. Rolling-over a Drawdown Loan - Oracle - A debt rollover in loan syndication means renewing an existing loan instead of liquidating it upon maturity, by initiating a new loan contract that can include the principal and accrued interest from the original loan.

Rollover Risk and Credit Risk - NYU Stern - Debt rollover involves issuing new bonds to replace maturing bonds, where the market price of new bonds can affect a firm's credit risk, and losses from rollover must be absorbed by equity holders to avoid bankruptcy.

dowidth.com

dowidth.com