Crowdlending and peer-to-peer lending are innovative financial models that connect borrowers directly with individual investors through online platforms, bypassing traditional banks. Crowdlending typically involves multiple investors funding a single loan collectively, while peer-to-peer lending focuses on one-to-one lending relationships between individuals. Explore the nuances, benefits, and risks of both financing options to make informed investment decisions.

Why it is important

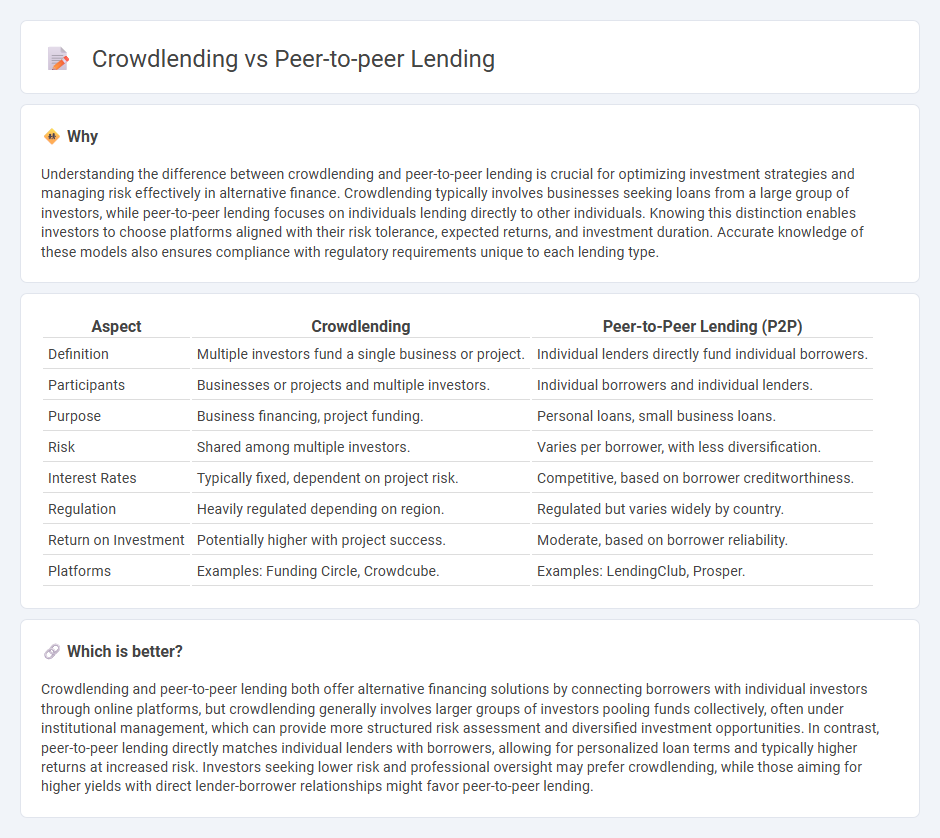

Understanding the difference between crowdlending and peer-to-peer lending is crucial for optimizing investment strategies and managing risk effectively in alternative finance. Crowdlending typically involves businesses seeking loans from a large group of investors, while peer-to-peer lending focuses on individuals lending directly to other individuals. Knowing this distinction enables investors to choose platforms aligned with their risk tolerance, expected returns, and investment duration. Accurate knowledge of these models also ensures compliance with regulatory requirements unique to each lending type.

Comparison Table

| Aspect | Crowdlending | Peer-to-Peer Lending (P2P) |

|---|---|---|

| Definition | Multiple investors fund a single business or project. | Individual lenders directly fund individual borrowers. |

| Participants | Businesses or projects and multiple investors. | Individual borrowers and individual lenders. |

| Purpose | Business financing, project funding. | Personal loans, small business loans. |

| Risk | Shared among multiple investors. | Varies per borrower, with less diversification. |

| Interest Rates | Typically fixed, dependent on project risk. | Competitive, based on borrower creditworthiness. |

| Regulation | Heavily regulated depending on region. | Regulated but varies widely by country. |

| Return on Investment | Potentially higher with project success. | Moderate, based on borrower reliability. |

| Platforms | Examples: Funding Circle, Crowdcube. | Examples: LendingClub, Prosper. |

Which is better?

Crowdlending and peer-to-peer lending both offer alternative financing solutions by connecting borrowers with individual investors through online platforms, but crowdlending generally involves larger groups of investors pooling funds collectively, often under institutional management, which can provide more structured risk assessment and diversified investment opportunities. In contrast, peer-to-peer lending directly matches individual lenders with borrowers, allowing for personalized loan terms and typically higher returns at increased risk. Investors seeking lower risk and professional oversight may prefer crowdlending, while those aiming for higher yields with direct lender-borrower relationships might favor peer-to-peer lending.

Connection

Crowdlending and peer-to-peer lending both facilitate direct borrowing by individuals or businesses from a pool of investors, bypassing traditional financial institutions. These alternative financing methods leverage online platforms to connect borrowers with lenders, enabling faster access to capital and diversified investment opportunities. The shared reliance on digital technology and community-driven funding links crowdlending and peer-to-peer lending within the broader fintech ecosystem.

Key Terms

Platform

Peer-to-peer lending platforms connect individual borrowers directly with lenders, facilitating personal loans through streamlined online interfaces that emphasize quick approvals and competitive interest rates. Crowdlending platforms, on the other hand, aggregate investments from multiple backers to fund larger business projects or startups, offering diverse risk options and structured repayment plans. Explore the unique features of leading platforms to determine which model best suits your financial goals.

Risk assessment

Peer-to-peer lending risk assessment relies heavily on individual borrower creditworthiness, using credit scores, income verification, and debt-to-income ratios to evaluate repayment potential. Crowdlending platforms often diversify risk by pooling funds from multiple investors to finance projects, with risk analyzed based on project viability, borrower track record, and industry trends. Explore detailed comparisons of risk models and mitigation strategies to understand which lending approach suits your investment profile better.

Investor returns

Peer-to-peer lending platforms typically offer investors higher returns by connecting borrowers directly with individual lenders, resulting in competitive interest rates and reduced intermediary costs. Crowdlending aggregates multiple investors to fund larger projects, often balancing risk through diversified portfolios but sometimes yielding more moderate returns compared to peer-to-peer loans. Explore detailed comparisons of risk profiles and return rates to determine the best investment strategy.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work - Peer-to-peer (P2P) lending is a way for individuals to borrow and lend money without involving banks, using websites that connect borrowers with individual investors; it offers flexible terms and can be a profitable investment, but with increased risk as it lacks traditional financial institution protections.

Peer-to-peer lending - P2P lending is an alternative financial service conducted online where lenders and borrowers transact without traditional intermediaries, facilitated by P2P platforms that provide credit models, identity verification, and loan servicing, with loans often unsecured and carrying higher risks.

Peer to peer lending: what you need to know - P2P lending marketplaces connect lenders with borrowers such as individuals or businesses, offering higher interest than savings accounts but with greater risk; lenders can choose how their money is allocated and borrowers access funds outside traditional finance sources.

dowidth.com

dowidth.com