Tax loss harvesting involves selling investments at a loss to offset capital gains and reduce taxable income, while tax lot optimization focuses on strategically selecting which specific investment lots to sell to maximize tax efficiency. Both strategies aim to minimize tax liability by leveraging the cost basis and timing of asset sales within a portfolio. Discover how these techniques can enhance your investment returns through savvy tax management.

Why it is important

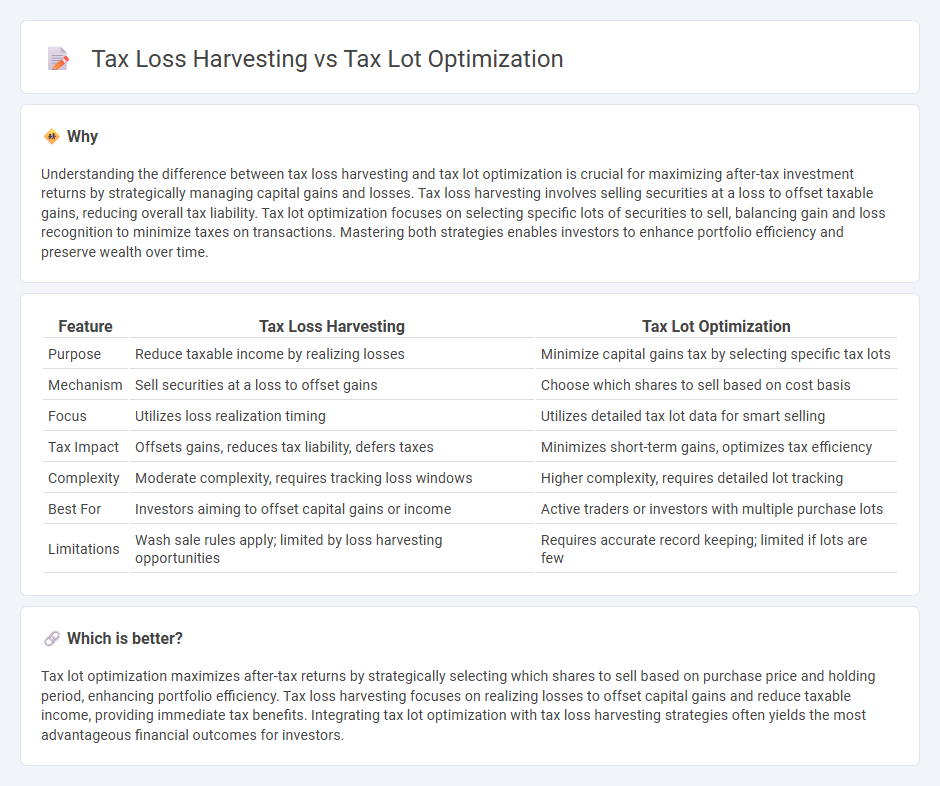

Understanding the difference between tax loss harvesting and tax lot optimization is crucial for maximizing after-tax investment returns by strategically managing capital gains and losses. Tax loss harvesting involves selling securities at a loss to offset taxable gains, reducing overall tax liability. Tax lot optimization focuses on selecting specific lots of securities to sell, balancing gain and loss recognition to minimize taxes on transactions. Mastering both strategies enables investors to enhance portfolio efficiency and preserve wealth over time.

Comparison Table

| Feature | Tax Loss Harvesting | Tax Lot Optimization |

|---|---|---|

| Purpose | Reduce taxable income by realizing losses | Minimize capital gains tax by selecting specific tax lots |

| Mechanism | Sell securities at a loss to offset gains | Choose which shares to sell based on cost basis |

| Focus | Utilizes loss realization timing | Utilizes detailed tax lot data for smart selling |

| Tax Impact | Offsets gains, reduces tax liability, defers taxes | Minimizes short-term gains, optimizes tax efficiency |

| Complexity | Moderate complexity, requires tracking loss windows | Higher complexity, requires detailed lot tracking |

| Best For | Investors aiming to offset capital gains or income | Active traders or investors with multiple purchase lots |

| Limitations | Wash sale rules apply; limited by loss harvesting opportunities | Requires accurate record keeping; limited if lots are few |

Which is better?

Tax lot optimization maximizes after-tax returns by strategically selecting which shares to sell based on purchase price and holding period, enhancing portfolio efficiency. Tax loss harvesting focuses on realizing losses to offset capital gains and reduce taxable income, providing immediate tax benefits. Integrating tax lot optimization with tax loss harvesting strategies often yields the most advantageous financial outcomes for investors.

Connection

Tax loss harvesting and tax lot optimization are interconnected strategies used to minimize tax liabilities on investment gains. Tax loss harvesting involves selling securities at a loss to offset capital gains, while tax lot optimization selects specific purchase lots to maximize tax efficiency when selling shares. Together, these techniques enhance portfolio tax management by reducing taxable income and improving after-tax returns.

Key Terms

Cost Basis

Tax lot optimization focuses on selecting specific tax lots strategically to minimize tax liability by managing the cost basis of investments, whereas tax loss harvesting involves selling securities at a loss to offset capital gains and reduce taxable income. Understanding cost basis adjustment is crucial in tax lot optimization as it directly impacts the calculation of gains or losses for each lot, enabling more precise tax management. Explore how detailed cost basis tracking improves investment returns and tax efficiency by learning more about these strategies.

Capital Gains

Tax lot optimization strategically selects specific lots of securities to sell, minimizing taxable capital gains by identifying the most tax-efficient lots. Tax loss harvesting intentionally sells securities at a loss to offset realized capital gains and reduce overall tax liability. Explore detailed strategies to maximize your portfolio's tax efficiency and capital gains management.

Wash Sale Rule

Tax lot optimization involves selecting specific lots of securities to sell in order to minimize tax liability while managing portfolio performance, whereas tax loss harvesting strategically sells losing investments to offset capital gains for tax benefits; both approaches must carefully navigate the Wash Sale Rule to avoid disallowed losses. The Wash Sale Rule prohibits claiming a tax loss if the same or substantially identical security is repurchased within 30 days before or after the sale, necessitating precise tracking of trade dates and securities to ensure compliance. Explore more to understand how integrating tax lot optimization and tax loss harvesting can enhance your investment tax strategy effectively.

Source and External Links

Tax Lot Optimization: Why It Matters To Investors - Tax Lot Optimization is a strategy where specific shares are sold selectively to minimize capital gains or realize tax losses, thereby reducing tax liability and potentially offsetting income or gains in the current year.

Tax Lots - Optimizer - Tax lot optimization involves tracking gains and losses per lot, allowing an optimizer to select lots for sale that improve after-tax returns by selling losing lots first and managing capital gains constraints.

Save on Taxes: Know Your Cost Basis - Tax lot optimization algorithms determine the optimal shares to sell to minimize taxes, often outperforming simpler methods like FIFO by considering both gain size and tax rates on short- vs. long-term gains.

dowidth.com

dowidth.com