Direct indexing offers personalized stock ownership by replicating an index through individual securities, enabling tax-loss harvesting and customized exposure. Model portfolios provide pre-constructed, diversified asset allocations managed by professionals for simplicity and ease of use. Explore the advantages and differences between direct indexing and model portfolios to determine the best fit for your investment strategy.

Why it is important

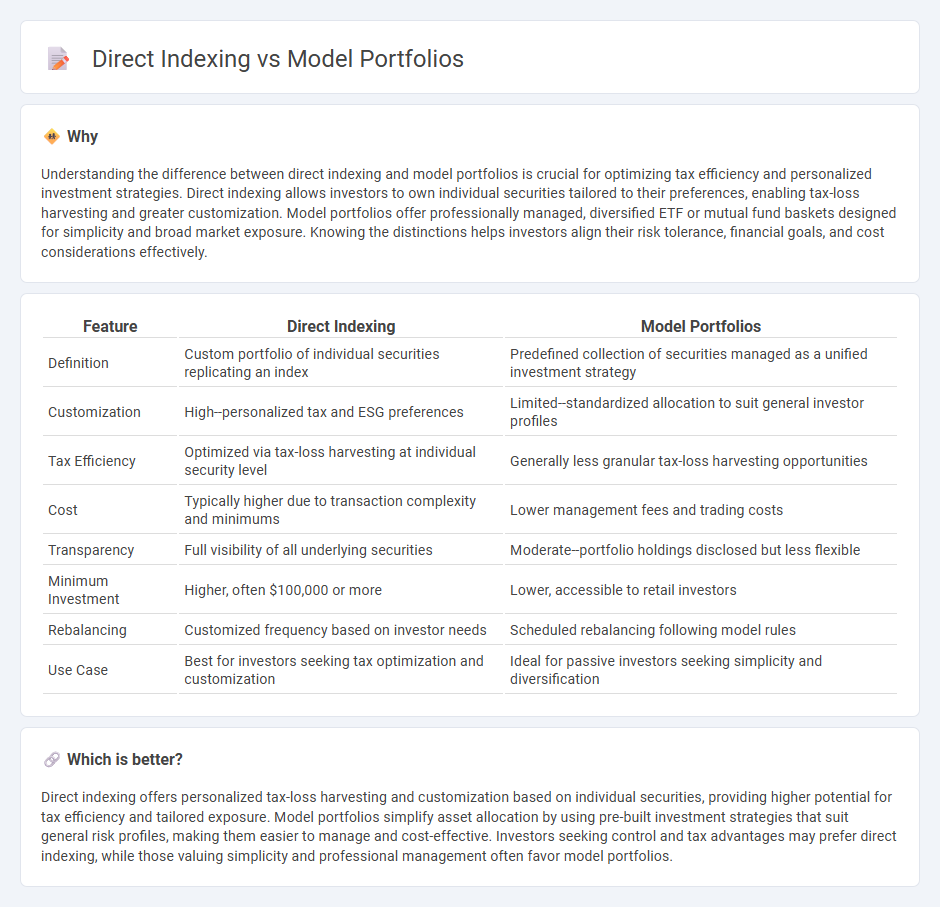

Understanding the difference between direct indexing and model portfolios is crucial for optimizing tax efficiency and personalized investment strategies. Direct indexing allows investors to own individual securities tailored to their preferences, enabling tax-loss harvesting and greater customization. Model portfolios offer professionally managed, diversified ETF or mutual fund baskets designed for simplicity and broad market exposure. Knowing the distinctions helps investors align their risk tolerance, financial goals, and cost considerations effectively.

Comparison Table

| Feature | Direct Indexing | Model Portfolios |

|---|---|---|

| Definition | Custom portfolio of individual securities replicating an index | Predefined collection of securities managed as a unified investment strategy |

| Customization | High--personalized tax and ESG preferences | Limited--standardized allocation to suit general investor profiles |

| Tax Efficiency | Optimized via tax-loss harvesting at individual security level | Generally less granular tax-loss harvesting opportunities |

| Cost | Typically higher due to transaction complexity and minimums | Lower management fees and trading costs |

| Transparency | Full visibility of all underlying securities | Moderate--portfolio holdings disclosed but less flexible |

| Minimum Investment | Higher, often $100,000 or more | Lower, accessible to retail investors |

| Rebalancing | Customized frequency based on investor needs | Scheduled rebalancing following model rules |

| Use Case | Best for investors seeking tax optimization and customization | Ideal for passive investors seeking simplicity and diversification |

Which is better?

Direct indexing offers personalized tax-loss harvesting and customization based on individual securities, providing higher potential for tax efficiency and tailored exposure. Model portfolios simplify asset allocation by using pre-built investment strategies that suit general risk profiles, making them easier to manage and cost-effective. Investors seeking control and tax advantages may prefer direct indexing, while those valuing simplicity and professional management often favor model portfolios.

Connection

Direct indexing and model portfolios both serve as investment strategies aimed at portfolio customization and diversification. Direct indexing allows investors to own individual securities that mimic an index, enabling tax-loss harvesting and personalized exposure, while model portfolios offer pre-constructed allocations based on risk tolerance and investment goals using ETFs or mutual funds. Integration of direct indexing with model portfolios enhances customization by combining tailored security selection with strategic asset allocation, optimizing tax efficiency and investment alignment.

Key Terms

Diversification

Model portfolios offer pre-constructed diversification across asset classes and sectors, simplifying investment decisions through expert-driven allocations. Direct indexing provides personalized diversification by enabling investors to own individual securities tailored to their preferences, tax situations, and ESG criteria. Explore how each strategy can optimize your portfolio's risk management and returns.

Customization

Model portfolios offer predefined asset allocations based on risk tolerance and investment goals, limiting customization options for individual investors. Direct indexing enables personalized portfolios by allowing investors to select specific securities that align with their values, tax strategies, and financial objectives. Discover how custom investment strategies through direct indexing can better meet your unique needs and enhance portfolio control.

Tax Efficiency

Model portfolios offer diversified asset allocation managed by professionals, but may generate capital gains taxes due to periodic rebalancing. Direct indexing enables investors to customize holdings and apply tax-loss harvesting at the individual security level, often resulting in enhanced tax efficiency. Explore how direct indexing can optimize your tax strategy and improve after-tax returns.

Source and External Links

The Best Allocation Model Portfolios - Morningstar - Morningstar highlights top-rated allocation model portfolios, awarded Gold or Bronze for strong processes and people, focusing on factor-based investing and dynamic bond allocations to manage market volatility.

The Rise of Model Portfolios | Broadridge - Model portfolios are predefined asset mixes used across the industry to improve investment efficiency, with most assets managed by internal research groups, and growing adoption driven by advisors seeking streamlined processes.

Model Portfolios - Fidelity Institutional - Fidelity offers a range of model portfolios designed to help advisors scale their practices, providing access to institutional research, a variety of investment objectives, and no advisory fees on the models themselves.

dowidth.com

dowidth.com