Perpetual futures enable traders to speculate on asset price movements without an expiration date, offering continuous exposure and the use of leverage, while spot trading involves buying or selling the actual asset for immediate settlement. Leverage in perpetual futures increases profit potential but also the risk of liquidation, contrasting with the ownership and straightforward nature of spot trades. Explore the detailed mechanics and risk factors of perpetual futures and spot trading to make informed investment decisions.

Why it is important

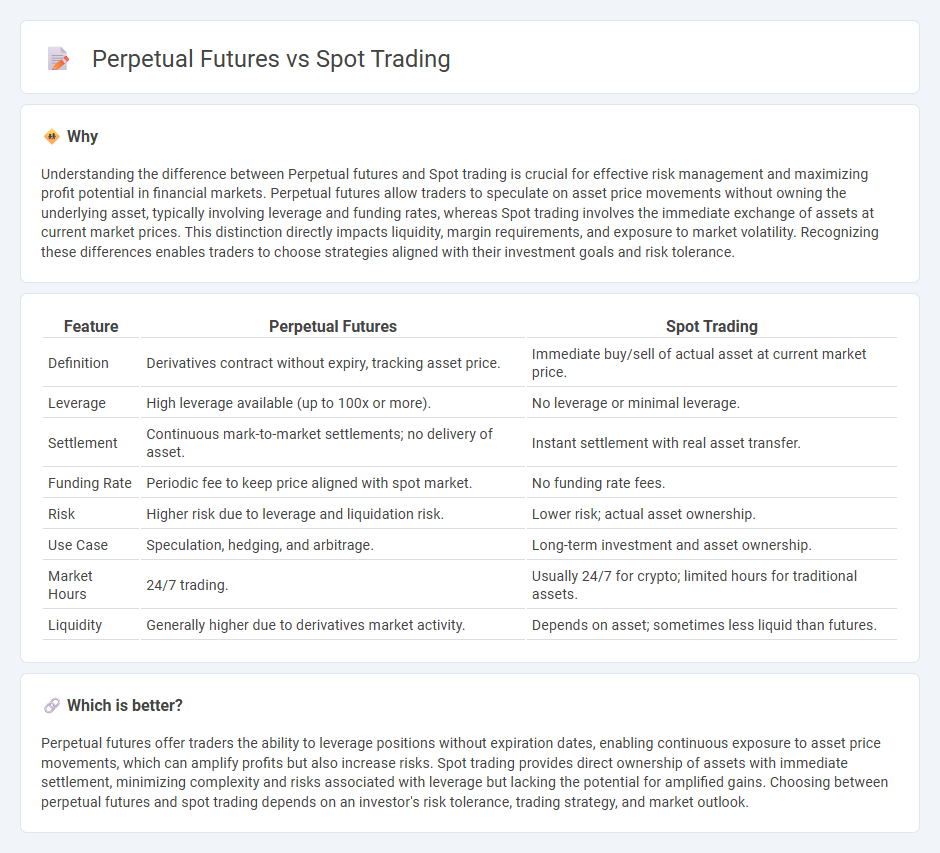

Understanding the difference between Perpetual futures and Spot trading is crucial for effective risk management and maximizing profit potential in financial markets. Perpetual futures allow traders to speculate on asset price movements without owning the underlying asset, typically involving leverage and funding rates, whereas Spot trading involves the immediate exchange of assets at current market prices. This distinction directly impacts liquidity, margin requirements, and exposure to market volatility. Recognizing these differences enables traders to choose strategies aligned with their investment goals and risk tolerance.

Comparison Table

| Feature | Perpetual Futures | Spot Trading |

|---|---|---|

| Definition | Derivatives contract without expiry, tracking asset price. | Immediate buy/sell of actual asset at current market price. |

| Leverage | High leverage available (up to 100x or more). | No leverage or minimal leverage. |

| Settlement | Continuous mark-to-market settlements; no delivery of asset. | Instant settlement with real asset transfer. |

| Funding Rate | Periodic fee to keep price aligned with spot market. | No funding rate fees. |

| Risk | Higher risk due to leverage and liquidation risk. | Lower risk; actual asset ownership. |

| Use Case | Speculation, hedging, and arbitrage. | Long-term investment and asset ownership. |

| Market Hours | 24/7 trading. | Usually 24/7 for crypto; limited hours for traditional assets. |

| Liquidity | Generally higher due to derivatives market activity. | Depends on asset; sometimes less liquid than futures. |

Which is better?

Perpetual futures offer traders the ability to leverage positions without expiration dates, enabling continuous exposure to asset price movements, which can amplify profits but also increase risks. Spot trading provides direct ownership of assets with immediate settlement, minimizing complexity and risks associated with leverage but lacking the potential for amplified gains. Choosing between perpetual futures and spot trading depends on an investor's risk tolerance, trading strategy, and market outlook.

Connection

Perpetual futures and spot trading are interconnected through their pricing mechanisms, where perpetual futures contracts closely track the spot price of the underlying asset using funding rates to maintain price convergence. Traders use perpetual futures for leverage and hedging while spot trading involves the actual asset exchange, creating liquidity that influences futures pricing. The interaction between these markets ensures price discovery, risk management, and arbitrage opportunities in financial trading.

Key Terms

Settlement

Spot trading involves the immediate exchange of assets at current market prices, with settlement typically occurring within two business days (T+2). Perpetual futures contracts have no fixed expiration date and settle continuously through a funding mechanism linking the contract price to the spot price, preventing significant divergence. Explore the nuances of settlement processes to better understand risk management in both trading methods.

Leverage

Spot trading involves buying or selling an asset for immediate delivery with no leverage, limiting risk but also potential returns. Perpetual futures enable traders to use leverage, often ranging from 1x to 100x, amplifying both gains and losses by borrowing funds to take larger positions. Explore detailed comparisons and strategies to understand which trading method aligns with your investment goals.

Expiry

Spot trading involves the immediate exchange of assets without any expiration date, making transactions final and settlement instant. Perpetual futures contracts, unlike traditional futures, have no expiry date, allowing traders to hold positions indefinitely while using funding rates to anchor the contract price to the spot market. Explore more to understand how expiration differences impact risk management and trading strategies.

Source and External Links

What is a Spot Trade? - Spot Trade Definition - FOREX.com US - Spot trading is the immediate purchase or sale of a financial instrument such as forex, commodities, or securities at the current market price, typically executed as market orders at the spot price.

Differences of Spot Trading vs. Day Trading - Nasdaq - Spot trading involves the immediate exchange of assets settled usually within two business days and is often used for quick transactions at the prevailing market rate known as the spot price.

What is spot trading in crypto and how does it work? - Coinbase - Spot trading in cryptocurrency refers to buying and selling digital currencies at their current market prices, allowing traders to own the assets immediately upon transaction execution.

dowidth.com

dowidth.com