Regenerative finance focuses on creating economic systems that restore and enhance natural and social capital, aiming for long-term ecological and community resilience. Impact investing targets generating measurable social and environmental benefits alongside financial returns, often through targeted projects or companies. Explore the distinctions and synergies between these innovative financial approaches to understand how your investments can drive sustainable change.

Why it is important

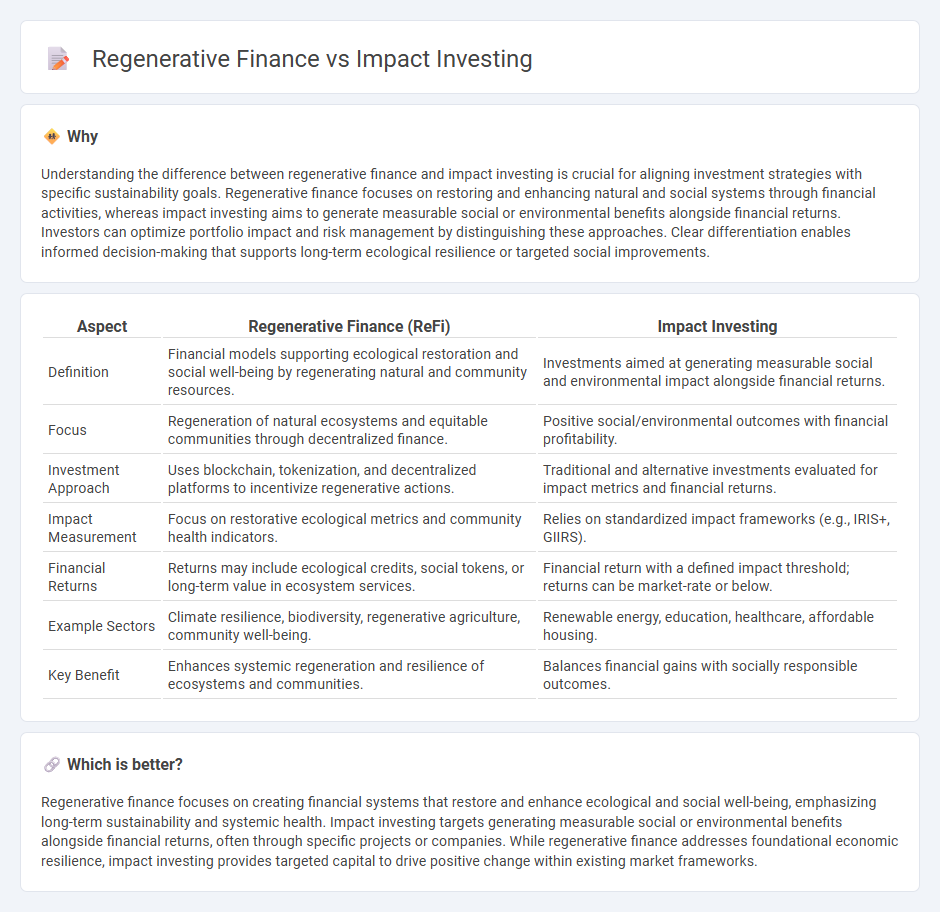

Understanding the difference between regenerative finance and impact investing is crucial for aligning investment strategies with specific sustainability goals. Regenerative finance focuses on restoring and enhancing natural and social systems through financial activities, whereas impact investing aims to generate measurable social or environmental benefits alongside financial returns. Investors can optimize portfolio impact and risk management by distinguishing these approaches. Clear differentiation enables informed decision-making that supports long-term ecological resilience or targeted social improvements.

Comparison Table

| Aspect | Regenerative Finance (ReFi) | Impact Investing |

|---|---|---|

| Definition | Financial models supporting ecological restoration and social well-being by regenerating natural and community resources. | Investments aimed at generating measurable social and environmental impact alongside financial returns. |

| Focus | Regeneration of natural ecosystems and equitable communities through decentralized finance. | Positive social/environmental outcomes with financial profitability. |

| Investment Approach | Uses blockchain, tokenization, and decentralized platforms to incentivize regenerative actions. | Traditional and alternative investments evaluated for impact metrics and financial returns. |

| Impact Measurement | Focus on restorative ecological metrics and community health indicators. | Relies on standardized impact frameworks (e.g., IRIS+, GIIRS). |

| Financial Returns | Returns may include ecological credits, social tokens, or long-term value in ecosystem services. | Financial return with a defined impact threshold; returns can be market-rate or below. |

| Example Sectors | Climate resilience, biodiversity, regenerative agriculture, community well-being. | Renewable energy, education, healthcare, affordable housing. |

| Key Benefit | Enhances systemic regeneration and resilience of ecosystems and communities. | Balances financial gains with socially responsible outcomes. |

Which is better?

Regenerative finance focuses on creating financial systems that restore and enhance ecological and social well-being, emphasizing long-term sustainability and systemic health. Impact investing targets generating measurable social or environmental benefits alongside financial returns, often through specific projects or companies. While regenerative finance addresses foundational economic resilience, impact investing provides targeted capital to drive positive change within existing market frameworks.

Connection

Regenerative finance focuses on creating financial systems that restore and sustain environmental and social health, aligning closely with impact investing, which directs capital towards projects generating measurable social and environmental benefits. Both approaches prioritize long-term value creation over short-term profits by investing in enterprises that promote sustainability, equity, and resilience. Data from the Global Impact Investing Network shows impact investments reached $715 billion in 2023, reflecting growing integration with regenerative finance principles.

Key Terms

Social Return

Impact investing targets measurable social and environmental outcomes alongside financial returns by funding projects with explicit positive impacts such as affordable housing and renewable energy. Regenerative finance goes further by actively restoring ecosystems and communities through circular economic models that rebuild natural and social capital. Discover how these approaches maximize social return and reshape sustainable finance strategies.

Regenerative Capital

Regenerative Capital emphasizes restoring ecosystems and communities through investments that generate positive environmental and social outcomes alongside financial returns, distinguishing it from traditional impact investing, which primarily seeks measurable social impact. This approach integrates circular economy principles and supports long-term resilience by funding projects that revive natural resources, promote biodiversity, and empower indigenous populations. Explore how Regenerative Capital can drive sustainable transformation by aligning profit with planetary health.

Sustainability Metrics

Impact investing measures success through specific sustainability metrics such as carbon footprint reduction, social impact scores, and ESG (Environmental, Social, Governance) ratings to ensure positive environmental and social outcomes. Regenerative finance goes beyond by actively restoring and enhancing natural ecosystems and community resilience, incorporating metrics like soil health improvement, biodiversity indices, and circular economy indicators. Explore the nuanced differences and applications of these frameworks to enhance your sustainable investment strategy.

Source and External Links

What you need to know about impact investing - The GIIN - Impact investing involves making investments with the explicit intention to generate positive, measurable social or environmental impacts alongside financial returns, targeting sectors like energy, microfinance, and housing with approaches driven by data and impact measurement.

What Is Impact Investing? | NPTrust - Impact investing strategically leverages capital to achieve social or environmental change while also generating financial returns, with a growing global market projected to reach $6 trillion by 2031 and strong participation from Millennials.

What is Impact Investing? | Fidelity Charitable - Impact investing enables investors to align financial goals with personal or philanthropic values by investing in companies or projects that produce social or environmental benefits while delivering financial returns, with growing interest among younger generations and institutional investors.

dowidth.com

dowidth.com