Structured credit involves pooling various debt instruments into securities to redistribute risk and enhance liquidity, commonly used in mortgage-backed or collateralized loan obligations. Trade finance facilitates international commerce by providing financing solutions like letters of credit, guarantees, and factoring to manage cash flow and mitigate risks between exporters and importers. Explore how these financial instruments differ in risk management and capital allocation to understand their impact on global markets.

Why it is important

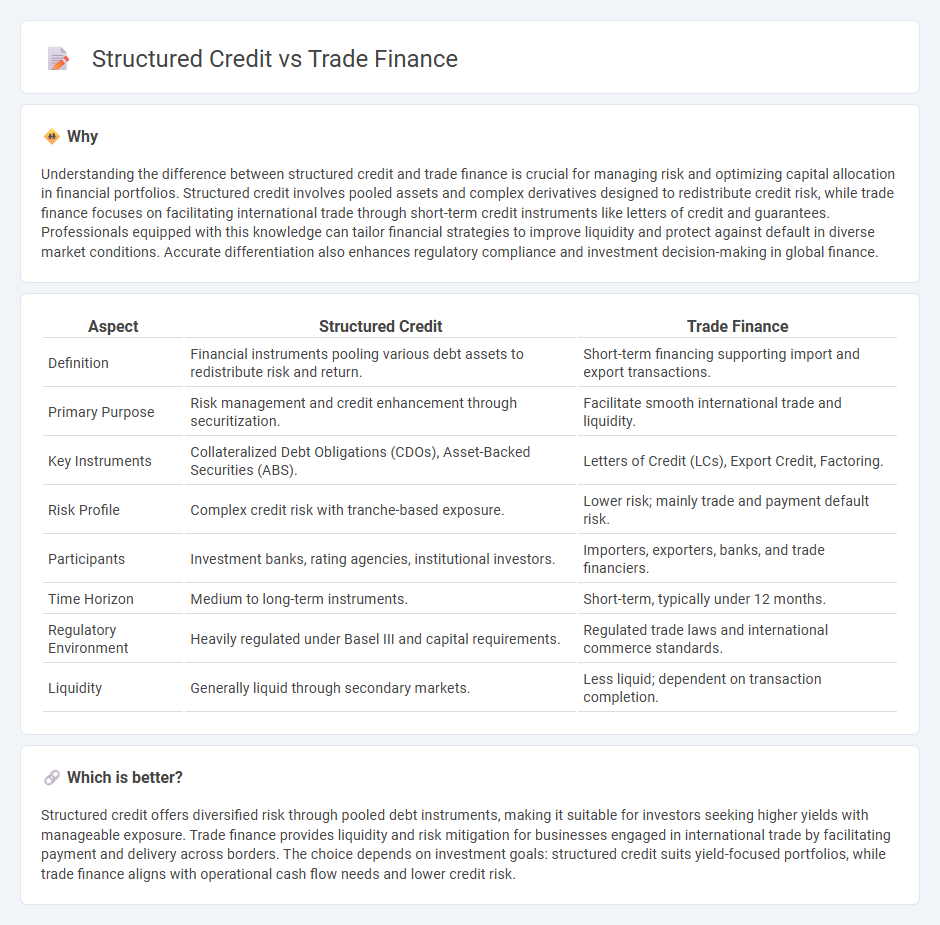

Understanding the difference between structured credit and trade finance is crucial for managing risk and optimizing capital allocation in financial portfolios. Structured credit involves pooled assets and complex derivatives designed to redistribute credit risk, while trade finance focuses on facilitating international trade through short-term credit instruments like letters of credit and guarantees. Professionals equipped with this knowledge can tailor financial strategies to improve liquidity and protect against default in diverse market conditions. Accurate differentiation also enhances regulatory compliance and investment decision-making in global finance.

Comparison Table

| Aspect | Structured Credit | Trade Finance |

|---|---|---|

| Definition | Financial instruments pooling various debt assets to redistribute risk and return. | Short-term financing supporting import and export transactions. |

| Primary Purpose | Risk management and credit enhancement through securitization. | Facilitate smooth international trade and liquidity. |

| Key Instruments | Collateralized Debt Obligations (CDOs), Asset-Backed Securities (ABS). | Letters of Credit (LCs), Export Credit, Factoring. |

| Risk Profile | Complex credit risk with tranche-based exposure. | Lower risk; mainly trade and payment default risk. |

| Participants | Investment banks, rating agencies, institutional investors. | Importers, exporters, banks, and trade financiers. |

| Time Horizon | Medium to long-term instruments. | Short-term, typically under 12 months. |

| Regulatory Environment | Heavily regulated under Basel III and capital requirements. | Regulated trade laws and international commerce standards. |

| Liquidity | Generally liquid through secondary markets. | Less liquid; dependent on transaction completion. |

Which is better?

Structured credit offers diversified risk through pooled debt instruments, making it suitable for investors seeking higher yields with manageable exposure. Trade finance provides liquidity and risk mitigation for businesses engaged in international trade by facilitating payment and delivery across borders. The choice depends on investment goals: structured credit suits yield-focused portfolios, while trade finance aligns with operational cash flow needs and lower credit risk.

Connection

Structured credit facilitates risk management and liquidity optimization in trade finance by securitizing receivables and payment streams from trade transactions. This connection enables financial institutions to unlock capital tied in trade assets, enhancing cash flow and credit availability for importers and exporters. As a result, trade finance benefits from improved risk diversification and access to more sophisticated funding mechanisms through structured credit products.

Key Terms

**Trade finance:**

Trade finance facilitates international trade by providing short-term credit solutions such as letters of credit, export factoring, and invoice financing to mitigate risks and improve cash flow for exporters and importers. It supports global supply chains by ensuring payment guarantees and liquidity, enabling companies to manage currency fluctuations and political risks effectively. Explore detailed strategies and benefits of trade finance to enhance your global trading operations.

Letter of Credit

Letters of Credit (LCs) in trade finance serve as secure payment guarantees for international transactions, mitigating risks between exporters and importers by involving banks as intermediaries. Structured credit, while encompassing financial products like asset-backed securities, rarely utilizes Letters of Credit directly, instead focusing on pooling various debt instruments to enhance credit quality and manage risk. Explore how Letters of Credit optimize risk management and liquidity in global trade finance transactions.

Bill of Lading

Trade finance often relies on the Bill of Lading as a crucial document that serves as proof of shipment, title of goods, and facilitates payment under letters of credit. Structured credit, however, incorporates Bills of Lading in securitized transactions to mitigate risks related to asset ownership and cash flow verification. Explore the intricate roles Bills of Lading play in both domains to deepen your understanding of trade finance and structured credit mechanisms.

Source and External Links

What is trade finance? | Global Trade Review (GTR) - Trade finance is the financing of international trade flows, designed to reduce risks involved in cross-border trade transactions.

Beginners guide to Trade Finance - DGFT - Trade finance provides credit, payment guarantees, and insurance that bridge the payment gap between exporters and importers, facilitating business growth and larger trade volumes.

What Is Trade Finance? A Guide for Beginners - Statrys - Trade finance offers tools to improve cash flow, reduce risk, and support business growth in international trade, though it involves certain costs and complex documentation.

dowidth.com

dowidth.com