Synthetic assets replicate the performance of real financial instruments using derivatives, offering targeted exposure without direct ownership of underlying assets. Index funds aggregate a diversified portfolio mirroring market indices, providing broad market exposure with lower management fees. Explore the differences in risk, cost, and transparency to determine which option fits your investment strategy.

Why it is important

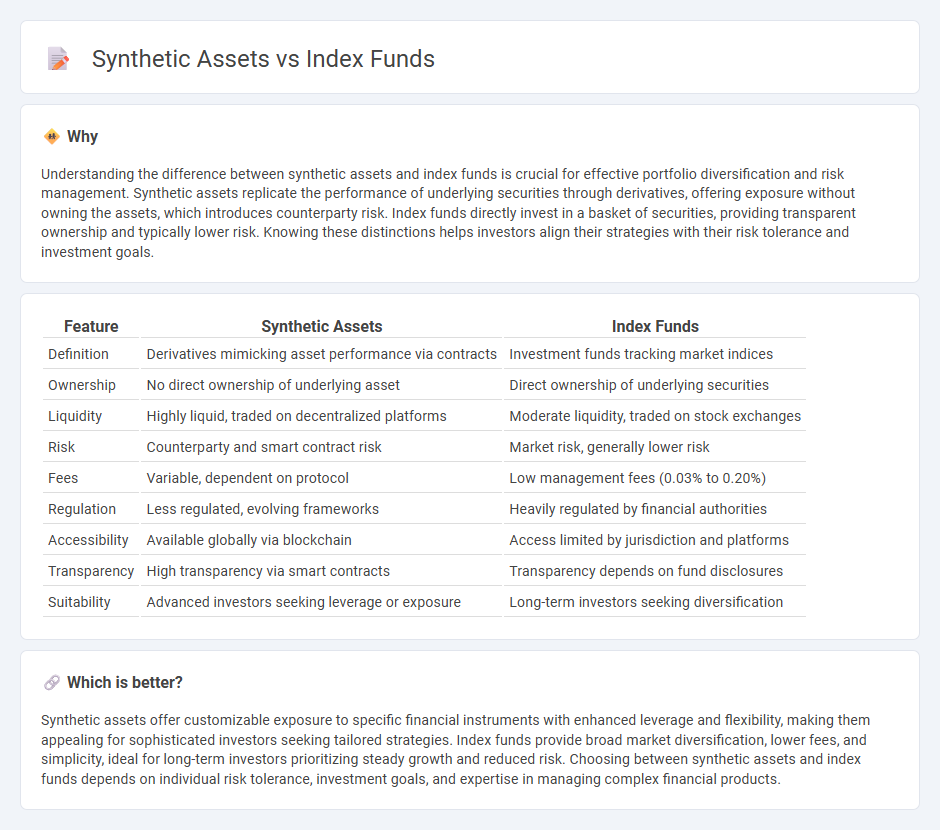

Understanding the difference between synthetic assets and index funds is crucial for effective portfolio diversification and risk management. Synthetic assets replicate the performance of underlying securities through derivatives, offering exposure without owning the assets, which introduces counterparty risk. Index funds directly invest in a basket of securities, providing transparent ownership and typically lower risk. Knowing these distinctions helps investors align their strategies with their risk tolerance and investment goals.

Comparison Table

| Feature | Synthetic Assets | Index Funds |

|---|---|---|

| Definition | Derivatives mimicking asset performance via contracts | Investment funds tracking market indices |

| Ownership | No direct ownership of underlying asset | Direct ownership of underlying securities |

| Liquidity | Highly liquid, traded on decentralized platforms | Moderate liquidity, traded on stock exchanges |

| Risk | Counterparty and smart contract risk | Market risk, generally lower risk |

| Fees | Variable, dependent on protocol | Low management fees (0.03% to 0.20%) |

| Regulation | Less regulated, evolving frameworks | Heavily regulated by financial authorities |

| Accessibility | Available globally via blockchain | Access limited by jurisdiction and platforms |

| Transparency | High transparency via smart contracts | Transparency depends on fund disclosures |

| Suitability | Advanced investors seeking leverage or exposure | Long-term investors seeking diversification |

Which is better?

Synthetic assets offer customizable exposure to specific financial instruments with enhanced leverage and flexibility, making them appealing for sophisticated investors seeking tailored strategies. Index funds provide broad market diversification, lower fees, and simplicity, ideal for long-term investors prioritizing steady growth and reduced risk. Choosing between synthetic assets and index funds depends on individual risk tolerance, investment goals, and expertise in managing complex financial products.

Connection

Synthetic assets replicate the performance of real financial instruments using derivatives like swaps and options, providing exposure without owning the underlying asset. Index funds invest in a basket of securities designed to mirror a market index, offering diversified market returns at low cost. Both leverage market indices to optimize portfolio exposure, with synthetic assets enabling customizable risk profiles and index funds delivering passive investment strategies.

Key Terms

Diversification

Index funds provide diversification by holding a broad basket of assets that mirror a market index, reducing individual security risk. Synthetic assets use derivatives to replicate the performance of underlying assets, offering exposure without direct ownership, which can introduce counterparty risk. Explore more about diversification strategies by comparing index funds and synthetic assets in detail.

Derivatives

Index funds provide diversified exposure by pooling investments in a range of assets that replicate a market index. Synthetic assets use derivatives such as swaps and options to mimic the performance of an underlying asset without direct ownership, enabling leveraged or inverse strategies. Explore deeper insights into risk management and performance implications in derivatives-based synthetic assets.

Tracking error

Index funds typically exhibit lower tracking error due to their direct replication of benchmark indices, ensuring close alignment with market performance. Synthetic assets use derivatives to mimic index returns but often introduce higher tracking error caused by counterparty risk and imperfect replication. Explore deeper insights on tracking error impacts between index funds and synthetic assets to make informed investment choices.

Source and External Links

Index Funds | Investor.gov - An index fund is a mutual fund or ETF designed to track the returns of a market index like the S&P 500 by investing in all or a sample of the securities in that index, often weighted by market capitalization.

What is an index fund? - Vanguard - Index funds passively track a market benchmark, offering diversification by owning a piece of every security in the index, which helps spread risk and aims for long-term growth rather than outperforming the market.

Investing in Index Funds | Charles Schwab - Index funds are low-cost, tax-efficient mutual funds or ETFs that use a passive strategy to match a market index's performance, providing diversification and generally lower fees compared to actively managed funds.

dowidth.com

dowidth.com