Liquid staking enables cryptocurrency holders to earn staking rewards while maintaining liquidity by receiving tokenized versions of their staked assets, enhancing capital efficiency in decentralized finance (DeFi). Synthetic assets are blockchain-based instruments that replicate the value of real-world assets, allowing users to gain exposure without owning the underlying asset, thus broadening access to diverse financial markets. Explore the differences between liquid staking and synthetic assets to optimize your DeFi investment strategy.

Why it is important

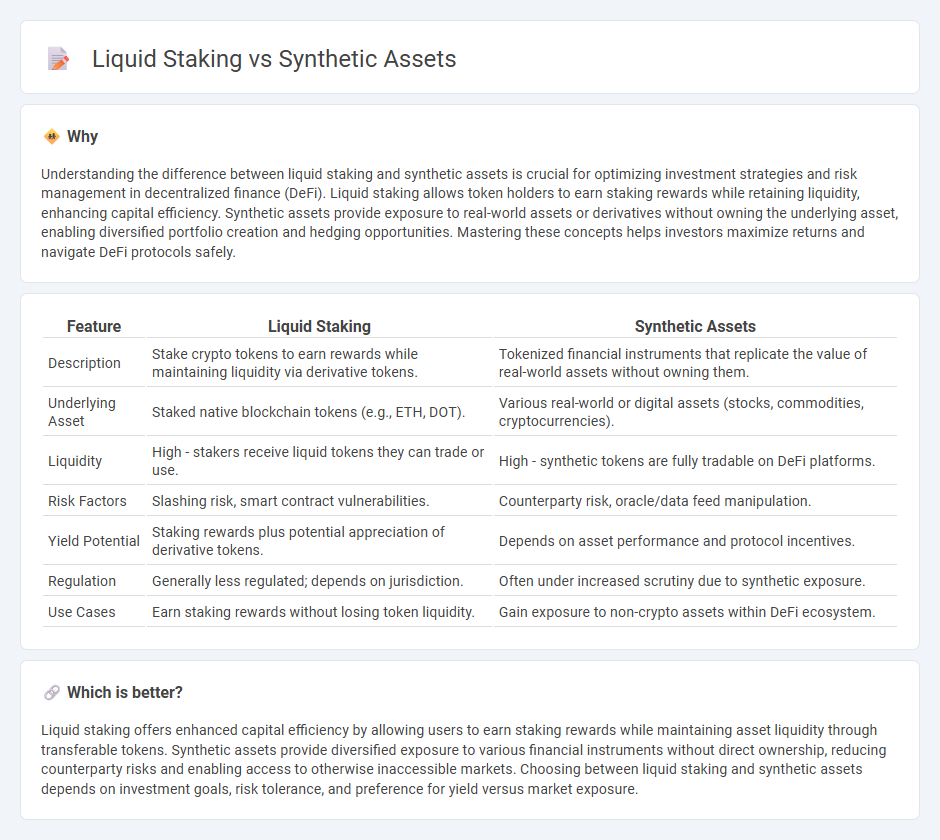

Understanding the difference between liquid staking and synthetic assets is crucial for optimizing investment strategies and risk management in decentralized finance (DeFi). Liquid staking allows token holders to earn staking rewards while retaining liquidity, enhancing capital efficiency. Synthetic assets provide exposure to real-world assets or derivatives without owning the underlying asset, enabling diversified portfolio creation and hedging opportunities. Mastering these concepts helps investors maximize returns and navigate DeFi protocols safely.

Comparison Table

| Feature | Liquid Staking | Synthetic Assets |

|---|---|---|

| Description | Stake crypto tokens to earn rewards while maintaining liquidity via derivative tokens. | Tokenized financial instruments that replicate the value of real-world assets without owning them. |

| Underlying Asset | Staked native blockchain tokens (e.g., ETH, DOT). | Various real-world or digital assets (stocks, commodities, cryptocurrencies). |

| Liquidity | High - stakers receive liquid tokens they can trade or use. | High - synthetic tokens are fully tradable on DeFi platforms. |

| Risk Factors | Slashing risk, smart contract vulnerabilities. | Counterparty risk, oracle/data feed manipulation. |

| Yield Potential | Staking rewards plus potential appreciation of derivative tokens. | Depends on asset performance and protocol incentives. |

| Regulation | Generally less regulated; depends on jurisdiction. | Often under increased scrutiny due to synthetic exposure. |

| Use Cases | Earn staking rewards without losing token liquidity. | Gain exposure to non-crypto assets within DeFi ecosystem. |

Which is better?

Liquid staking offers enhanced capital efficiency by allowing users to earn staking rewards while maintaining asset liquidity through transferable tokens. Synthetic assets provide diversified exposure to various financial instruments without direct ownership, reducing counterparty risks and enabling access to otherwise inaccessible markets. Choosing between liquid staking and synthetic assets depends on investment goals, risk tolerance, and preference for yield versus market exposure.

Connection

Liquid staking enhances capital efficiency by allowing staked assets to remain accessible as tradable tokens, which can be used to mint synthetic assets on decentralized finance platforms. These synthetic assets replicate the value of real-world or crypto assets without requiring direct ownership, enabling increased liquidity and diversified exposure. Integrating liquid staking with synthetic assets fosters seamless asset utilization, amplifying yield opportunities and market participation within decentralized ecosystems.

Key Terms

Derivatives

Synthetic assets replicate the value of real-world assets through blockchain-based smart contracts, offering traders exposure to derivatives without owning the underlying assets, while liquid staking enables users to stake cryptocurrencies and receive tokenized derivatives representing their staked holdings. Both synthetic assets and liquid staking derivatives enhance liquidity and capital efficiency, but synthetic assets provide broader exposure across various asset classes beyond staking rewards. Explore the evolving landscape of decentralized derivatives to understand how these innovations reshape trading strategies and portfolio diversification.

Tokenization

Synthetic assets create tokenized representations of real-world assets, enabling exposure to commodities, stocks, or indices without owning the underlying asset. Liquid staking tokens represent staked assets on Proof-of-Stake blockchains, providing users with liquidity while earning staking rewards. Explore how these tokenization methods differ in enabling decentralized finance opportunities and risk management.

Yield

Synthetic assets generate yield by mimicking real-world asset performance, often offering exposure to stocks, commodities, and indices without actual ownership, enabling diversified income streams. Liquid staking provides yield through staking native blockchain tokens, allowing users to earn rewards while retaining liquidity and participating in DeFi activities. Explore how these yield strategies compare in risk, return, and flexibility to enhance your crypto portfolio.

Source and External Links

Crypto synthetic assets, explained - Cointelegraph - Synthetic assets are blockchain-based financial instruments that mimic the value and performance of real-world assets like stocks or commodities using smart contracts in DeFi, allowing access to various markets without owning the underlying asset.

Synthetic Asset Definition - CoinMarketCap - Synthetic assets, or synths, are tokenized derivatives recorded on the blockchain that represent ownership in real assets without holding them directly, offering security and traceability for trading diverse assets on-chain.

What are synthetic crypto assets? - Kraken - Synthetic crypto assets are blockchain tokens that act as derivatives to give indirect exposure to traditional assets, combining the benefits of traditional derivatives with transparency and accessibility from blockchain technology.

dowidth.com

dowidth.com