Alternative data consists of non-traditional datasets such as satellite imagery, social media activity, and transaction records used to enhance financial decision-making. Unstructured data refers to information that lacks a predefined format, including emails, text documents, and multimedia content, posing challenges for integration in financial analysis. Discover how leveraging both alternative and unstructured data can transform investment strategies and risk management.

Why it is important

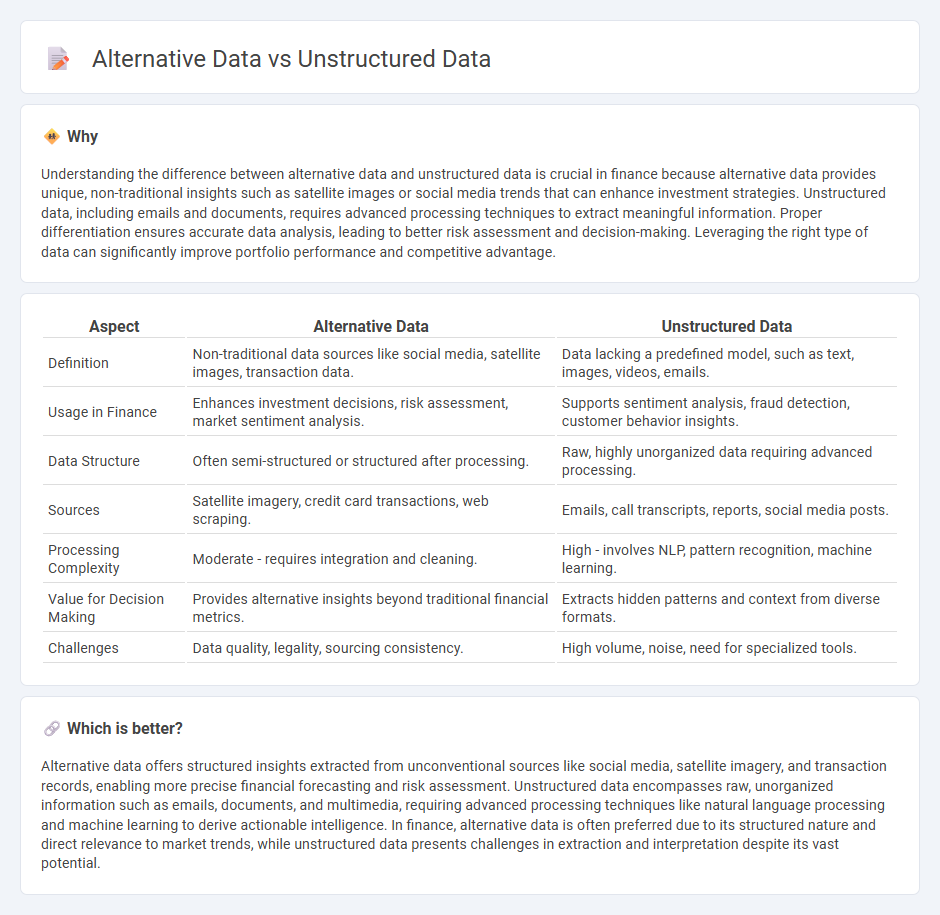

Understanding the difference between alternative data and unstructured data is crucial in finance because alternative data provides unique, non-traditional insights such as satellite images or social media trends that can enhance investment strategies. Unstructured data, including emails and documents, requires advanced processing techniques to extract meaningful information. Proper differentiation ensures accurate data analysis, leading to better risk assessment and decision-making. Leveraging the right type of data can significantly improve portfolio performance and competitive advantage.

Comparison Table

| Aspect | Alternative Data | Unstructured Data |

|---|---|---|

| Definition | Non-traditional data sources like social media, satellite images, transaction data. | Data lacking a predefined model, such as text, images, videos, emails. |

| Usage in Finance | Enhances investment decisions, risk assessment, market sentiment analysis. | Supports sentiment analysis, fraud detection, customer behavior insights. |

| Data Structure | Often semi-structured or structured after processing. | Raw, highly unorganized data requiring advanced processing. |

| Sources | Satellite imagery, credit card transactions, web scraping. | Emails, call transcripts, reports, social media posts. |

| Processing Complexity | Moderate - requires integration and cleaning. | High - involves NLP, pattern recognition, machine learning. |

| Value for Decision Making | Provides alternative insights beyond traditional financial metrics. | Extracts hidden patterns and context from diverse formats. |

| Challenges | Data quality, legality, sourcing consistency. | High volume, noise, need for specialized tools. |

Which is better?

Alternative data offers structured insights extracted from unconventional sources like social media, satellite imagery, and transaction records, enabling more precise financial forecasting and risk assessment. Unstructured data encompasses raw, unorganized information such as emails, documents, and multimedia, requiring advanced processing techniques like natural language processing and machine learning to derive actionable intelligence. In finance, alternative data is often preferred due to its structured nature and direct relevance to market trends, while unstructured data presents challenges in extraction and interpretation despite its vast potential.

Connection

Alternative data and unstructured data are interconnected through their shared use in enhancing financial decision-making processes. Alternative data often includes unstructured data sources such as social media posts, satellite images, and transaction records, which require advanced analytics techniques like natural language processing and machine learning for extraction and interpretation. Leveraging these data types enables financial institutions to gain deeper insights into market trends, risk assessments, and consumer behavior beyond traditional structured datasets.

Key Terms

Data Sources

Unstructured data originates from sources such as emails, social media posts, video files, and sensor outputs, characterized by its lack of predefined format, making it complex to analyze using traditional methods. Alternative data, derived from unconventional sources including satellite imagery, credit card transactions, and web scraping, provides unique insights beyond standard financial statements and market data. Explore how leveraging these diverse data sources can enhance decision-making and predictive analytics.

Data Analytics

Unstructured data refers to information that lacks a predefined format, including text, images, and videos, while alternative data encompasses novel data sources like social media, satellite imagery, and sensor data used to gain unique business insights. In data analytics, alternative data is often unstructured and requires advanced processing techniques such as natural language processing (NLP) and machine learning to extract actionable intelligence. Explore how integrating unstructured and alternative data can revolutionize analytics strategies and decision-making processes.

Investment Signals

Unstructured data, including emails, social media posts, and videos, offers rich, real-time insights but requires advanced natural language processing and machine learning techniques for effective analysis in investment signals. Alternative data, encompassing satellite images, credit card transactions, and web traffic, provides unique, non-traditional indicators that can enhance alpha generation by revealing market trends and consumer behavior ahead of financial reports. Explore how integrating unstructured and alternative data sources can transform your investment strategies and decision-making processes.

Source and External Links

What is Unstructured Data? - Unstructured data is information without a predefined format or structure, often messy and unorganized, including text documents, images, audio, videos, and social media content, making it harder to store and process compared to structured data organized in tables or databases.

Glossary: Unstructured Data | resources.data.gov - Unstructured data refers to free-form electronic information like multimedia files and unstructured text that doesn't follow relational rules and is not easily machine-readable, accounting for over 85% of business information.

Unstructured data - Wikipedia - Unstructured data lacks a pre-defined data model or organization, is often text-heavy but ambiguous, and represents the majority of data within organizations, with projections that it will continue to grow dramatically in volume worldwide.

dowidth.com

dowidth.com