Climate-linked derivatives provide investors with financial instruments to hedge risks associated with climate events, offering flexibility and liquidity in managing weather-related exposures. Catastrophe bonds transfer risks from insurers to capital markets, enabling coverage for extreme events like hurricanes and earthquakes while delivering potential high returns to investors. Explore the differences and strategic benefits of climate-linked derivatives and catastrophe bonds in modern risk management.

Why it is important

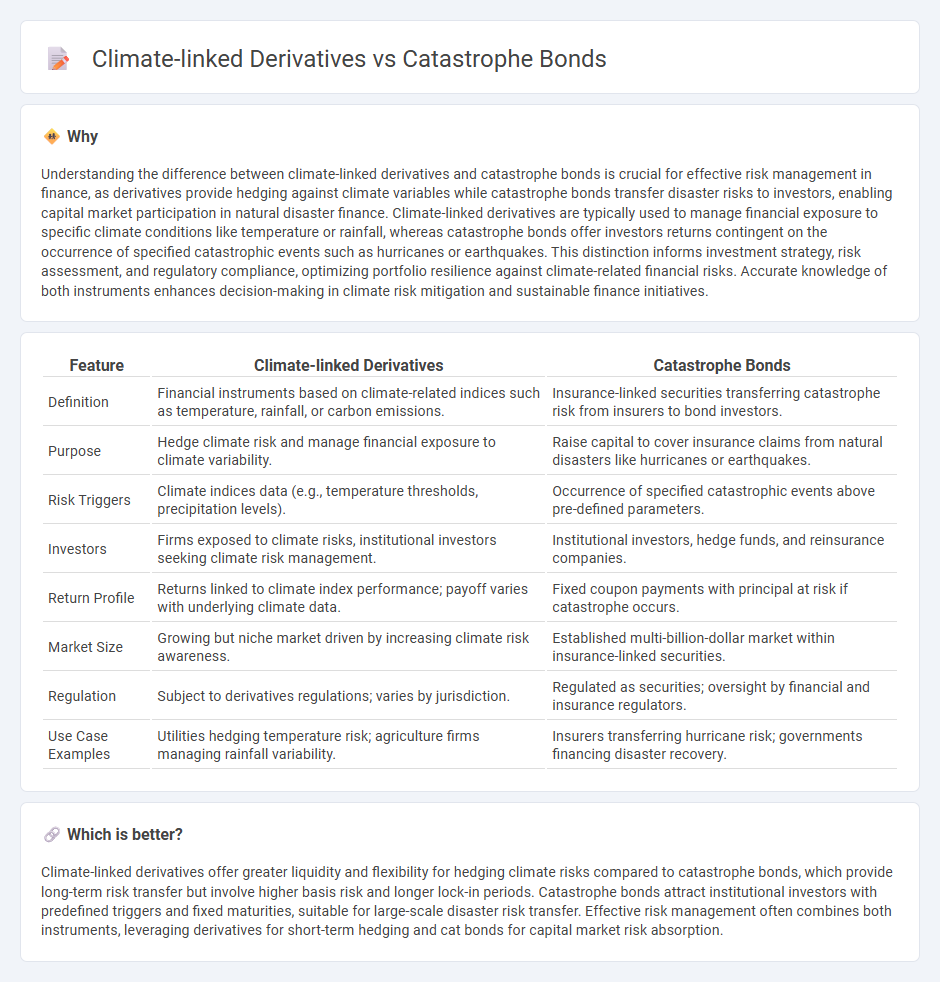

Understanding the difference between climate-linked derivatives and catastrophe bonds is crucial for effective risk management in finance, as derivatives provide hedging against climate variables while catastrophe bonds transfer disaster risks to investors, enabling capital market participation in natural disaster finance. Climate-linked derivatives are typically used to manage financial exposure to specific climate conditions like temperature or rainfall, whereas catastrophe bonds offer investors returns contingent on the occurrence of specified catastrophic events such as hurricanes or earthquakes. This distinction informs investment strategy, risk assessment, and regulatory compliance, optimizing portfolio resilience against climate-related financial risks. Accurate knowledge of both instruments enhances decision-making in climate risk mitigation and sustainable finance initiatives.

Comparison Table

| Feature | Climate-linked Derivatives | Catastrophe Bonds |

|---|---|---|

| Definition | Financial instruments based on climate-related indices such as temperature, rainfall, or carbon emissions. | Insurance-linked securities transferring catastrophe risk from insurers to bond investors. |

| Purpose | Hedge climate risk and manage financial exposure to climate variability. | Raise capital to cover insurance claims from natural disasters like hurricanes or earthquakes. |

| Risk Triggers | Climate indices data (e.g., temperature thresholds, precipitation levels). | Occurrence of specified catastrophic events above pre-defined parameters. |

| Investors | Firms exposed to climate risks, institutional investors seeking climate risk management. | Institutional investors, hedge funds, and reinsurance companies. |

| Return Profile | Returns linked to climate index performance; payoff varies with underlying climate data. | Fixed coupon payments with principal at risk if catastrophe occurs. |

| Market Size | Growing but niche market driven by increasing climate risk awareness. | Established multi-billion-dollar market within insurance-linked securities. |

| Regulation | Subject to derivatives regulations; varies by jurisdiction. | Regulated as securities; oversight by financial and insurance regulators. |

| Use Case Examples | Utilities hedging temperature risk; agriculture firms managing rainfall variability. | Insurers transferring hurricane risk; governments financing disaster recovery. |

Which is better?

Climate-linked derivatives offer greater liquidity and flexibility for hedging climate risks compared to catastrophe bonds, which provide long-term risk transfer but involve higher basis risk and longer lock-in periods. Catastrophe bonds attract institutional investors with predefined triggers and fixed maturities, suitable for large-scale disaster risk transfer. Effective risk management often combines both instruments, leveraging derivatives for short-term hedging and cat bonds for capital market risk absorption.

Connection

Climate-linked derivatives and catastrophe bonds are financial instruments designed to transfer risks associated with climate change and natural disasters to capital markets. Both tools enable insurers, governments, and investors to hedge against extreme weather events by quantifying risk through models that incorporate climate data and catastrophe scenarios. This connection enhances market-based risk management by providing liquidity and stability in the face of increasing climate-related uncertainties.

Key Terms

Risk Transfer

Catastrophe bonds transfer the financial risk of natural disasters to investors by issuing debt securities that pay high yields unless a specified event, like a hurricane or earthquake, occurs. Climate-linked derivatives are financial instruments whose payoffs depend on climate-related variables such as temperature or rainfall, allowing businesses to hedge exposure to weather risks. Explore further to understand how these innovative risk transfer tools enhance climate resilience and financial stability.

Trigger Events

Catastrophe bonds activate payouts when predefined natural disaster parameters, such as earthquake magnitude or hurricane wind speed, meet specific thresholds, transferring risk from insurers to investors. Climate-linked derivatives rely on environmental indicators like temperature or rainfall indices as trigger events, enabling hedging against climate variability impacts in agriculture and energy sectors. Explore further to understand how these financial instruments manage climate risks and investment strategies.

Hedging

Catastrophe bonds provide investors with high-yield returns while transferring insurance risk related to natural disasters, offering a direct hedge against specific catastrophic events like hurricanes or earthquakes. Climate-linked derivatives, such as weather futures and options, enable organizations to manage financial exposure to climate variables by triggering payouts based on temperature, rainfall, or other environmental indices. Explore in-depth comparisons to understand which hedging instrument aligns best with your risk management strategy.

Source and External Links

Catastrophe bond - Wikipedia - Catastrophe bonds (cat bonds) are insurance-linked securities transferring specified risks from sponsors (like insurers) to investors; if a catastrophe occurs, principal is forgiven to cover claims, otherwise investors receive coupons. Used mostly to cover large natural disaster risks, they usually have floating interest rates, about 3-year maturity, and serve as an alternative to reinsurance.

Catastrophe Bonds: A Primer and Retrospective - Chicago Fed - Catastrophe bonds work via a special purpose vehicle collecting investors' principal to cover insured losses from events like hurricanes; if no event occurs, investors receive premiums plus interest, but if a triggering disaster happens, investors lose their principal as it pays the insurer's claims, transferring risk from insurer to capital markets.

What role do catastrophe bonds play? - LSE Grantham Institute - Catastrophe bonds transfer financial risk of natural disasters to investors in exchange for interest, with principal reduced upon event triggering; however, concerns exist about high transaction costs, complex disbursement rules, and effectiveness especially in sovereign and development contexts, with debate on parametric triggers and payout conditions.

dowidth.com

dowidth.com