Liability-driven investing (LDI) focuses on aligning asset portfolios with future debt obligations to minimize funding risks, prioritizing cash flow matching and risk mitigation. Passive investing aims to replicate market indices, offering broad diversification and lower fees without active management targeting specific liabilities. Explore further to understand which strategy best suits your financial goals and risk tolerance.

Why it is important

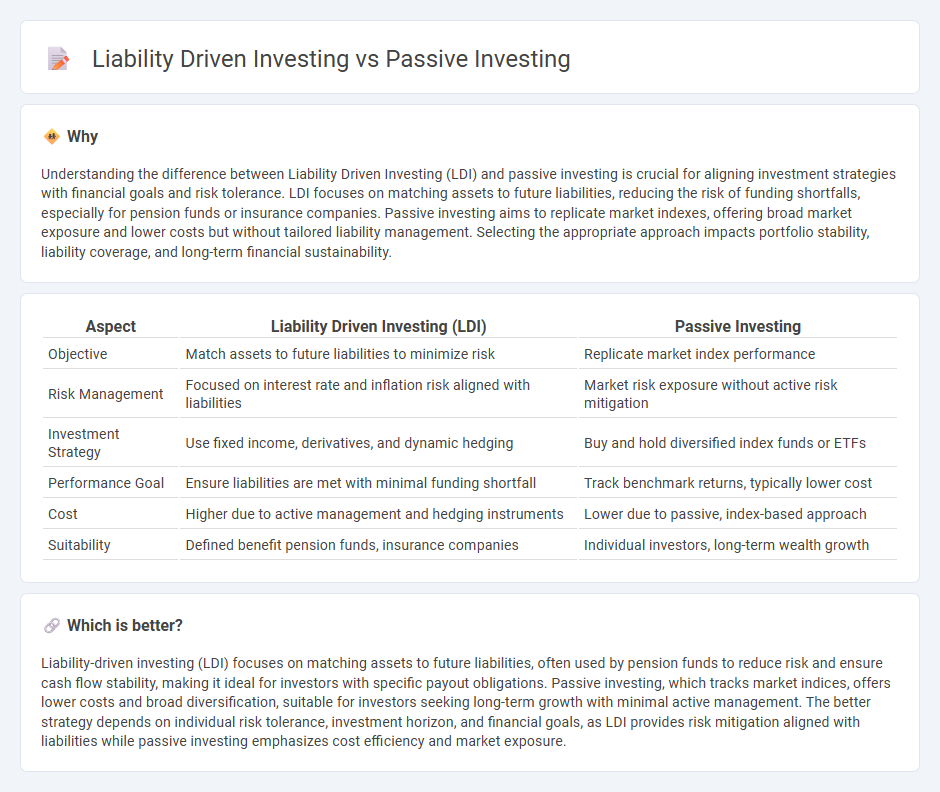

Understanding the difference between Liability Driven Investing (LDI) and passive investing is crucial for aligning investment strategies with financial goals and risk tolerance. LDI focuses on matching assets to future liabilities, reducing the risk of funding shortfalls, especially for pension funds or insurance companies. Passive investing aims to replicate market indexes, offering broad market exposure and lower costs but without tailored liability management. Selecting the appropriate approach impacts portfolio stability, liability coverage, and long-term financial sustainability.

Comparison Table

| Aspect | Liability Driven Investing (LDI) | Passive Investing |

|---|---|---|

| Objective | Match assets to future liabilities to minimize risk | Replicate market index performance |

| Risk Management | Focused on interest rate and inflation risk aligned with liabilities | Market risk exposure without active risk mitigation |

| Investment Strategy | Use fixed income, derivatives, and dynamic hedging | Buy and hold diversified index funds or ETFs |

| Performance Goal | Ensure liabilities are met with minimal funding shortfall | Track benchmark returns, typically lower cost |

| Cost | Higher due to active management and hedging instruments | Lower due to passive, index-based approach |

| Suitability | Defined benefit pension funds, insurance companies | Individual investors, long-term wealth growth |

Which is better?

Liability-driven investing (LDI) focuses on matching assets to future liabilities, often used by pension funds to reduce risk and ensure cash flow stability, making it ideal for investors with specific payout obligations. Passive investing, which tracks market indices, offers lower costs and broad diversification, suitable for investors seeking long-term growth with minimal active management. The better strategy depends on individual risk tolerance, investment horizon, and financial goals, as LDI provides risk mitigation aligned with liabilities while passive investing emphasizes cost efficiency and market exposure.

Connection

Liability-driven investing (LDI) strategically aligns a portfolio's assets with future liabilities, minimizing risk and ensuring obligations are met, which complements passive investing's emphasis on long-term market exposure and cost efficiency. Both approaches prioritize risk management and stability, with LDI focusing on matching liabilities while passive investing targets broad market performance through index funds. This synergy supports pension funds and institutional investors in securing predictable returns and fulfilling financial commitments.

Key Terms

Index Funds

Index funds represent a cornerstone of passive investing, offering diversified market exposure with low fees and minimal portfolio turnover. Liability Driven Investing (LDI) focuses on managing investments to meet specific future liabilities, often prioritizing fixed-income assets to ensure cash flow alignment. Explore how index funds can complement LDI strategies for balanced growth and risk management.

Asset-Liability Matching

Passive investing aims to replicate market indexes with minimal trading, focusing on broad market exposure and low fees. Liability Driven Investing (LDI) prioritizes aligning asset portfolios directly with future liabilities, emphasizing precise Asset-Liability Matching to manage risk and ensure financial obligations are met. Explore how LDI strategies optimize liability coverage compared to traditional passive approaches.

Benchmark

Passive investing relies on tracking a market benchmark such as the S&P 500 to achieve broad market exposure and minimize costs. Liability-driven investing (LDI) focuses on aligning asset allocation with the timing and size of future liabilities, often using customized benchmarks based on discount rates and liability profiles. Explore the strategic differences and benchmark implications to better understand which approach suits your financial goals.

Source and External Links

What is Passive Investing & How it Works? | TD Direct Investing - Passive investing is a long-term strategy of buying and holding a diversified portfolio that typically mirrors a market index, aimed at building wealth gradually with lower costs and minimal trading.

Passive management - Wikipedia - Passive investing tracks a market-weighted index using vehicles like index funds and ETFs, focusing on replicating index returns with minimal management and trading.

Active vs. Passive Investing | FINRA.org - Passive investing, also called "buy and hold," aims to replicate market performance over time by investing mainly in index funds, offering a less hands-on approach compared to active investing.

dowidth.com

dowidth.com