Decentralized exchanges (DEXs) operate on blockchain technology, allowing peer-to-peer trading without intermediaries, enhancing transparency and security. Over-the-counter (OTC) markets facilitate large-volume transactions directly between parties, offering privacy and reduced market impact but relying on trust between participants. Explore the benefits and trade-offs of DEXs and OTC markets to optimize your trading strategy.

Why it is important

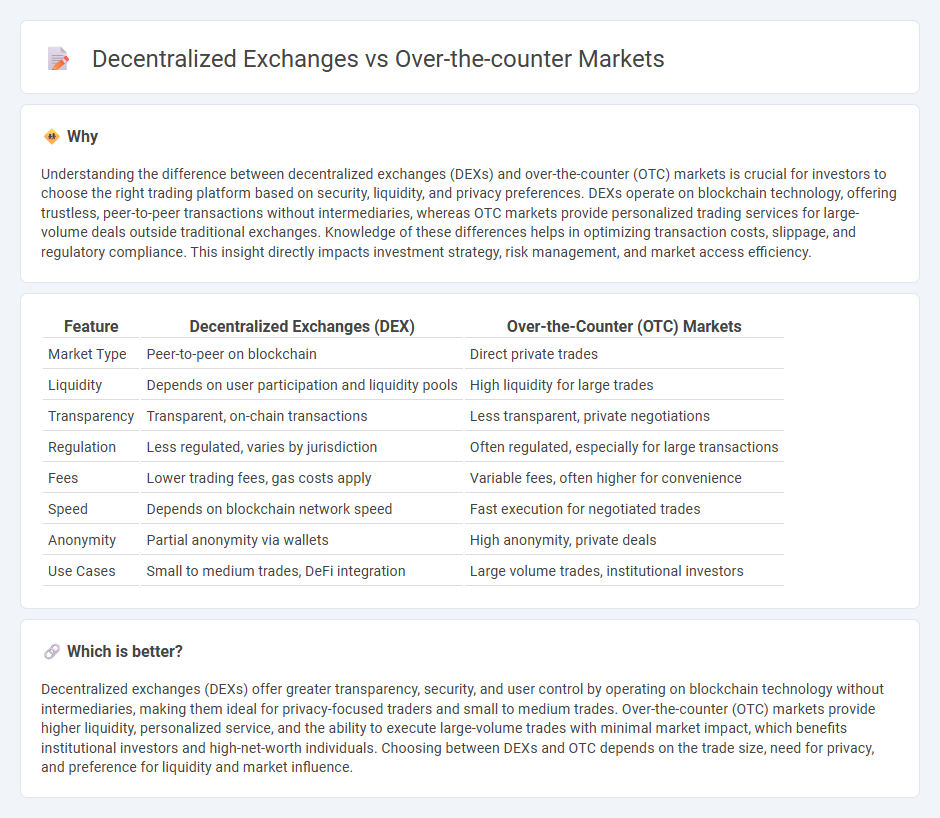

Understanding the difference between decentralized exchanges (DEXs) and over-the-counter (OTC) markets is crucial for investors to choose the right trading platform based on security, liquidity, and privacy preferences. DEXs operate on blockchain technology, offering trustless, peer-to-peer transactions without intermediaries, whereas OTC markets provide personalized trading services for large-volume deals outside traditional exchanges. Knowledge of these differences helps in optimizing transaction costs, slippage, and regulatory compliance. This insight directly impacts investment strategy, risk management, and market access efficiency.

Comparison Table

| Feature | Decentralized Exchanges (DEX) | Over-the-Counter (OTC) Markets |

|---|---|---|

| Market Type | Peer-to-peer on blockchain | Direct private trades |

| Liquidity | Depends on user participation and liquidity pools | High liquidity for large trades |

| Transparency | Transparent, on-chain transactions | Less transparent, private negotiations |

| Regulation | Less regulated, varies by jurisdiction | Often regulated, especially for large transactions |

| Fees | Lower trading fees, gas costs apply | Variable fees, often higher for convenience |

| Speed | Depends on blockchain network speed | Fast execution for negotiated trades |

| Anonymity | Partial anonymity via wallets | High anonymity, private deals |

| Use Cases | Small to medium trades, DeFi integration | Large volume trades, institutional investors |

Which is better?

Decentralized exchanges (DEXs) offer greater transparency, security, and user control by operating on blockchain technology without intermediaries, making them ideal for privacy-focused traders and small to medium trades. Over-the-counter (OTC) markets provide higher liquidity, personalized service, and the ability to execute large-volume trades with minimal market impact, which benefits institutional investors and high-net-worth individuals. Choosing between DEXs and OTC depends on the trade size, need for privacy, and preference for liquidity and market influence.

Connection

Decentralized exchanges (DEXs) and over-the-counter (OTC) markets both facilitate peer-to-peer trading, offering alternatives to traditional centralized finance by enhancing liquidity and privacy. DEXs operate on blockchain technology, enabling direct token swaps without intermediaries, while OTC markets handle large-volume trades off-exchange to minimize price impact. The interplay between DEXs and OTC platforms supports diverse trading strategies, catering to institutional investors and retail traders seeking efficient asset exchange with reduced slippage and transparent settlement.

Key Terms

Counterparty Risk

Over-the-counter (OTC) markets expose participants to counterparty risk due to the lack of centralized oversight, increasing the probability of default or fraud during transactions. Decentralized exchanges (DEXs) minimize counterparty risk by leveraging blockchain technology and smart contracts to automate trade execution without intermediaries. Explore how these platforms manage risk to enhance security and trust in trading environments.

Liquidity

Over-the-counter (OTC) markets offer high liquidity by facilitating large trades directly between parties, reducing price slippage and market impact compared to decentralized exchanges (DEXs), which rely on automated market makers and face liquidity fragmentation across pools. OTC desks typically cater to institutional investors requiring discreet, sizable transactions, while DEXs provide more access and transparency but often exhibit lower liquidity depth, especially for less popular tokens. Explore detailed liquidity comparisons to optimize your trading strategy.

Intermediary

Over-the-counter (OTC) markets rely heavily on intermediaries such as brokers and dealers to facilitate large-scale transactions, providing personalized services and reducing market impact. Decentralized exchanges (DEXs) eliminate intermediaries by using smart contracts on blockchain networks, enabling peer-to-peer trades with increased transparency and reduced counterparty risk. Explore the differences in intermediary roles to understand how they affect trading efficiency and security in these markets.

Source and External Links

What is the Over The Counter (OTC) market? - The OTC market is a decentralized system where financial instruments like stocks, bonds, and derivatives are traded directly between parties through dealer networks and electronic platforms, rather than on centralized exchanges, offering flexibility but with less transparency and higher volatility risks.

Over-the-counter (finance) - OTC trading involves direct transactions between parties without exchange supervision; it includes stocks often not listed on formal exchanges and carries certain risks like penny stock fraud, though it can serve as a pathway for companies to enter fully regulated markets.

Financial markets: Exchange or Over the Counter - OTC markets operate as distributed dealer networks where prices and trades are negotiated bilaterally, characterized by lower transparency and liquidity than exchanges, with quotes communicated via phone or electronic means, impacting the ease and stability of trading.

dowidth.com

dowidth.com