Liquidity staking increases asset accessibility by allowing users to earn rewards without locking their tokens, enhancing capital efficiency within DeFi ecosystems. Staking derivatives represent tokenized staked assets, providing tradable liquidity and enabling portfolio diversification with reduced staking risks. Explore the nuanced benefits and mechanisms of liquidity staking versus staking derivatives to optimize your blockchain investment strategy.

Why it is important

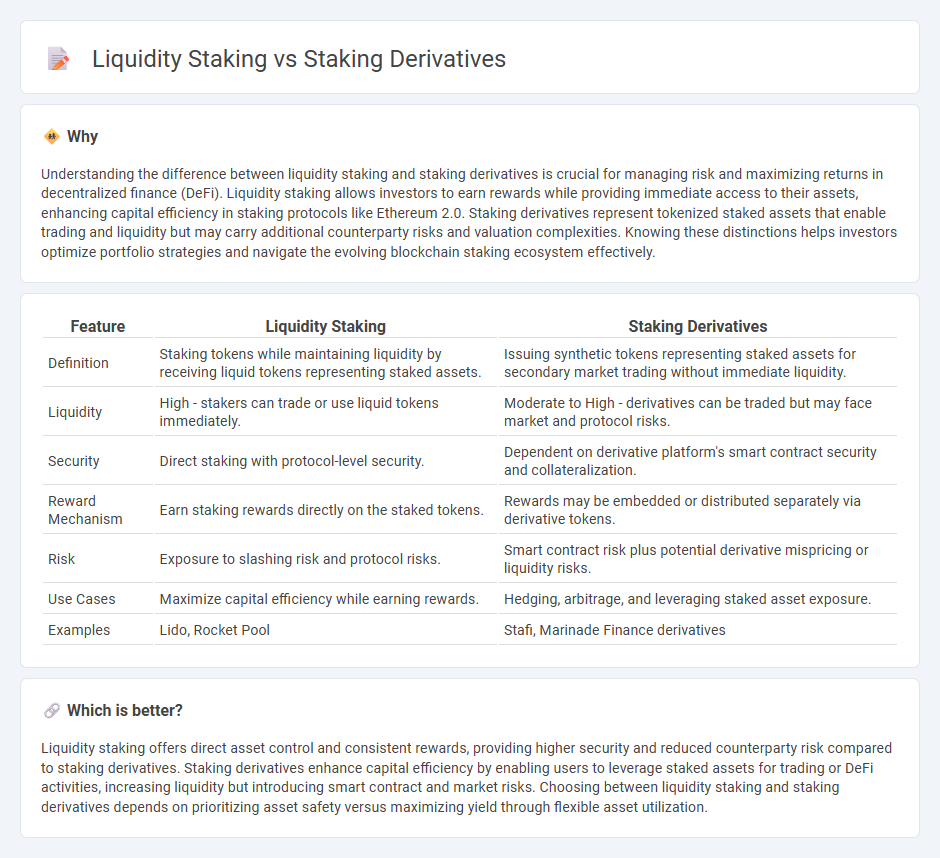

Understanding the difference between liquidity staking and staking derivatives is crucial for managing risk and maximizing returns in decentralized finance (DeFi). Liquidity staking allows investors to earn rewards while providing immediate access to their assets, enhancing capital efficiency in staking protocols like Ethereum 2.0. Staking derivatives represent tokenized staked assets that enable trading and liquidity but may carry additional counterparty risks and valuation complexities. Knowing these distinctions helps investors optimize portfolio strategies and navigate the evolving blockchain staking ecosystem effectively.

Comparison Table

| Feature | Liquidity Staking | Staking Derivatives |

|---|---|---|

| Definition | Staking tokens while maintaining liquidity by receiving liquid tokens representing staked assets. | Issuing synthetic tokens representing staked assets for secondary market trading without immediate liquidity. |

| Liquidity | High - stakers can trade or use liquid tokens immediately. | Moderate to High - derivatives can be traded but may face market and protocol risks. |

| Security | Direct staking with protocol-level security. | Dependent on derivative platform's smart contract security and collateralization. |

| Reward Mechanism | Earn staking rewards directly on the staked tokens. | Rewards may be embedded or distributed separately via derivative tokens. |

| Risk | Exposure to slashing risk and protocol risks. | Smart contract risk plus potential derivative mispricing or liquidity risks. |

| Use Cases | Maximize capital efficiency while earning rewards. | Hedging, arbitrage, and leveraging staked asset exposure. |

| Examples | Lido, Rocket Pool | Stafi, Marinade Finance derivatives |

Which is better?

Liquidity staking offers direct asset control and consistent rewards, providing higher security and reduced counterparty risk compared to staking derivatives. Staking derivatives enhance capital efficiency by enabling users to leverage staked assets for trading or DeFi activities, increasing liquidity but introducing smart contract and market risks. Choosing between liquidity staking and staking derivatives depends on prioritizing asset safety versus maximizing yield through flexible asset utilization.

Connection

Liquidity staking enhances capital efficiency by allowing staked assets to remain liquid through staking derivatives, which represent these locked assets as tradable tokens. Staking derivatives enable users to unlock the economic benefits of staked tokens without unbonding periods, facilitating participation in decentralized finance (DeFi) protocols. This interconnected mechanism boosts asset utility, improves market liquidity, and optimizes yield generation in blockchain ecosystems.

Key Terms

Yield Generation

Staking derivatives enable users to unlock liquidity from staked assets by issuing tokens representing staked positions, allowing participation in yield-generating activities like DeFi lending and trading without unstaking. Liquidity staking pools aggregate user stakes, providing more stable and potentially higher rewards through collective delegation and better validator selection, enhancing yield consistency. Explore deeper insights on optimizing yield generation through staking derivatives and liquidity staking strategies.

Tokenization

Staking derivatives tokenize staked assets, enabling holders to maintain liquidity while earning staking rewards, as these tokens can be traded or used in decentralized finance (DeFi) applications. Liquidity staking pools aggregate user funds and tokenize the pooled assets, providing enhanced liquidity and diversified staking exposure across multiple validators. Explore the nuances of tokenization in staking derivatives and liquidity staking to maximize your DeFi strategies.

Liquidity Provision

Liquidity staking enhances liquidity provision by allowing staked assets to remain tradable as liquid tokens, enabling users to participate in decentralized finance (DeFi) protocols without losing staking rewards. Staking derivatives represent these liquid tokens, providing flexible trading and collateral opportunities while retaining exposure to staking yield. Explore the advantages and mechanisms of liquidity staking to optimize your portfolio's earning potential.

Source and External Links

What Are Liquid Staking Derivatives? - OSL - Liquid staking derivatives are tokenized representations of staked assets, allowing users to maintain liquidity and access DeFi opportunities while still earning staking rewards on the underlying assets locked in a protocol.

Liquid Staking Derivatives Definition | CoinMarketCap - These derivatives provide staked token holders with liquid tokens that can be traded, lent, or used as collateral in DeFi, effectively unlocking liquidity for staked assets and enabling greater capital efficiency within staking ecosystems.

What Are Liquid Staking Derivatives? A Comparative Overview - Liquid staking derivatives (LSDs) let users stake PoS native coins like ETH while retaining liquidity via fungible ERC-20 receipt tokens, supported by various providers who take a portion of staking rewards in exchange for offering liquidity services.

dowidth.com

dowidth.com