AI-driven portfolio management harnesses advanced algorithms and machine learning to optimize asset allocation based on real-time data and predictive analytics. Thematic investing focuses on identifying long-term trends and sectors, enabling investors to capitalize on specific themes such as renewable energy or technology innovation. Explore how these strategies compare to enhance your investment approach.

Why it is important

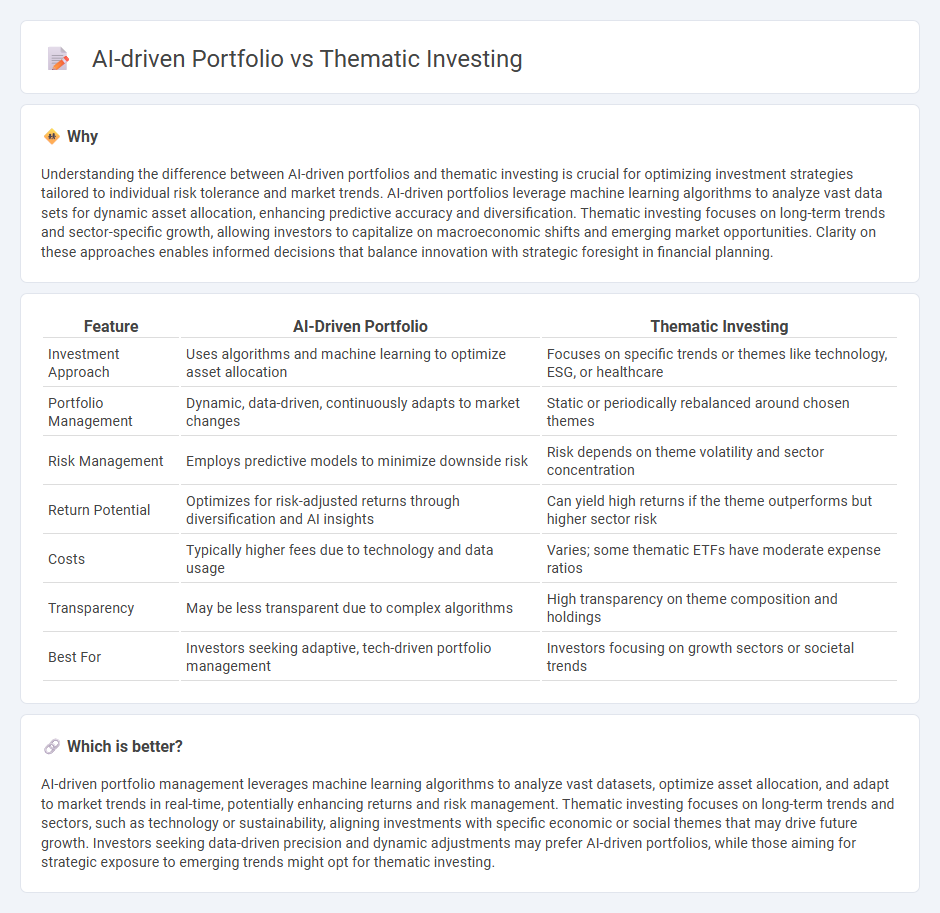

Understanding the difference between AI-driven portfolios and thematic investing is crucial for optimizing investment strategies tailored to individual risk tolerance and market trends. AI-driven portfolios leverage machine learning algorithms to analyze vast data sets for dynamic asset allocation, enhancing predictive accuracy and diversification. Thematic investing focuses on long-term trends and sector-specific growth, allowing investors to capitalize on macroeconomic shifts and emerging market opportunities. Clarity on these approaches enables informed decisions that balance innovation with strategic foresight in financial planning.

Comparison Table

| Feature | AI-Driven Portfolio | Thematic Investing |

|---|---|---|

| Investment Approach | Uses algorithms and machine learning to optimize asset allocation | Focuses on specific trends or themes like technology, ESG, or healthcare |

| Portfolio Management | Dynamic, data-driven, continuously adapts to market changes | Static or periodically rebalanced around chosen themes |

| Risk Management | Employs predictive models to minimize downside risk | Risk depends on theme volatility and sector concentration |

| Return Potential | Optimizes for risk-adjusted returns through diversification and AI insights | Can yield high returns if the theme outperforms but higher sector risk |

| Costs | Typically higher fees due to technology and data usage | Varies; some thematic ETFs have moderate expense ratios |

| Transparency | May be less transparent due to complex algorithms | High transparency on theme composition and holdings |

| Best For | Investors seeking adaptive, tech-driven portfolio management | Investors focusing on growth sectors or societal trends |

Which is better?

AI-driven portfolio management leverages machine learning algorithms to analyze vast datasets, optimize asset allocation, and adapt to market trends in real-time, potentially enhancing returns and risk management. Thematic investing focuses on long-term trends and sectors, such as technology or sustainability, aligning investments with specific economic or social themes that may drive future growth. Investors seeking data-driven precision and dynamic adjustments may prefer AI-driven portfolios, while those aiming for strategic exposure to emerging trends might opt for thematic investing.

Connection

AI-driven portfolio management leverages machine learning algorithms to analyze vast financial datasets, identifying trends and optimizing asset allocation for thematic investing strategies. Thematic investing focuses on specific sectors or macroeconomic trends, such as clean energy or technology innovation, where AI enhances the selection of high-potential assets by predicting market shifts and risk factors. Integrating AI with thematic investing enables more precise targeting of investment themes, improving returns and managing portfolio volatility effectively.

Key Terms

Investment Strategy

Thematic investing targets specific trends or sectors such as clean energy or biotechnology to capitalize on long-term growth opportunities, relying heavily on qualitative analysis and market cycles. AI-driven portfolios employ machine learning algorithms to analyze vast datasets, optimize asset allocation dynamically, and adapt strategies based on real-time data patterns, enhancing risk management and return potential. Explore how these distinct investment strategies can align with your financial goals and risk appetite for more tailored portfolio solutions.

Data Analytics

Thematic investing targets specific trends or sectors such as renewable energy or healthcare, leveraging qualitative insights and market forecasts to inform decisions. AI-driven portfolios utilize advanced machine learning algorithms to analyze vast datasets in real time, optimizing asset allocation based on predictive analytics and risk assessment. Explore the cutting-edge integration of data analytics in modern investment strategies to enhance portfolio performance and innovation.

Portfolio Diversification

Thematic investing targets specific trends, sectors, or themes, concentrating assets in areas like renewable energy, technology, or healthcare to capture growth opportunities. AI-driven portfolios leverage machine learning algorithms to analyze vast datasets and dynamically diversify holdings across multiple asset classes, reducing risk and enhancing returns through adaptive strategies. Explore how these approaches reshape diversification strategies and optimize investment outcomes.

Source and External Links

What is Thematic Investing? | Charles Schwab - Thematic investing targets broad ideas, personal values, or trends that don't fit neatly into traditional sectors, allowing investors to invest in themes like artificial intelligence by grouping relevant companies across industries into baskets or funds, although investors should maintain disciplined practices despite the appeal of thematic trends.

Thematic Investing: Tomorrow's themes, today - BlackRock - Thematic investing aligns portfolios with future-shaping trends, focuses on dynamic themes that span unrelated companies and sectors, and uses advanced analysis like natural language processing to identify persistent, market-driving themes with meaningful return potential.

Thematic investing - Wikipedia - Thematic investing involves building portfolios around macro-level trends or megatrends such as population aging, digital revolution, or sustainable development by selecting companies across various sectors relevant to the theme, though care should be taken to avoid marketing-driven funds lacking rigorous methodology.

dowidth.com

dowidth.com