Bucket investing segments assets into distinct time frames to meet specific income needs, balancing growth and safety by aligning investments with cash flow requirements. Laddered investing involves staggering bond maturities to manage interest rate risk and provide a steady stream of income through regular reinvestments. Explore detailed strategies to optimize your investment portfolio based on these approaches.

Why it is important

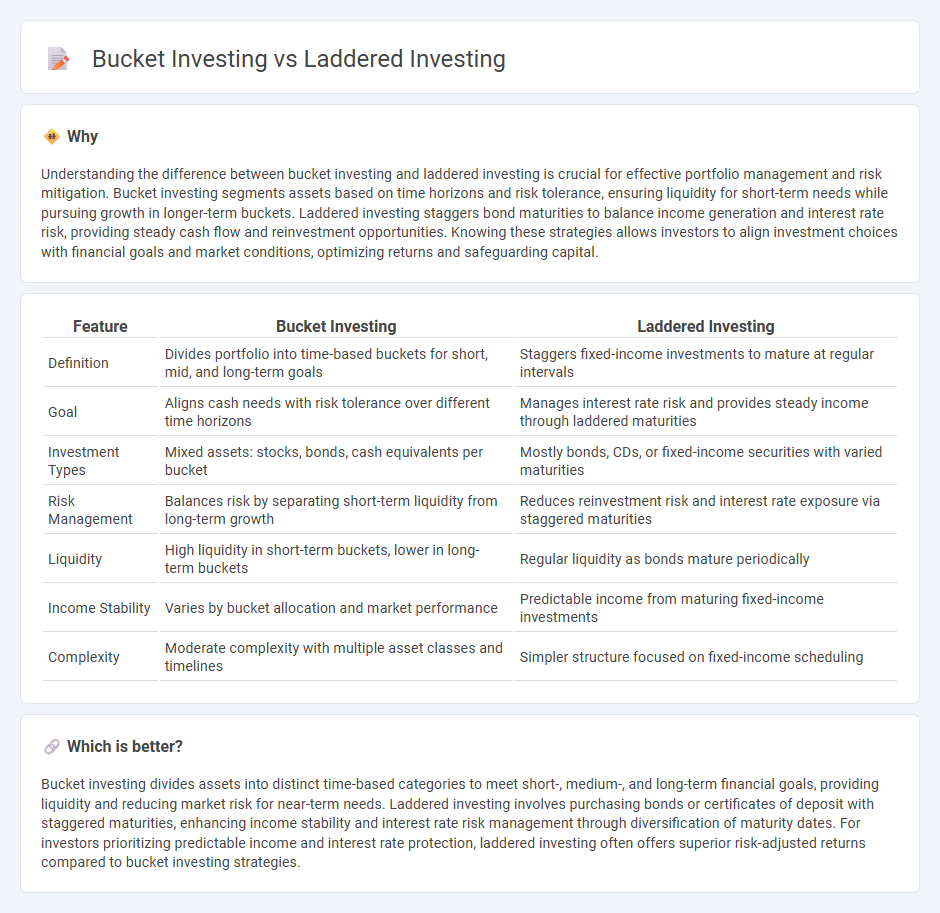

Understanding the difference between bucket investing and laddered investing is crucial for effective portfolio management and risk mitigation. Bucket investing segments assets based on time horizons and risk tolerance, ensuring liquidity for short-term needs while pursuing growth in longer-term buckets. Laddered investing staggers bond maturities to balance income generation and interest rate risk, providing steady cash flow and reinvestment opportunities. Knowing these strategies allows investors to align investment choices with financial goals and market conditions, optimizing returns and safeguarding capital.

Comparison Table

| Feature | Bucket Investing | Laddered Investing |

|---|---|---|

| Definition | Divides portfolio into time-based buckets for short, mid, and long-term goals | Staggers fixed-income investments to mature at regular intervals |

| Goal | Aligns cash needs with risk tolerance over different time horizons | Manages interest rate risk and provides steady income through laddered maturities |

| Investment Types | Mixed assets: stocks, bonds, cash equivalents per bucket | Mostly bonds, CDs, or fixed-income securities with varied maturities |

| Risk Management | Balances risk by separating short-term liquidity from long-term growth | Reduces reinvestment risk and interest rate exposure via staggered maturities |

| Liquidity | High liquidity in short-term buckets, lower in long-term buckets | Regular liquidity as bonds mature periodically |

| Income Stability | Varies by bucket allocation and market performance | Predictable income from maturing fixed-income investments |

| Complexity | Moderate complexity with multiple asset classes and timelines | Simpler structure focused on fixed-income scheduling |

Which is better?

Bucket investing divides assets into distinct time-based categories to meet short-, medium-, and long-term financial goals, providing liquidity and reducing market risk for near-term needs. Laddered investing involves purchasing bonds or certificates of deposit with staggered maturities, enhancing income stability and interest rate risk management through diversification of maturity dates. For investors prioritizing predictable income and interest rate protection, laddered investing often offers superior risk-adjusted returns compared to bucket investing strategies.

Connection

Bucket investing and laddered investing both employ structured asset allocation techniques to manage risk and enhance liquidity over time. Bucket investing segments assets based on time horizons and purposes, similar to laddered investing's staggered maturities of bonds or CDs that provide periodic cash flow. This strategic alignment allows investors to systematically meet short-term needs while targeting long-term growth through diversified income streams.

Key Terms

Time Horizon

Laddered investing structures bonds or CDs with staggered maturity dates to provide consistent income and reduce interest rate risk over time horizons. Bucket investing divides assets into segments based on time frames and risk tolerance, aligning liquidity needs with market volatility expectations. Explore strategies tailored to your investment timeline to optimize returns and manage risk effectively.

Asset Allocation

Laddered investing strategically staggers bond maturity dates to ensure steady income and reduced interest rate risk, while bucket investing segments assets into time-based portfolios to meet specific cash flow needs. Asset allocation in laddered investing emphasizes diversification across bond durations, optimizing risk-return balance over time. Explore detailed comparisons to determine the best approach for your financial goals.

Cash Flow Management

Laddered investing structures bond maturities at staggered intervals to ensure steady income and reduce reinvestment risk, while bucket investing divides assets into time-based segments aligned with cash flow needs, enhancing liquidity planning for different life stages. Laddered portfolios provide predictable cash flow through systematic bond maturities, whereas bucket strategies emphasize matching asset allocation with immediate, intermediate, and long-term financial goals. Explore our detailed guide to discover which strategy best optimizes your cash flow management.

Source and External Links

Laddering - Wikipedia - Laddered investing is an investment technique where investors purchase multiple financial products with different maturity dates or "rungs" to diversify risk, stabilize yield, and allow reinvestment flexibility over time, often applied across bonds, CDs, and retirement planning assets.

Laddered Fixed Income | Parametric Portfolio - Laddered fixed income strategies provide a rules-based approach to investing in bonds with staggered maturities, aiming to deliver predictable income, preserve capital, and benefit from rising interest rates by reinvesting proceeds into longer maturities over time.

Laddering Maturities - Fixed Income Strategies | Raymond James - A bond ladder involves buying bonds with different maturities so that as each bond matures, its proceeds can be reinvested at potentially higher rates, reducing risk, enhancing yield, and maintaining liquidity across varying interest rate environments.

dowidth.com

dowidth.com