Green bond laddering involves structuring a portfolio solely with green bonds, which finance environmentally sustainable projects, while traditional bond laddering diversifies across various types of bonds to balance risk and yield. This strategy helps investors support eco-friendly initiatives and potentially benefit from incentives related to green finance, contrasting with the broader risk management goals of general bond laddering. Explore more about how green bond laddering can align your investments with sustainability goals.

Why it is important

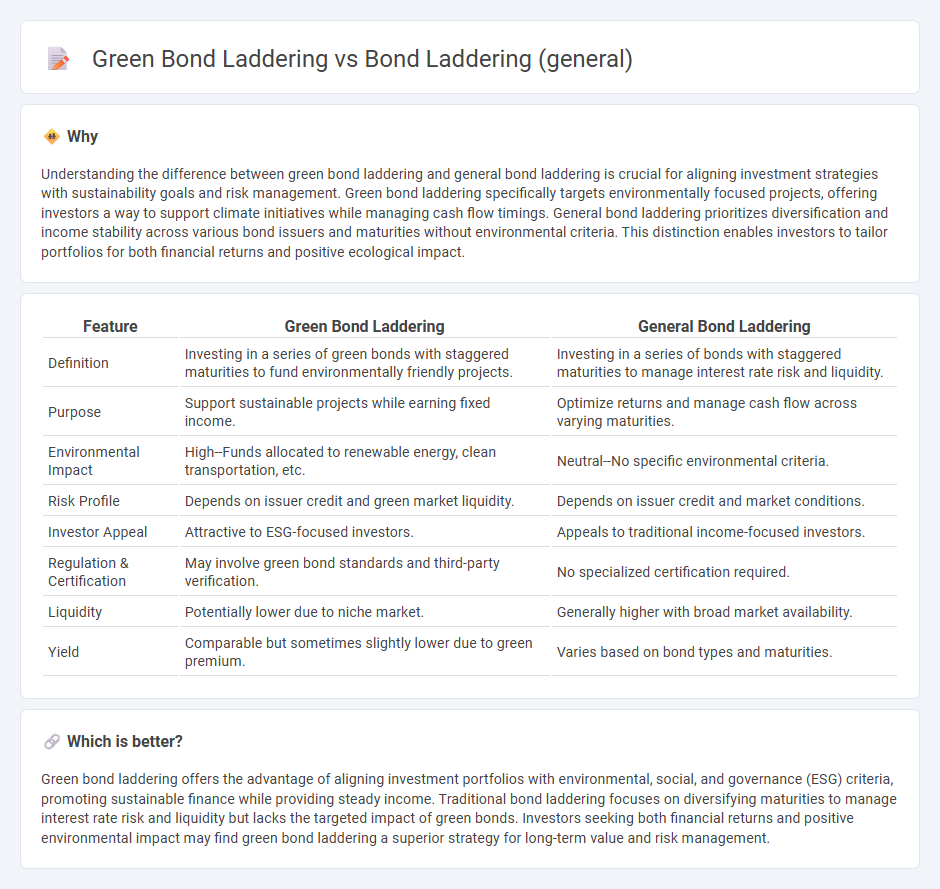

Understanding the difference between green bond laddering and general bond laddering is crucial for aligning investment strategies with sustainability goals and risk management. Green bond laddering specifically targets environmentally focused projects, offering investors a way to support climate initiatives while managing cash flow timings. General bond laddering prioritizes diversification and income stability across various bond issuers and maturities without environmental criteria. This distinction enables investors to tailor portfolios for both financial returns and positive ecological impact.

Comparison Table

| Feature | Green Bond Laddering | General Bond Laddering |

|---|---|---|

| Definition | Investing in a series of green bonds with staggered maturities to fund environmentally friendly projects. | Investing in a series of bonds with staggered maturities to manage interest rate risk and liquidity. |

| Purpose | Support sustainable projects while earning fixed income. | Optimize returns and manage cash flow across varying maturities. |

| Environmental Impact | High--Funds allocated to renewable energy, clean transportation, etc. | Neutral--No specific environmental criteria. |

| Risk Profile | Depends on issuer credit and green market liquidity. | Depends on issuer credit and market conditions. |

| Investor Appeal | Attractive to ESG-focused investors. | Appeals to traditional income-focused investors. |

| Regulation & Certification | May involve green bond standards and third-party verification. | No specialized certification required. |

| Liquidity | Potentially lower due to niche market. | Generally higher with broad market availability. |

| Yield | Comparable but sometimes slightly lower due to green premium. | Varies based on bond types and maturities. |

Which is better?

Green bond laddering offers the advantage of aligning investment portfolios with environmental, social, and governance (ESG) criteria, promoting sustainable finance while providing steady income. Traditional bond laddering focuses on diversifying maturities to manage interest rate risk and liquidity but lacks the targeted impact of green bonds. Investors seeking both financial returns and positive environmental impact may find green bond laddering a superior strategy for long-term value and risk management.

Connection

Green bond laddering and general bond laddering are investment strategies that involve purchasing bonds with staggered maturities to manage interest rate risk and enhance liquidity. Both approaches use the laddering technique to create a diversified fixed-income portfolio, but green bond laddering specifically focuses on environmentally sustainable projects, aligning financial returns with ESG goals. This connection allows investors to balance risk, ensure steady cash flow, and support eco-friendly initiatives simultaneously.

Key Terms

**Bond laddering (general):**

Bond laddering is an investment strategy that involves purchasing bonds with staggered maturities to manage interest rate risk and ensure steady income streams. This method enhances portfolio diversification and liquidity by spreading investments across various maturity dates, reducing the impact of market fluctuations. Explore more about optimizing fixed income portfolios through effective bond laddering techniques.

Maturity diversification

Bond laddering involves creating a portfolio of bonds with staggered maturities to manage interest rate risk and ensure liquidity at regular intervals. Green bond laddering applies this strategy specifically to environmentally-focused bonds, promoting sustainability while achieving maturity diversification to match cash flow needs and risk tolerance. Explore how green bond laddering can optimize your investment strategy while supporting eco-friendly projects.

Interest rate risk

Bond laddering reduces interest rate risk by staggering bond maturities, allowing investors to reinvest periodically at prevailing rates and maintain consistent cash flow. Green bond laddering applies the same strategy but specifically targets environmentally sustainable projects, potentially benefiting from investor demand and regulatory incentives that may affect yield stability. Explore how green bond laddering can uniquely mitigate interest rate risk while supporting sustainability goals.

Source and External Links

Bond Laddering: Understanding a Fixed Income Investing ... - Bond laddering is a fixed income investing strategy that involves buying bonds with staggered maturity dates to manage interest rate risk and align investments with financial goals by reinvesting proceeds at maturity.

An Introduction to Bond Ladders - Bond ladders smooth out interest rate risk by holding bonds of varying maturities and reinvesting maturing principal into longer-term bonds, allowing investors to benefit from higher long-term yields and changing interest rates.

Bond Laddering Explained: Bet on Bond Coupons, Not ... - Bond laddering involves owning bonds with staggered maturities, holding until maturity, and collecting fixed interest and principal periodically, securing predictable cash flow independent of bond price fluctuations or interest rate changes.

dowidth.com

dowidth.com