Fractional shares enable investors to purchase less than one full share of expensive stocks, increasing accessibility and portfolio diversification without requiring large capital. Stock splits divide existing shares into multiple new shares to reduce the stock price per share, making them more affordable while maintaining the overall value of an investor's holdings. Explore the differences between fractional shares and stock splits to optimize your investment strategy.

Why it is important

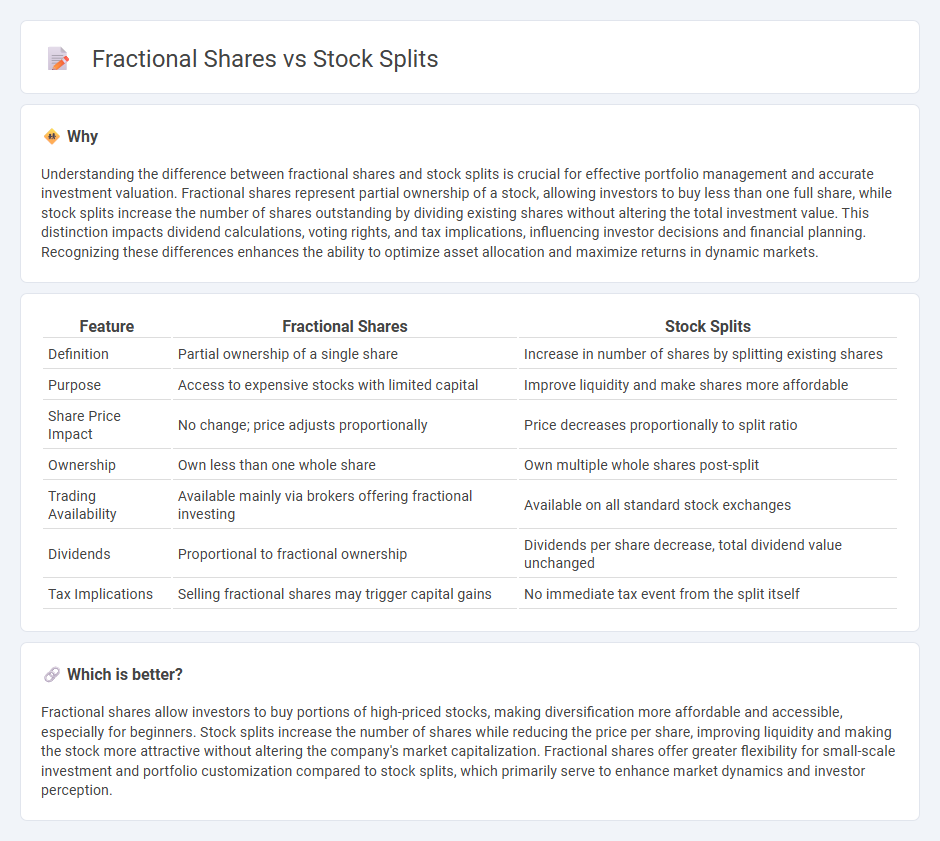

Understanding the difference between fractional shares and stock splits is crucial for effective portfolio management and accurate investment valuation. Fractional shares represent partial ownership of a stock, allowing investors to buy less than one full share, while stock splits increase the number of shares outstanding by dividing existing shares without altering the total investment value. This distinction impacts dividend calculations, voting rights, and tax implications, influencing investor decisions and financial planning. Recognizing these differences enhances the ability to optimize asset allocation and maximize returns in dynamic markets.

Comparison Table

| Feature | Fractional Shares | Stock Splits |

|---|---|---|

| Definition | Partial ownership of a single share | Increase in number of shares by splitting existing shares |

| Purpose | Access to expensive stocks with limited capital | Improve liquidity and make shares more affordable |

| Share Price Impact | No change; price adjusts proportionally | Price decreases proportionally to split ratio |

| Ownership | Own less than one whole share | Own multiple whole shares post-split |

| Trading Availability | Available mainly via brokers offering fractional investing | Available on all standard stock exchanges |

| Dividends | Proportional to fractional ownership | Dividends per share decrease, total dividend value unchanged |

| Tax Implications | Selling fractional shares may trigger capital gains | No immediate tax event from the split itself |

Which is better?

Fractional shares allow investors to buy portions of high-priced stocks, making diversification more affordable and accessible, especially for beginners. Stock splits increase the number of shares while reducing the price per share, improving liquidity and making the stock more attractive without altering the company's market capitalization. Fractional shares offer greater flexibility for small-scale investment and portfolio customization compared to stock splits, which primarily serve to enhance market dynamics and investor perception.

Connection

Fractional shares occur when investors buy portions of a whole share, often used in dividend reinvestment plans or after stock splits. Stock splits increase the number of shares outstanding by dividing existing shares, resulting in fractional shares if investors hold odd quantities. Both mechanisms enhance accessibility and liquidity by allowing more precise investment amounts and smoother trading.

Key Terms

Share price

Stock splits increase the number of outstanding shares by dividing existing shares, lowering the share price proportionally without changing the company's market capitalization. Fractional shares represent a portion of a single share, allowing investors to buy less than one full share at the current market price, which may fluctuate independently. Explore more to understand how these mechanisms impact your investment strategies and portfolio diversification.

Outstanding shares

Stock splits increase the number of outstanding shares by dividing existing shares into multiple units, which lowers the stock price proportionally while maintaining the company's market capitalization. Fractional shares represent less than one whole share, often resulting from dividend reinvestments or stock splits that don't evenly divide shares, and they do not affect the total number of outstanding shares reported. To understand the impact of stock splits and fractional shares on your portfolio and corporate equity, explore detailed analyses and examples.

Ownership percentage

Stock splits increase the total number of shares outstanding, maintaining the same ownership percentage for shareholders by proportionally dividing existing shares. Fractional shares represent less than one full share, allowing investors to own a specific ownership percentage without purchasing whole shares, essential for precise portfolio diversification. Explore more to understand how these mechanisms affect your investment strategy and ownership control.

Source and External Links

Stock Splits | FINRA.org - A stock split is when a company increases the number of its outstanding shares by issuing new shares to existing shareholders in a set proportion, such as 2-for-1 or 3-for-1, which lowers the stock price without changing the total value of shares owned or the company's market capitalization.

Stock split - Wikipedia - Stock splits increase liquidity by making shares more affordable and potentially signaling company confidence, with common split ratios including 2-for-1 and 3-for-2; owners end up with more shares but the overall ownership percentage and market value remain unchanged.

Stock Split | Investor.gov - A stock split boosts the number of shares without changing shareholders' equity, making the stock more affordable and not diluting ownership, for example doubling the shares owned while halving the price in a two-for-one split.

dowidth.com

dowidth.com