Retail algorithmic trading employs automated strategies tailored for individual investors using programmed instructions to execute trades based on market signals, focusing on medium to low-frequency transactions. High-frequency trading, by contrast, leverages cutting-edge technology and ultra-low latency systems to perform thousands of trades per second, capitalizing on minute price discrepancies in highly liquid markets. Explore the nuances and strategic advantages of each approach to enhance your trading insight.

Why it is important

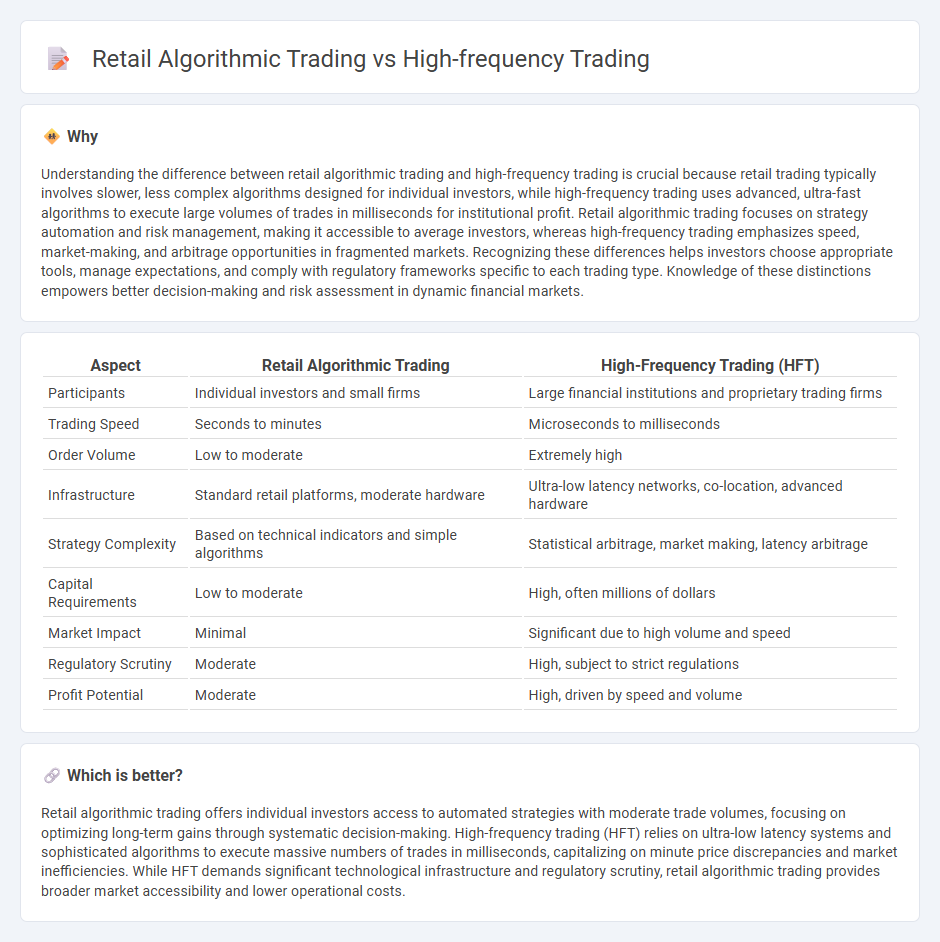

Understanding the difference between retail algorithmic trading and high-frequency trading is crucial because retail trading typically involves slower, less complex algorithms designed for individual investors, while high-frequency trading uses advanced, ultra-fast algorithms to execute large volumes of trades in milliseconds for institutional profit. Retail algorithmic trading focuses on strategy automation and risk management, making it accessible to average investors, whereas high-frequency trading emphasizes speed, market-making, and arbitrage opportunities in fragmented markets. Recognizing these differences helps investors choose appropriate tools, manage expectations, and comply with regulatory frameworks specific to each trading type. Knowledge of these distinctions empowers better decision-making and risk assessment in dynamic financial markets.

Comparison Table

| Aspect | Retail Algorithmic Trading | High-Frequency Trading (HFT) |

|---|---|---|

| Participants | Individual investors and small firms | Large financial institutions and proprietary trading firms |

| Trading Speed | Seconds to minutes | Microseconds to milliseconds |

| Order Volume | Low to moderate | Extremely high |

| Infrastructure | Standard retail platforms, moderate hardware | Ultra-low latency networks, co-location, advanced hardware |

| Strategy Complexity | Based on technical indicators and simple algorithms | Statistical arbitrage, market making, latency arbitrage |

| Capital Requirements | Low to moderate | High, often millions of dollars |

| Market Impact | Minimal | Significant due to high volume and speed |

| Regulatory Scrutiny | Moderate | High, subject to strict regulations |

| Profit Potential | Moderate | High, driven by speed and volume |

Which is better?

Retail algorithmic trading offers individual investors access to automated strategies with moderate trade volumes, focusing on optimizing long-term gains through systematic decision-making. High-frequency trading (HFT) relies on ultra-low latency systems and sophisticated algorithms to execute massive numbers of trades in milliseconds, capitalizing on minute price discrepancies and market inefficiencies. While HFT demands significant technological infrastructure and regulatory scrutiny, retail algorithmic trading provides broader market accessibility and lower operational costs.

Connection

Retail algorithmic trading and high-frequency trading (HFT) are connected through their reliance on automated systems and algorithms to execute trades efficiently. Both utilize advanced computational techniques, but HFT focuses on ultra-fast execution and short holding periods, enabling market making and arbitrage strategies. Retail algorithmic trading, while slower and less complex, empowers individual investors to implement systematic trading strategies previously accessible only to institutional players.

Key Terms

Latency

High-frequency trading (HFT) relies on ultra-low latency systems operating in microseconds or nanoseconds to capitalize on rapid market fluctuations, using colocated servers and specialized hardware. Retail algorithmic trading experiences higher latency in milliseconds, influenced by internet speed and broker execution times, limiting its ability to compete directly with HFT firms. Explore the technologies and strategies shaping latency-driven trading advantages.

Order Execution

High-frequency trading (HFT) utilizes sophisticated algorithms and ultra-low latency systems to execute thousands of orders per second, prioritizing speed and minimizing latency to capitalize on minute price discrepancies. Retail algorithmic trading, while leveraging automated strategies, operates with higher latency and executes fewer orders, often focusing on optimized order execution to reduce slippage and transaction costs. Explore the key distinctions in order execution techniques and technology infrastructure between HFT and retail algorithmic trading.

Market Access

High-frequency trading (HFT) leverages ultra-low latency connections and direct market access to execute thousands of orders per second on major exchanges, capitalizing on minuscule price discrepancies. Retail algorithmic trading typically operates through brokers with API access, experiencing higher latency and limited direct exchange connectivity, which impacts trade execution speed and market depth exposure. Explore deeper insights into how market access differentiates these trading strategies and shapes execution efficiency.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do ... - High-frequency trading (HFT) is an automated trading method using advanced computers and algorithms to execute a huge number of trades at extremely high speeds, often in microseconds, capitalizing on tiny price differences across markets.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT involves algorithmic trading with rapid execution and very short holding periods, enabling institutional investors to profit from small price fluctuations and increase market liquidity through high trade volumes.

High-frequency trading - HFT is a quantitative trading strategy relying on computerized models to process large volumes of data quickly, employing algorithms such as market-making and arbitrage, primarily competing on speed rather than new algorithmic breakthroughs.

dowidth.com

dowidth.com