Special Purpose Acquisition Companies (SPACs) offer an alternative route for private companies to enter public markets through a merger with a shell company, bypassing the traditional IPO process. Secondary offerings involve existing shareholders selling additional shares after the initial public offering, often to raise capital or provide liquidity. Explore the key differences and implications of SPACs and secondary offerings to understand their impact on market dynamics.

Why it is important

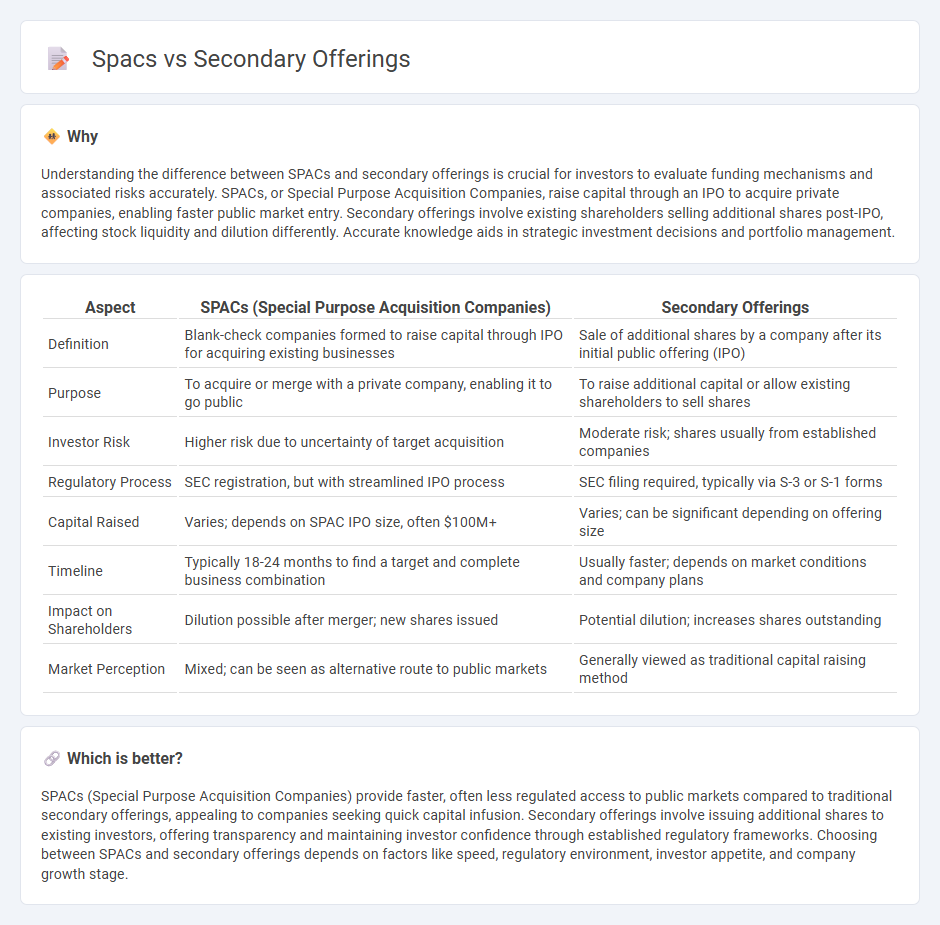

Understanding the difference between SPACs and secondary offerings is crucial for investors to evaluate funding mechanisms and associated risks accurately. SPACs, or Special Purpose Acquisition Companies, raise capital through an IPO to acquire private companies, enabling faster public market entry. Secondary offerings involve existing shareholders selling additional shares post-IPO, affecting stock liquidity and dilution differently. Accurate knowledge aids in strategic investment decisions and portfolio management.

Comparison Table

| Aspect | SPACs (Special Purpose Acquisition Companies) | Secondary Offerings |

|---|---|---|

| Definition | Blank-check companies formed to raise capital through IPO for acquiring existing businesses | Sale of additional shares by a company after its initial public offering (IPO) |

| Purpose | To acquire or merge with a private company, enabling it to go public | To raise additional capital or allow existing shareholders to sell shares |

| Investor Risk | Higher risk due to uncertainty of target acquisition | Moderate risk; shares usually from established companies |

| Regulatory Process | SEC registration, but with streamlined IPO process | SEC filing required, typically via S-3 or S-1 forms |

| Capital Raised | Varies; depends on SPAC IPO size, often $100M+ | Varies; can be significant depending on offering size |

| Timeline | Typically 18-24 months to find a target and complete business combination | Usually faster; depends on market conditions and company plans |

| Impact on Shareholders | Dilution possible after merger; new shares issued | Potential dilution; increases shares outstanding |

| Market Perception | Mixed; can be seen as alternative route to public markets | Generally viewed as traditional capital raising method |

Which is better?

SPACs (Special Purpose Acquisition Companies) provide faster, often less regulated access to public markets compared to traditional secondary offerings, appealing to companies seeking quick capital infusion. Secondary offerings involve issuing additional shares to existing investors, offering transparency and maintaining investor confidence through established regulatory frameworks. Choosing between SPACs and secondary offerings depends on factors like speed, regulatory environment, investor appetite, and company growth stage.

Connection

SPACs (Special Purpose Acquisition Companies) and secondary offerings both play critical roles in capital markets by providing opportunities for companies to raise additional capital post-IPO. SPACs enable private companies to go public through a merger, after which secondary offerings allow these newly public entities to issue more shares, enhancing liquidity and funding expansion. The connection lies in the capital-raising lifecycle, where SPACs facilitate initial market entry and secondary offerings support continued financial growth.

Key Terms

Dilution

Secondary offerings involve issuing additional shares that can significantly dilute existing shareholders' ownership and earnings per share, potentially impacting stock price and investor value. SPACs (Special Purpose Acquisition Companies) often cause dilution through the issuance of founder shares and warrants, which may surpass dilution seen in traditional secondary offerings depending on deal structure and post-merger equity issuance. Explore further to understand how these mechanisms affect shareholder value and investment strategies.

Initial Public Offering (IPO)

Secondary offerings involve the sale of shares by existing shareholders after a company's Initial Public Offering (IPO), providing liquidity without raising new capital. SPACs (Special Purpose Acquisition Companies) offer an alternative IPO route by merging with a private company, accelerating public market entry but sometimes at higher risks and lower transparency. Explore in-depth comparisons of secondary offerings and SPACs to understand the strategic implications for going public.

Redemption Rights

Secondary offerings provide existing shareholders the opportunity to sell shares, often without redemption rights, whereas SPACs (Special Purpose Acquisition Companies) typically grant investors redemption rights, allowing them to reclaim their investment if they do not approve of the proposed merger. Redemption rights in SPACs serve as a critical investor protection mechanism, which can impact the transaction's capital structure and timing. Explore how these differences influence investment strategies and risk management in corporate finance.

Source and External Links

Secondary Offering | Definition + Examples - A secondary offering refers to the sale of securities by an investor on the secondary market after the IPO, where the proceeds go to the selling investors, not the company, and can also mean the company's issuance of additional shares post-IPO, known as a seasoned equity offering or follow-on offering.

Secondary market offering - A secondary market offering is a registered sale by existing shareholders (not the company), is non-dilutive since no new shares are issued, and proceeds do not benefit the company but provide liquidity for shareholders; it should be distinguished from a follow-on offering where the company issues new shares.

Secondary Offering | Practical Law - Westlaw - A secondary offering is an SEC-registered sale of securities by existing securityholders, where the company receives no proceeds, and can be purely secondary (only selling shareholders) or mixed with primary shares sold by the company; these offerings often arise from registration rights agreements.

dowidth.com

dowidth.com