Dim sum bonds are yuan-denominated bonds issued outside China, primarily in Hong Kong, targeting investors seeking exposure to Chinese currency assets. Yankee bonds are U.S. dollar-denominated bonds issued by foreign entities in the U.S. market, offering access to American investors and benefiting from the dollar's global reserve status. Explore the key differences in issuance, currency risk, and investor base to better understand how these bonds fit into international finance strategies.

Why it is important

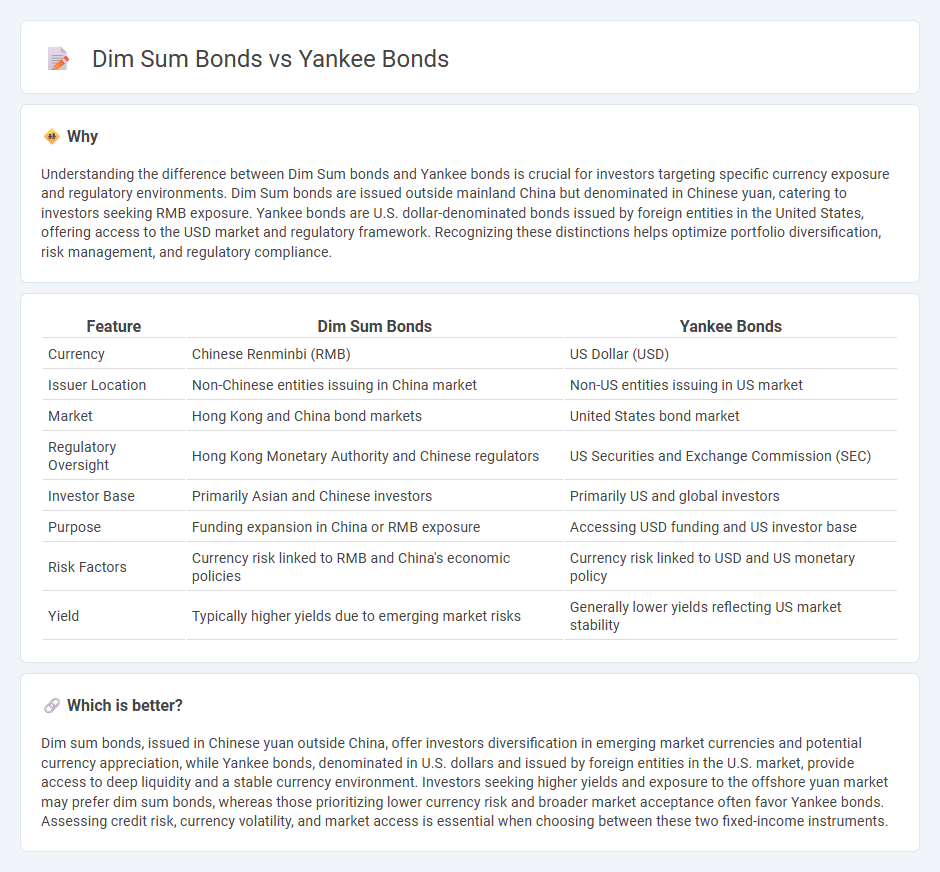

Understanding the difference between Dim Sum bonds and Yankee bonds is crucial for investors targeting specific currency exposure and regulatory environments. Dim Sum bonds are issued outside mainland China but denominated in Chinese yuan, catering to investors seeking RMB exposure. Yankee bonds are U.S. dollar-denominated bonds issued by foreign entities in the United States, offering access to the USD market and regulatory framework. Recognizing these distinctions helps optimize portfolio diversification, risk management, and regulatory compliance.

Comparison Table

| Feature | Dim Sum Bonds | Yankee Bonds |

|---|---|---|

| Currency | Chinese Renminbi (RMB) | US Dollar (USD) |

| Issuer Location | Non-Chinese entities issuing in China market | Non-US entities issuing in US market |

| Market | Hong Kong and China bond markets | United States bond market |

| Regulatory Oversight | Hong Kong Monetary Authority and Chinese regulators | US Securities and Exchange Commission (SEC) |

| Investor Base | Primarily Asian and Chinese investors | Primarily US and global investors |

| Purpose | Funding expansion in China or RMB exposure | Accessing USD funding and US investor base |

| Risk Factors | Currency risk linked to RMB and China's economic policies | Currency risk linked to USD and US monetary policy |

| Yield | Typically higher yields due to emerging market risks | Generally lower yields reflecting US market stability |

Which is better?

Dim sum bonds, issued in Chinese yuan outside China, offer investors diversification in emerging market currencies and potential currency appreciation, while Yankee bonds, denominated in U.S. dollars and issued by foreign entities in the U.S. market, provide access to deep liquidity and a stable currency environment. Investors seeking higher yields and exposure to the offshore yuan market may prefer dim sum bonds, whereas those prioritizing lower currency risk and broader market acceptance often favor Yankee bonds. Assessing credit risk, currency volatility, and market access is essential when choosing between these two fixed-income instruments.

Connection

Dim sum bonds and Yankee bonds are both types of foreign bonds issued in offshores to attract international investors, with dim sum bonds denominated in Chinese yuan and sold mainly in Hong Kong, while Yankee bonds are dollar-denominated and issued by foreign entities in the U.S. market. Both securities enable issuers to diversify funding sources and tap into different currency markets, enhancing global capital access. The issuance of these bonds reflects the intersection of cross-border finance and currency strategy in global capital markets.

Key Terms

Currency denomination

Yankee bonds are U.S. dollar-denominated bonds issued by foreign entities in the American market, providing investors access to stable currency and a large investor base. Dim sum bonds are Chinese yuan-denominated bonds issued outside mainland China, primarily in Hong Kong, catering to investors seeking exposure to yuan assets without direct access to China's onshore markets. Explore the key differences and benefits of both bond types to enhance your international investment strategy.

Issuer's origin

Yankee bonds are U.S. dollar-denominated bonds issued by foreign entities in the United States, providing access to American capital markets, while Dim Sum bonds are RMB-denominated debt instruments issued by foreign issuers in Hong Kong's offshore market, targeting investors looking for Chinese currency exposure. The issuer's origin plays a crucial role in market accessibility, regulatory environment, and investor base, with Yankee bonds favored for dollar liquidity and Dim Sum bonds for RMB diversification. Explore the distinct advantages and issuance strategies of these bonds to deepen your understanding.

Target investor market

Yankee bonds primarily target U.S. domestic investors seeking exposure to foreign issuers, providing these issuers access to the deep, liquid U.S. dollar debt market. Dim sum bonds cater to investors interested in renminbi-denominated assets outside mainland China, often appealing to those focusing on offshore Chinese currency opportunities. Explore detailed comparisons to understand which bond aligns with your investment strategy.

Source and External Links

Yankee Bond - A Yankee bond is a bond issued by a foreign entity, denominated in U.S. dollars, and issued and traded in the United States, offering foreign issuers access to the U.S. market while avoiding exchange rate risk for investors.

Yankee Bond Explained - Yankee bonds are issued by foreign governments or corporations to raise funds from American investors and are traded on U.S. exchanges, providing liquidity and portfolio diversification without currency exchange risk.

What Is A Yankee Bond? | Financial Glossary - Yankee bonds are U.S. dollar-denominated debt instruments issued by foreign entities in the United States, regulated under U.S. law, and used by issuers to access the U.S. bond market and diversify investor bases.

dowidth.com

dowidth.com