Regenerative finance focuses on creating financial systems that restore and enhance environmental and social health, going beyond mere sustainability to actively improve ecosystem resilience and community well-being. Sustainable finance emphasizes investments and financial practices that minimize environmental impact and promote long-term economic stability without depleting resources. Explore the key principles and impacts of regenerative versus sustainable finance to understand how each approach shapes the future of responsible investing.

Why it is important

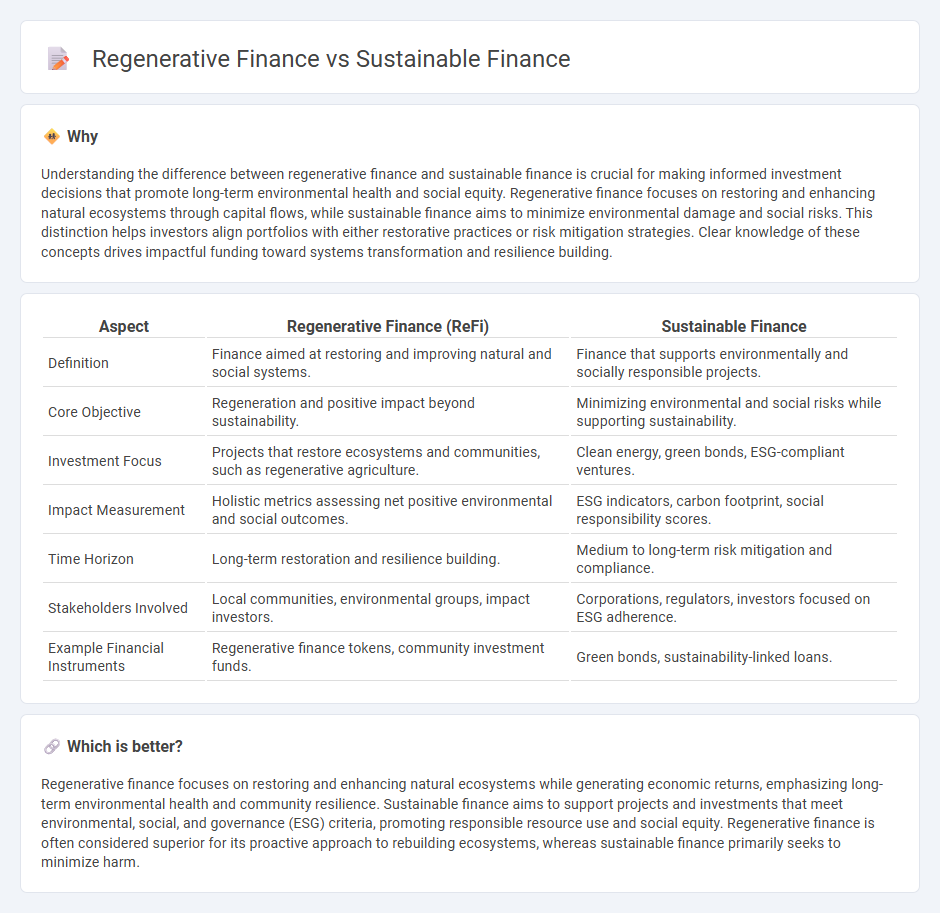

Understanding the difference between regenerative finance and sustainable finance is crucial for making informed investment decisions that promote long-term environmental health and social equity. Regenerative finance focuses on restoring and enhancing natural ecosystems through capital flows, while sustainable finance aims to minimize environmental damage and social risks. This distinction helps investors align portfolios with either restorative practices or risk mitigation strategies. Clear knowledge of these concepts drives impactful funding toward systems transformation and resilience building.

Comparison Table

| Aspect | Regenerative Finance (ReFi) | Sustainable Finance |

|---|---|---|

| Definition | Finance aimed at restoring and improving natural and social systems. | Finance that supports environmentally and socially responsible projects. |

| Core Objective | Regeneration and positive impact beyond sustainability. | Minimizing environmental and social risks while supporting sustainability. |

| Investment Focus | Projects that restore ecosystems and communities, such as regenerative agriculture. | Clean energy, green bonds, ESG-compliant ventures. |

| Impact Measurement | Holistic metrics assessing net positive environmental and social outcomes. | ESG indicators, carbon footprint, social responsibility scores. |

| Time Horizon | Long-term restoration and resilience building. | Medium to long-term risk mitigation and compliance. |

| Stakeholders Involved | Local communities, environmental groups, impact investors. | Corporations, regulators, investors focused on ESG adherence. |

| Example Financial Instruments | Regenerative finance tokens, community investment funds. | Green bonds, sustainability-linked loans. |

Which is better?

Regenerative finance focuses on restoring and enhancing natural ecosystems while generating economic returns, emphasizing long-term environmental health and community resilience. Sustainable finance aims to support projects and investments that meet environmental, social, and governance (ESG) criteria, promoting responsible resource use and social equity. Regenerative finance is often considered superior for its proactive approach to rebuilding ecosystems, whereas sustainable finance primarily seeks to minimize harm.

Connection

Regenerative finance integrates principles of sustainability by funding projects that restore ecosystems and promote social equity, directly supporting the goals of sustainable finance. Both approaches prioritize long-term environmental health and social well-being, ensuring financial investments generate positive impacts beyond economic returns. This interconnected framework drives innovation in green bonds, impact investing, and circular economy financing, aligning capital with the transition to a low-carbon, resilient future.

Key Terms

ESG (Environmental, Social, and Governance)

Sustainable finance prioritizes investments that incorporate ESG (Environmental, Social, and Governance) criteria to minimize environmental impact, promote social responsibility, and ensure ethical governance. Regenerative finance goes beyond by actively restoring ecosystems, enhancing biodiversity, and fostering long-term community resilience through innovative financial models. Explore how these frameworks drive the transition to a more sustainable and equitable economy.

Impact Investing

Sustainable finance prioritizes environmental, social, and governance (ESG) criteria to minimize negative impacts while promoting long-term value, whereas regenerative finance aims to restore and enhance ecosystems and communities through positive, measurable outcomes. Impact investing serves as a bridge by channeling capital into projects that generate both financial returns and significant social or environmental benefits, often measured by frameworks like IRIS+ or the Sustainable Development Goals (SDGs). Explore further to understand how combining these approaches can transform investment portfolios and drive systemic change.

Circular Economy

Sustainable finance prioritizes investments that minimize environmental impact and promote long-term ecological balance, often focusing on resource efficiency and reducing carbon footprints. Regenerative finance goes beyond sustainability by actively restoring and enhancing natural systems, fostering a circular economy where materials continuously flow through reuse, remanufacturing, and recycling processes. Discover how integrating regenerative finance can transform circular economy practices to create resilient and thriving ecosystems.

Source and External Links

Sustainable finance - Wikipedia - Sustainable finance is the set of practices and products that pursue financial returns alongside environmental and social objectives, often aligned with ESG investing and global goals such as the Paris Climate Agreement and UN Sustainable Development Goals.

Overview of sustainable finance - European Commission - Sustainable finance means integrating environmental, social, and governance (ESG) factors into investment decisions to support long-term sustainable economic growth, climate goals, and social fairness.

Sustainable Finance - World Bank - Sustainable finance involves considering ESG criteria to increase long-term investments in sustainable projects, with the World Bank actively supporting global efforts to green financial systems.

dowidth.com

dowidth.com