Bucket investing involves dividing assets into different "buckets" based on time horizons and risk tolerance, allowing tailored investment strategies for short, medium, and long-term goals. Target Date Funds automatically adjust the asset allocation as the selected retirement date approaches, simplifying portfolio management through a glide path strategy. Explore more to determine which approach aligns best with your financial goals and risk appetite.

Why it is important

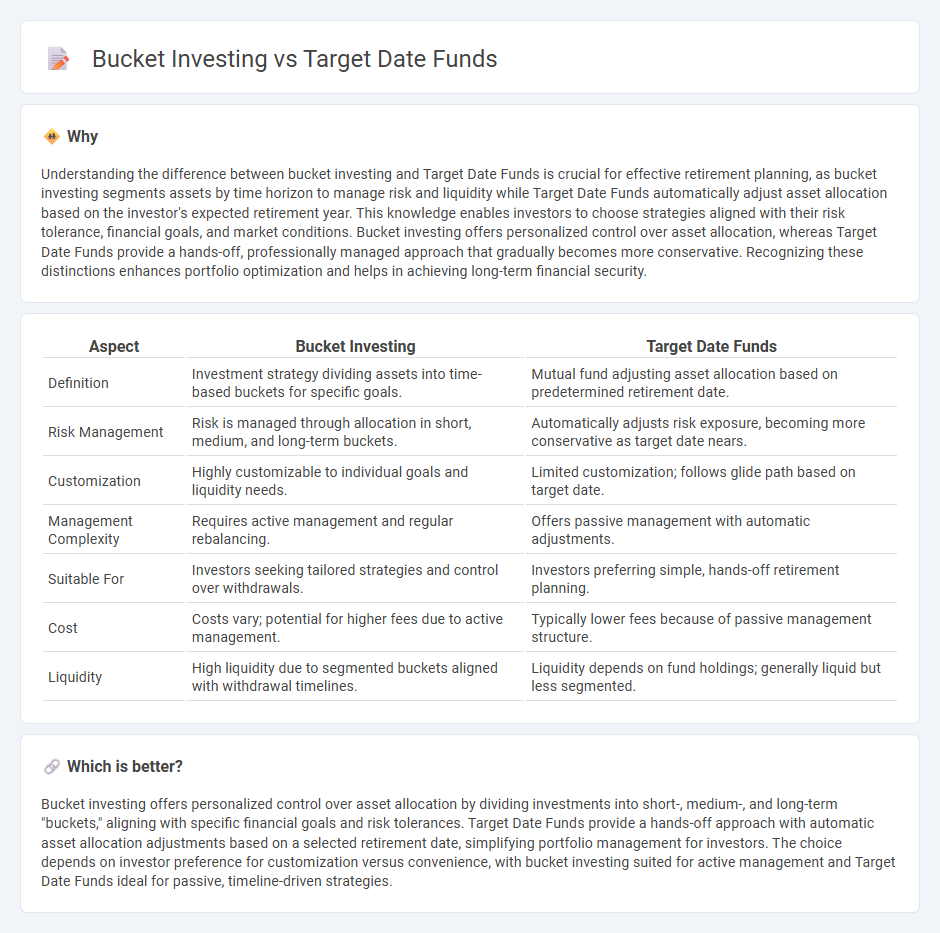

Understanding the difference between bucket investing and Target Date Funds is crucial for effective retirement planning, as bucket investing segments assets by time horizon to manage risk and liquidity while Target Date Funds automatically adjust asset allocation based on the investor's expected retirement year. This knowledge enables investors to choose strategies aligned with their risk tolerance, financial goals, and market conditions. Bucket investing offers personalized control over asset allocation, whereas Target Date Funds provide a hands-off, professionally managed approach that gradually becomes more conservative. Recognizing these distinctions enhances portfolio optimization and helps in achieving long-term financial security.

Comparison Table

| Aspect | Bucket Investing | Target Date Funds |

|---|---|---|

| Definition | Investment strategy dividing assets into time-based buckets for specific goals. | Mutual fund adjusting asset allocation based on predetermined retirement date. |

| Risk Management | Risk is managed through allocation in short, medium, and long-term buckets. | Automatically adjusts risk exposure, becoming more conservative as target date nears. |

| Customization | Highly customizable to individual goals and liquidity needs. | Limited customization; follows glide path based on target date. |

| Management Complexity | Requires active management and regular rebalancing. | Offers passive management with automatic adjustments. |

| Suitable For | Investors seeking tailored strategies and control over withdrawals. | Investors preferring simple, hands-off retirement planning. |

| Cost | Costs vary; potential for higher fees due to active management. | Typically lower fees because of passive management structure. |

| Liquidity | High liquidity due to segmented buckets aligned with withdrawal timelines. | Liquidity depends on fund holdings; generally liquid but less segmented. |

Which is better?

Bucket investing offers personalized control over asset allocation by dividing investments into short-, medium-, and long-term "buckets," aligning with specific financial goals and risk tolerances. Target Date Funds provide a hands-off approach with automatic asset allocation adjustments based on a selected retirement date, simplifying portfolio management for investors. The choice depends on investor preference for customization versus convenience, with bucket investing suited for active management and Target Date Funds ideal for passive, timeline-driven strategies.

Connection

Bucket investing and Target Date Funds both aim to manage investment risk over time by structuring asset allocation according to time horizons. Bucket investing divides assets into separate portfolios, each designated for specific spending periods, while Target Date Funds automatically adjust asset allocation to become more conservative as the target retirement date approaches. Both strategies provide systematic frameworks for aligning investment growth and income needs with retirement timelines.

Key Terms

Glide Path

Target Date Funds employ a glide path strategy that automatically adjusts asset allocation to reduce risk as the target retirement date approaches, typically shifting from equities to bonds over time. Bucket investing segments retirement savings into multiple portfolios or "buckets," each designed for different time horizons and risk levels, offering more tailored control over asset allocation compared to the fixed glide path. Explore the differences in glide path flexibility and risk management to determine which strategy aligns best with your retirement goals.

Asset Allocation

Target Date Funds automate asset allocation by gradually shifting from aggressive to conservative investments as the target retirement date approaches, providing a hands-off investment strategy aligned with lifecycle stages. Bucket investing segments assets into different time horizons with distinct allocations, offering flexibility to customize risk and liquidity based on short-, medium-, and long-term needs. Explore deeper insights on how asset allocation strategies can optimize retirement outcomes by visiting our resource page.

Withdrawal Strategy

Target date funds simplify withdrawal strategies by automatically adjusting asset allocation to reduce risk as the target retirement date approaches, promoting steady income throughout retirement. Bucket investing divides assets into segments aligned with specific withdrawal horizons, aiming to balance liquidity with long-term growth to manage market volatility effectively. Explore our detailed comparison to optimize your retirement withdrawal strategy.

Source and External Links

Target Date Funds | Investor.gov - Target date funds are long-term investments that automatically shift from higher-risk stocks to more conservative bonds as the target retirement or goal date approaches, often used in 401(k) plans with the fund's name reflecting the year the investor plans to retire.

5 Low-Cost Target-Date Funds for 2025 - NerdWallet - Target-date funds provide automatic portfolio rebalancing from growth stocks to safer investments over time, making them convenient "set-it-and-forget-it" retirement savings vehicles that align risk with the investor's age and planned retirement year.

Target Date Mutual Funds | Charles Schwab - These funds gradually become more conservative by shifting asset allocation from equities to fixed income as the target date nears, offering an all-in-one investment solution that requires no rebalancing by the investor and is structured in 5-year increments around planned retirement years.

dowidth.com

dowidth.com